ITIN SERVICE

Get your Individual Taxpayer Identification Number (ITIN) and access the lucrative US credit card market!

How It Works

Step 1

Complete our request form below (fee: $140 CAD)

Step 2

We generate and send you a W-7 ITIN application and 1040-NR tax return pre-filled with your information

Step 3

You sign and mail the package to the IRS, along with documents to verify your identity.

Step 4

You receive your ITIN ~ 12 weeks later. Don’t forget to pay your taxes to the IRS!

Get Started – ITIN Request Form

Notice: As a result of the Government of Canada no longer embossing seals on Certified True Passport Copies, we have begun seeing the IRS reject some ITIN applications. See this post for details and alternative options for verifying identity.

Testimonials

See our 100+ ★★★★★ reviews on Trustpilot and Google!

Frequently Asked Questions

Based on our DPs, no you do not. This may be dependent on the type of income claimed.

Also, you generally need to make over a certain threshold to have tax forms like 1099’s issued. Since you are claiming an amount under that threshold, there shouldn’t be any expectation that you have these forms.

Yes you will pay a small amount of tax (~$5-10), which is why you are filing the return and why the IRS has to assign an ITIN to you.

Email details or a copy of your 1099 form to [email protected] and we can discuss options for doing a manual return.

The IRS quote an 8 week turnaround time. Anecdotally it can take a bit longer than that during busy tax season. Furthermore, in the wake of COVID-19 we’ve been seeing applications take 16 weeks turnaround. Try not to be anxious if there is a delay – the IRS have to respond and return your documents, regardless of the outcome.

We do not have an official refund policy. We have tested this method thoroughly, and have yet to see any applications rejected. If your application is rejected, email the IRS rejection letter to [email protected] and we will suggest a solution. In the case that IRS policies change and we are unable to adapt and secure your ITIN, yes we would refund you.

Yes, we offer a modest discount for customers who purchase multiple ITINs through us – email us at [email protected] and we will provide you with a code to enter in the coupon field for the second ITIN application.

Yes we have a valid preparer tax identification number (PTIN). However, because we are not an Enrolled Agent we are not authorized to speak with IRS on your behalf or represent you to the IRS. You will be responsible for any correspondence with the IRS (if applicable). You are of course still welcome to ask us questions!

Yes. You don’t need to be physically present in the US to qualify for an ITIN, or to have earned US income that would require you to file a US tax return.

You can visit the US government website to view your United States arrival and departure history at this link: https://i94.cbp.dhs.gov/I94/#/history-search.

In almost all cases, yes! Shoot us an email ([email protected]) and we can confirm. Cheers.

Please see how the IRS calculates late filing and late payment penalties (tl;dr, it’s a fraction of the tax owed). The maximum total penalty for failure to file and pay is 47.5% (22.5% late filing and 25% late payment) of the tax. On ~$10 USD of tax, this shouldn’t be of great concern.

You will receive detailed instructions after completing our form on how to send in your documents. Generally, we recommend getting a certified true copy (CTC) of your passport and sending that in, if possible. Alternatively, you can:

1) send in your original passport to the IRS,

2) apply via a Certified Acceptance Agent (this will cost money), or

3) book an appt and show up in person to an IRS Taxpayer Assistance Center in the USA. For IRS Taxpayer Assistant Centers, you must have completed all docs and bring them to appt (no mailing required). However, of note, we have a few data points of people being turned away if past the year’s tax reporting deadline.

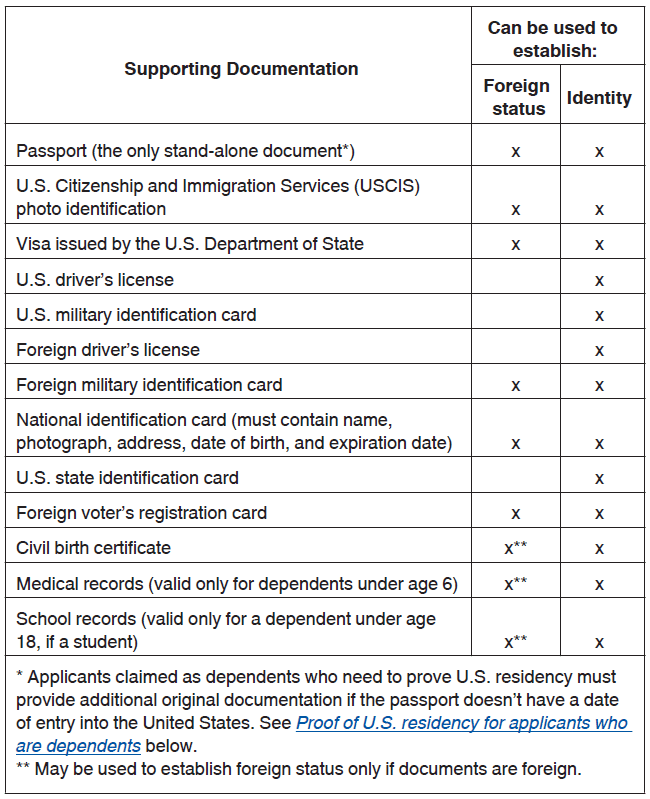

Alternatively to a passport, you may provide any two of the following to validate your identity and foreign status:

– Foreign driver’s license

– Foreign military identification card

– National identification card (must contain name, photograph, address, date of birth, and expiration date)

– Foreign voter’s registration card

– Civil birth certificate

See the table below for eligible support documentation. You must include a document that establishes both foreign status and identity.

Generally these alternative documents will need to be original copies however you may be able to get certified copies of driver’s license. Data points suggest that you can these for free from Public Service Ontario locations for example.

I would recommend signed. Signed just means that your passport is signed. The only way to get unsigned would be if you applied for a new passport and certified copies of the passport at the same time.

Unfortunately, no notarized copies of identifying documents including passport are not accepted by the IRS.

As stated on the IRS ITIN Procedures Frequently Asked Questions page:

“A certified document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the Agency. These documents will be accepted. A notarized document is one that the taxpayer provides to a public notary who bears witness to the signing of the official document and affixes a seal assuring that the document is legitimate. These documents will not be accepted for ITIN applications.”

The U.S. Embassy or consulates can also certify true copies of foreign passports. Please make an appointment with the nearest Embassy or consulate and make sure to bring the original foreign passport to your appointment. Read more about this service on the U.S. Embassy and Consulates in Canada website.

Yes, you can. They can be reached from outside the US at 267-941-1000. Beware this is not a toll-free number. I recommend using a VoIP service (Google Voice, Textnow, Paygo etc) to make the call, especially if you don’t have a good long-distance phone plan.

If that doesn’t work, you can also try calling the +1 800-908-9982 number. Press 1 for English, then 3 for ‘Other Inquiries’. Option 2 (obtain the status of your ITIN) seems to produce a ‘call us later’ prompt (YMMV).

Anecdotally, the best time to call is around late afternoon on the West coast (or in the evening on the East coast).

Simply having an ITIN will not create a tax obligation. Tax obligations are based on the nature of the income. Meaning, if you earn eligible US income you can be obligated to file US tax whether you have an ITIN or not.

After 3 years of not being used on a federal tax return, ITINs enter an “inactive” state. You can still use an inactive ITIN the same as before to apply for credit cards. However, there is a risk that in the future an inactive ITIN will be reissued to someone else.

The guaranteed solution to prevent your ITIN from going inactive and potentially being reissued to someone else is to file a tax return once every 3 years. We also offer an ITIN renewal service to renew ITINs which have become inactive.

See our flagship post on ITINs and our compilation of ITIN-related blog posts below.

Email them to us at [email protected].

ITIN-related Blog Posts

Legal Disclaimers

Frugal Flyer is not a registered tax accounting firm, and does not act as third-party designee for US tax returns. You assume all liabilities and responsibilities for submitting and paying your US tax return, as well as future communications with the IRS, if required.

No Representation of Advice

The information contained within this website is provided for information purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional and designated accountant.

The presentation of the information via the internet is not intended to create, and receipt does not constitute, an accountant – client relationship. Website users, internet subscribers and online readers are cautioned and advised not to act upon this information without seeking the services of a professional and designated accountant.

IRS Circular 230 notice

In order to comply with requirements imposed by the IRS, I must inform you that any U.S. federal tax advice contained in this blog is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter that is contained in this blog.