The Canadian credit card scene has some excellent rewards programs and offers that you can utilize to book some incredible vacations. From Aeroplan cards issued by Amex, CIBC and TD, to the Marriott Bonvoy co-branded cards, to RBC Avion and WestJet World Elite cards, the opportunities are expansive and essential to seeing success in the miles and points game in Canada.

However, as your credit card miles and points addiction progresses, and as your appetite for travel increases, you may end up searching for other opportunities to take advantage of. You might be aware of the even more lucrative programs in the USA, such as Chase Ultimate Rewards or Citi ThankYou Points.

Or, like many of us, you may find yourself rich in airline points but lacking in hotel points. Especially for programs like Hyatt and Hilton where there are no co-branded credit cards or easy ways to earn their points within Canada, the US credit card game starts to become alluring.

So what else is there to know about our neighbors to the south? Due to the increased competition as well as a significantly larger population, we often see some very high bonus points offers on many US credit cards. Similarly, we see US credit cards that are able to transfer points to programs that were previously inaccessible to Canadians. These facts alone showcase the value that the US credit card market can bring.

So where do we go from here? As it turns out, we are very fortunate as Canadians to have the opportunity to take a bite out of both pies. Getting a US credit card as a Canadian citizen is simpler than it may seem on the surface, as we will outline below.

Before You Apply for Your First US Credit Card

Before starting, you will need to establish your US-based address. For all intents and purposes, this will be a mail forwarding service – we prefer using 24/7 Parcel as they have no issue forwarding credit cards and readers will receive a $20 USD annual discount by mentioning you were referred from Frugal Flyer.

Once set up, this will be the address that you use whenever you are dealing with anything related to US credit cards. This leads to our next step, setting up a bank account.

Further reading: US Credit Cards for Canadians

There are a few choices when it comes to the best US bank accounts for Canadians. When exploring options for US banking, whatever option you proceed with only needs to meet the following criteria:

- Ensure you enter your mail forwarding address as your home address – this will give you the opportunity to use your bank statement as proof of residency should Amex or any other issuer ask for additional documentation

- Allows you to deposit and bill pay USD

Additionally, in order to apply for US credit cards, you will need to have an Individual Taxpayer Identification Number (ITIN) which further establishes your presence in the United States.

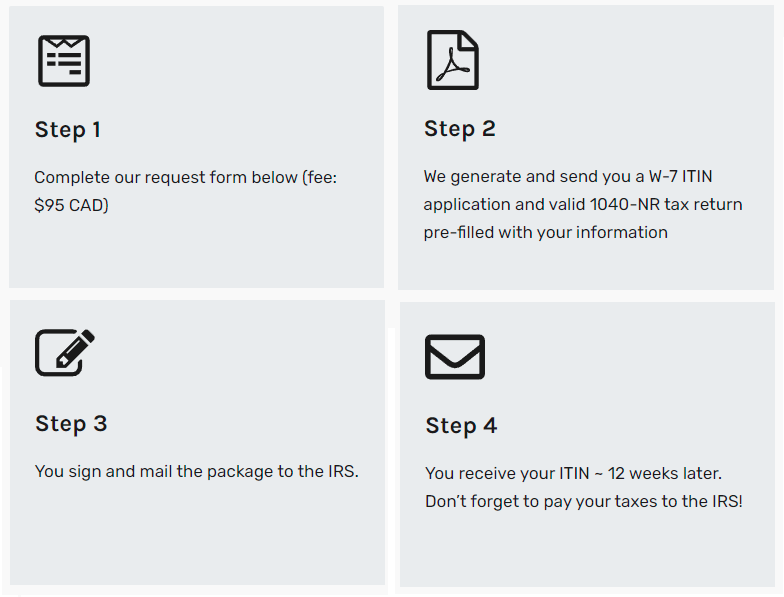

We do offer an in-house ITIN service that has a quick turnaround and many satisfied customers: Frugal Flyer’s ITIN Service. This service will provide you with all the forms you need in addition to instructions as to how to arrange your package of documents when mailing them to the IRS.

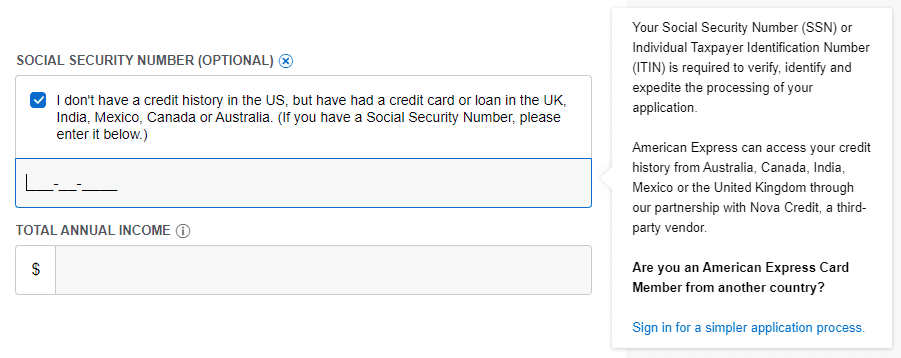

As you will be applying for an American Express (US) credit card, there are two methods to apply for your first card which both take into account your Canadian credit history: Nova Credit or the Amex Global Transfer program.

Nova Credit is a simpler method and both myself and my significant other have used this with great success – as a third-party service provider acting as an intermediary between yourself and American Express (US), they take care of pushing the transaction through on the US side and will pull your Canadian credit history to do so.

If you want to learn more about the process of applying for a US credit card with Nova Credit, check out our definitive guide to Nova Credit. Similarly, learn about how to apply for a US card through the American Express Global Transfer program, which will use your American Express Canada history to assist with approval.

The Best First US Credit Card for Canadians

Consider your first US credit card as an anchor, similar to your oldest credit cards in Canada. This card will serve as the basis for all future applications and is the start of your credit history in a new country.

With this in mind, the first card that you want to acquire as a Canadian is one of the American Express cards that has a strong welcome bonus but with no annual fee which means it will be convenient to keep active for years to come to build and maintain your credit history.

In our opinion, the strongest starter US credit card for Canadians is the American Express Hilton Honors credit card (US) since it has no annual fee and opens up a new loyalty program, Hilton Honors.

The American Express Hilton Honors card offers instant Hilton Honors Silver Elite status, which grants cardholders access to the fifth-night free benefit when booking stays on points.

80,000 Hilton Honors

$2,000

$480+

$0

No

–

Holding a credit card that earns points in the Hilton Honors loyalty program is a great way to diversify your hotel points and open up other opportunities for redemptions. The American Express Hilton Honors card currently has a welcome bonus of 80,000 Hilton Honors points, which is enough to get you on your way to your first redemption.

Additionally, starting with the American Express Hilton Honors credit card also will give you the opportunity to upgrade to other Hilton Honors cards down the road. These upgrade offers can show up after the one-year mark of holding a specific credit card and may allow you to get the rewards points bonus again.

Related: The Best Amex Hilton Honors Credit Card Strategy

For example, you might be able to upgrade your basic Amex Hilton Honors card to the more premium American Express Hilton Honors Aspire card (US) through an upgrade offer (to earn another welcome bonus) and then downgrade back to the no annual fee card down the line; this is one of the opportunities that the US game can offer.

Using Your US Credit Card in Canada

Once you are approved and you receive your US credit card through your mail forwarder you will be ready to complete your minimum spending requirement to earn the welcome bonus. Your next question might be: is it the same as using my US credit card in Canada as I use my Canadian credit cards? Yes, but no.

You will be able to use your new US credit card at any retailer in Canada that accepts Amex – no different than with any other Amex card. There are no foreign transaction fees imposed on US-based Amex cards that are used at Canadian retailers.

The main difference is that it will convert your Canadian dollar purchase to USD when the transaction is posted on your statement. As always, when you go to pay you will have two options: tap or insert your chip.

Paying via tap is identical to how it works in Canada. On the other hand, if you insert your chip, the card will simply authorize the payment without the need to enter a PIN. If the cashier is paying attention they will make you sign the authorization slip, but oftentimes they won’t notice or ask. Oftentimes, when I’m using a US credit card in Canada I find myself using self-checkouts where possible to avoid the need to sign.

Alternatively, loading your US credit card into your Google Pay or Apple Pay account makes for an easy way to pay, similar to tap.

Finally, you will need to convert your Canadian dollars to United States dollars and deposit them into your US bank account in order to pay off your credit card statement. There are many different ways to do this, but we have researched the cheapest methods to convert CAD to USD to help you get the best exchange rate possible.

Conclusion

No matter where you are currently within the Canadian miles and points scene, consider exploring the idea of opening up your first US credit card (additionally, you can compare US credit cards with our tool). Even if you are only ever planning to hold one US card, it doesn’t hurt to start building a US credit history if you should pursue additional cards in the future.

Josh Bandura

Latest posts by Josh Bandura (see all)

- New Scotiabank Credit Card Offers (July 2025) - Jul 2, 2025

- Best Credit Cards in Canada (July 2025) - Jul 1, 2025

- Definitive Guide: CIBC Aventura Airline Rewards Chart - Jun 30, 2025

- Earn Cash Back Rebates on Tangerine Bank Accounts - Jun 11, 2025

- New BMO Chequing Account Offers (June 2025) - Jun 9, 2025

Hello, I am from Mexico, I opened my bank account in USA and I have good credit history in Mexico. Do I need to get an ITIN to apply for the AMEX? I can no longer find info about applying with credit passport.

Yes you now need an ITIN to apply using Nova Credit. You may be able to apply for one card using Amex Global Transfer (if you have a Mexican Amex card) without an ITIN, but you won’t get much further than that. Our Guide to US Credit Cards for Canadians is a good resource.

If I don’t have an ITN but Amex UK history, can I go down the global transfer route?

I’d apply for the Hilton Honours Card.

As of yet, I don’t have a US bank account but presume I’d need to set that up?

And finally, if my end goal is the Chase Sapphire Preferred Card, will I still eventually need an ITN to apply for that as it’s not Amex etc.

Hi Dan,

You can. You can also use Nova Credit and select your country as United Kingdom like so: https://hello.novacredit.com/cards?country=GBR.

You will need a US bank account and statement showing a US address, unless you already have a US address with utility bills to provide.

You are also correct that you will need an ITIN to get Chase or additional Amex cards.

Can I apply for a US Hilton card through Global Transfer without ever getting an ITIN?

Hi Joanne,

Yes you can. On the application you can click “Show Details” and click through to log in to your account. The check the box that you don’t have SSN or ITIN and you’ll be prompted to upload a picture of your passport.

EXCELLENT information!

Hi there,

This post was very useful. Is the general process:

1. Use global transfer to obtain the first US Amex

2. Get ITIN

3. Apply another US Amex with ITIN and Nova

4. Apply to other bank’s products?

Or can we skip #3 and go straight to #4?

Thanks,

Rob

Hi Rob,

You can skip #3 if you have #1 and #2 and six months of credit history. Although most typically get another Amex card before going for another bank. Chase will almost always require one year or more of history unless you apply in branch.

You can also do #1 and #2 concurrently, or start with #2 and then #3 if Global Transfer isn’t successful. People seem find Nova Credit to be more straightforward, but they do require having an ITIN now.

Hi, I got my (and spouse’s) ITIN#’s yesterday using your service. They came in 8 weeks. Thanks a bunch!

I already have AMEX Hilton card for last 2 months and want to apply for Chase Aeroplan card for both of us (Individually). We do have US address and have jointly opened a Chase bank chequing account couple months ago with our family member who lives in US.

Spouse doesnt have a US AMEX card yet – I just added her to my AMEX Hilton account and have applied RBC Visa (her own) per details above (used SIN and ITIN).

Should we wait few months before applying Chase card? I dont have my FICO score yet.

I dont want to risk rejection at any cost!

Appreciate your advice.

Thanks

-Harry

Can US credit cards be paid off with Wise to avoid the need for a US bank account?

I don’t believe so, moreover a US bank account helps with US address verification.

Is this legal?

Depending on which part of the overall process and your specific situation, it can be a gray area, as is a lot of the miles and points game. Importantly, with the IRS/ITIN process, you aren’t claiming to be a resident so that aspect isn’t a misrepresentation.

Hi,

If a book travel on an American credit card and I need to use the travel insurance will it work?

Thanks

Hi Tyler. That is hard to say. Would depend on a number of factors including the specific credit card and what their terms and conditions state.

I expect in many cases, and for smaller claims in particular, that your claims would be successful.

However, I would personally feel safer being covered by a Canadian card, especially for things like travel medical insurance which are going to require a lot more detailed paperwork if you ever need to submit a claim.

Hi,

Great information!

Question – I have a Canadian AMEX credit card for 2-3 months now, and have a very good credit score in Canada. I am salaried in Canada.

I already have US SSN but a bad credit score there. ( I used to have a good credit score in US but then I left US 4 years ago and since then no activity).

Can I still apply for US Hilton Honors credit card that you mentioned in this article and what are my chances of approval?

Thanks,

Vivek

Hey Vivek,

It’s hard to say for sure your best approach going forward, without more details. Do you have any US products still that you could put some spend on and repair the score? Is the score itself bad (like say, sub 650), or you just haven’t been using any credit there for a while? Amex does tend to be fairly generous.

You can certainly apply using Nova Credit, which will leverage your TransUnion score in Canada. However, there are data points that Amex US will detect if you have US credit and use the US profile anyways.

Alternatively you could try Global Transfer Canada to USA, which uses just your amex canada relationship. 3 months isn’t a lot though.

And if that fails then I’d recommend using any US products you do have, or getting a US credit card via crossborder services with a Canadian bank, and trying to repair your US score that way and get back in the game.

Cheers.

Hi,

Is there a choice of a card other than AmEx? I can’t do the global transfer at the moment.

Thank you

Hi Mike,

Amex is definitely the best to start with since you begin to build that relationship with an issuer who has some of the biggest bonuses in the US. Are you Amex banned? I do have a friend who was still able to get his first US Amex card via Nova Credit after being banned by Amex Canada.

You could look to any of the big five banks in Canada that offer cross-border accounts as they may offer US-based credit cards – RBC is one of those issuers (https://www.rbcbank.com/cross-border/us-credit-cards.html). While they don’t come with any welcome offers, it might be an alternative option you could consider.

Thanks, I did not know that AmEx US can be available even with AmEx Canada bad luck.