Once you’ve been approved for your first United States credit card (most likely an Amex card through Nova Credit or Global Transfer), it’s a bit of a waiting game to build up your credit history and credit score before applying to other issuers. While we recommend getting an Individual Tax Identification Number (ITIN) as early as possible, having one only serves to resolve your identity to the credit bureaus, but it doesn’t actually improve any aspect of your credit file or credit score.

US Credit Building Takes Time

Most of the experts recommend playing the Amex game in your first year while trying to stay well under the infamous Chase 5/24 rule. Then when you’ve got a year of history under your belt you might start applying for Chase cards.

While we generally think this is a solid strategy, I would caution the following: 1) don’t assume that anything under 2 years of history will be enough for Chase, and 2) don’t pass up on great opportunities just because you’re holding out for Chase.

For me, it took nearly two years of history built on two Amex cards, and a Citi Premier card before I was able to get a Chase Sapphire Preferred (and I was denied multiple times). And even after getting my first Chase card, getting a second card isn’t proving to be a walk in the park either. So all that waiting and preserving my 5/24 spots, and now most of them are opening up anyway with me approaching two years of history.

My point here is simply that it can be good to take a step back and approach your US credit card strategy a bit more holistically and with a long-term view in mind. Building a solid foundation should be the priority, not getting a specific card or welcome bonus. And that’s what we hope to help you with throughout this article.

We’re not going to debate over what specific cards you should apply for in your second year of US history, or how long to wait before applying for Chase. Instead, we will provide an overview of the basic steps you should take to monitor and improve your US credit score as quickly as possible. Additionally, we also have several ideas for new and somewhat experimental ways surrounding the fastest ways to build credit.

We do assume you already have an ITIN for a lot of the strategies mentioned, so if you haven’t done so already, consider using our in-house ITIN Service!

Getting Started: Establish Credit Monitoring

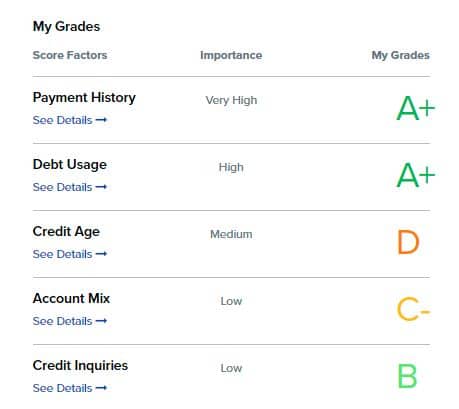

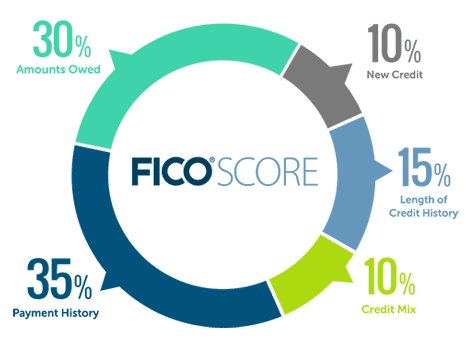

As you may know from our introduction to credit cards post, your credit score is determined by a variety of factors including payment history, debt usage, age of accounts, account mix, and credit inquiries (hard pulls).

As opposed to Canada where there are two credit bureaus, the US has three: Experian, Equifax, and TransUnion, which provide three slightly different (but the same) scores. FICO on the other hand is just a proprietary scoring model which uses information from all of the three bureaus.

| FICO | Experian | Equifax | TransUnion | |

|---|---|---|---|---|

| Range | 300-900 | 300-850 | 280-850 | 300-850 |

| Breakdown Payment history Utilization Length of history Inquiries Credit mix | Percentage 35% 30% 15% 10% 10% | Percentage 35% 30% 15% 10% 10% | Percentage 35% 30% 5-7% 10-12% 15% | Ranking Payment history: 4 Utilization: 3 Age & Type Of Credit: 3 Total Balances & Debt: 2 Available Credit: 1 Inquiries: 1 |

| Full Credit Report | ❌ (score only) | ✅ | ✅ | ✅ |

After about 3-6 months, your reported card payments should establish a profile with the credit bureaus. It’s important to keep track of your credit score and history through credit monitoring services.

Credit Monitoring with FICO

We generally assume that any Canadians starting out in the US card game will get an Amex card as their first. Luckily, Amex offers a built-in way to access your FICO score.

Simply log in to your US American Express dashboard and visit this link.

Now, there exist multiple versions of the FICO score. This score is FICO 8 and although Amex claims to use it, you might see a different number if you went directly to FICO, and the number seen by other financial institutions that use FICO when evaluating your creditworthiness could be different as well (depending on the type of credit too). Something to keep in mind.

Note: It seems that in addition to Amex, Citibank provides its clients with an Equifax-based FICO score, and Bank of America provides clients with a TransUnion-based FICO score.

Credit Monitoring With Experian

In addition to monitoring your FICO score with Amex, I recommend signing up to credit.com, which is a service similar to CreditKarma and Borrowell in Canada. This will provide you with your Experian-based VantageScore 3.0.

You will also get access to a ‘Credit Report Card’, which is a mini version of a full credit report, showing your open accounts, debt, total credit limits, recent inquiries, addresses on file, and some other useful information.

To sign up, you will need to enter your ITIN in the SSN field, along with identifying information including your US address and birthdate. I would recommend using a VPN such as Windscribe to emulate a US IP.

Credit Monitoring With Equifax

MyEquifax is a free portal provided by Equifax. It provides you with an Equifax-based VantageScore 3.0 along with a full detailed credit report. You will need to use your ITIN to sign up. The credit report section is more comprehensive than what is provided by any of the other monitoring services.

Credit Monitoring With TransUnion

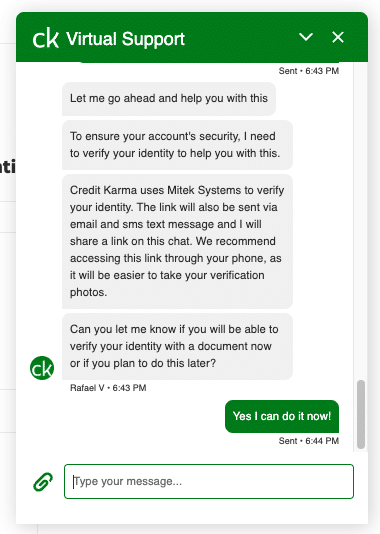

Unfortunately, I am not aware of any way to get your TransUnion scores for free without an SSN. Credit Karma will only accept SSN and does not recognize ITIN. If anyone is aware of anything else, please let us know in the comments!

Update: Allegedly you can sign up for Credit Karma, and at the verification step contact them via online chat via the HELP CENTER and ask for verification for a non US ID. Then they will provide a separate secure link to verify your passport.

What About Full Credit Reports?

Full credit reports are also hard to get without a valid SSN. Normally you can request one free once per year via annualcreditreport.com, but alas ITIN will not work. Experian will accept ITIN, but only if requested by mail. Use this form to request your credit report from Experian (entering ITIN in the SSN field). You will also need to provide a copy of piece of ID and proof of address such as bank statement, utility bill, etc. More information can be found on the Experian blog.

If you can get signed up for myEquifax, this will provide you with an online version of your full credit report, along with the VantageScore 3.0 based on Equifax data.

Standard Ways to Build US Credit History

On to the meat and potatoes: you now have your first US credit card with American Express, you’ve got an ITIN, and you’ve got access to your credit scores. What now? How do you start building your credit profile and unlock access to the other juicy issuers, namely Chase, Citi, CapitalOne, and maybe even Bank of America?

For Canadians without an SSN, there are limited ways to build credit history (aside from time). However, the most accessible means are the following:

- Apply for more credit cards

If you only have one card with Amex, I would definitely recommend trying for a second after 3-6 months. This will give you a higher credit score, which also doubles to decrease your utilization if you started off with a low limit. Find the best offers for US credit cards with our comparison tool.

- Apply for a higher credit limit on existing credit cards

If you already have a few credit cards with Amex, you can consider asking for a credit limit increase on some of those cards (but only every 6 months). I myself found this helped in finally getting approved with Chase, as Amex initially gave me a very low limit on my 1st and 2nd cards ($2,000-$3,000 if I recall). After a request, I was up to $13,000 and from there, things seemed to pick up for me with other issuers.

- Apply for secured credit cards

As a last resort, if you’re really having issues branching out, or just wanting to get an in at another issuer such as Citi or Capital One, you could consider applying for a secured card. I get mailers for these all the time with pre-approval. You deposit an initial amount (as low as $49 USD with a Capital One Platinum Secured card, and that becomes your credit limit. They work very much like prepaid cards.

At the end of the day, there is only so much a credit card can do to improve your credit rating. It is only one type of credit/debt among many (mortgages, personal loans, utilities). In addition, you run into a bit of a chicken and egg problem – without a rich history, getting approved for new issuers outside of Amex is limited. But without new accounts from a variety of lenders it’s a slow process to improve your history. As you saw previously in this post, even after 2 years of history and cards at Amex, Chase, and Citi, my account mix is still rated a C-.

So in this next section, we’ve brainstormed (and done some first-hand testing) ways that you can expedite your credit-building process and build a richer history faster (ideally in your first year of US card membership).

(Experimental) How to Build US Credit History Faster

Disclaimer: we have not tested all of these first hand, but where we have first hand experience we have commented as much.

Buying Tradelines

A tradeline is simply an account that appears on your credit report. Your first US Amex card is a tradeline for example. So why and how would you “buy” a tradeline? Well in the US (unlike in Canada), authorized users on a credit card will have the primary card account show up on their credit report. What’s more, you will inherit the full history of the primary card.

So by having someone else with say a 10 year old credit card add you as a supplementary cardholder, you suddenly have 10 years of credit history in the eyes of the bureaus and issuers. Sounds too good to be true!

Possibly… the trick is to find a reliable tradeline provider. The leading tradeline provider we’re familiar with is Tradeline Supply. Their service is entirely online, and works as follows

- You browse available tradelines being sold on their dashboard

- Add a tradeline to the cart and go through the checkout process (this will include signing an agreement/conditions and filling out personal information).

- Tradeline Supply takes care of the rest and ensures that you are added to the tradeline by the seller.

You are only guaranteed to have the tradeline reporting to your credit profile for 2 reporting periods so keep this in mind when looking at prices.

Tradelines are a large topic that may warrant a future dedicated post. Frugal Flyer may even consider entering the tradeline reselling business down the road. For now, I would recommend reading the resources page of Tradeline Supply’s website, as it’s filled with high-quality information on tradelines, including the (potential) benefits and risks.

Some other Tradeline suppliers which we haven’t researched as thoroughly:

Note: Tradeline Supply currently requires an SSN, so will not work for ITIN holders 🙁

Credit Builder Fintechs

Extra

There are a number of fintech apps popping up aimed at helping customers improve their credit score. Extra is one that came on our radar quite recently.

Extra is a prepaid debit card. When you make purchases with the Extra card, Extra immediately reimburses themselves for the purchase using your connected bank account.

There is no credit check required and no interest rates. The only catch is a monthly subscription fee of $8 USD (or $12 USD for the premium card that also earns rewards).

Extra is definitely something to consider early on if you want to expedite your credit history quickly in your first year. While I do not think it would have nearly the impact of an aged tradeline, it is considerably cheaper. Extra also claims to report to the bureaus as an uncapped loan, which would be more impactful than something like a secured credit card.

Read more in our article detailing the ins and outs of Extra Credit.

Others

Aside from Extra, there are numerous other fintech companies providing a similar service to improve credit scores. These are summarized below.

| Summary | Credit Type | Reports to | Subscription Cost | Interest | Accepts ITIN | Accepts Canadian Mobile Number | |

|---|---|---|---|---|---|---|---|

| Extra | Debit mastercard and app, purchases are paid by your connected bank account. | Uncapped loan | Experian, Equifax | $8 / month | None | ✅ | ✅ |

| Grain | Digital credit card, credit determined by linked bank account. Only available on Apple store currently. | Line of credit | Experian, Equifax, TransUnion | $0 | 15% APR | N/A* | ✅ |

| Brigit | Brigit opens a $250 loan and you deposit it into a community bank account. The loan is paid from there each month. | Installment loan | Experian, Equifax, TransUnion | $10 / month | None | ❓ | ❓ |

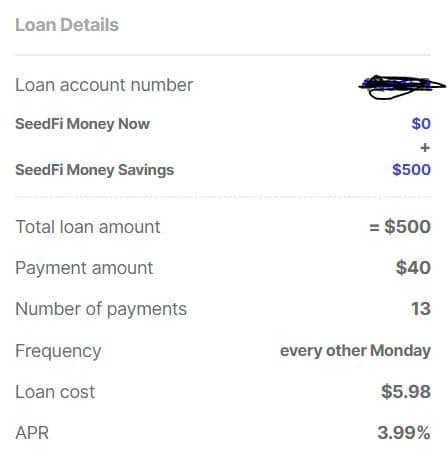

| SeedFi | You choose an amount ($20, $40, $80) to pay every month, and this is structured as a loan payment to SeedFi. You receive the money back once you reach $500 in savings. | Installment loan | Experian, Equifax, TransUnion | $1 / month or FREE with referral | None | ✅ | ❌ |

| Self | Setup as a monthly payment of $25, $35, $48, or $150 for a fixed term of 24 months. | Installment loan | Experian, Equifax, TransUnion | $9 admin fee | 15.92% APR | ✅ | ✅ |

| Credit Strong | Installment loan with borrowed funds placed in interest earning savings account. Single fixed monthly payments. Large loan amounts, designed to ‘supercharge’ your credit score. | Installment loan | Experian, Equifax, TransUnion | $25 admin fee | Variety of plans with APR of 5.9% – 13% and total installment amount from $1,000 to $10,000 | ✅ | ✅ |

| Kikoff | Kikoff provides a $500 credit line with no fees, you activate the line by buying items from the Kikoff store. | Revolving credit line | Experian, Equifax | $0 | None | ❌ | ❌ |

| Varo Believe | Secured credit account, must have a Varo Bank account with $500 in deposits to be eligible. | Secured credit card | Experian, Equifax, TransUnion | $0 | None | ✅ | ❓ |

Of note, none of these services will run a hard credit check. Some may require a US phone number in order to sign up (eg. Kikoff). I did not go through the full application and funding process with Grain, Brigit, or Self.

I did go through setting up an installment loan with SeedFi and it was a very smooth process. I entered my ITIN in the SSN field, uploaded a passport photo and a selfie, and connected my TD checking account via Plaid. The $40 payment comes out automatically every two weeks, and I can already see the loan on my credit report.

If you’d like to try SeedFi, use our link and you will save on the $1/month administrative fee.

Update (10/2023): I have also now used Credit Strong when helping set up a few friends and family with their US credit cards. The process was very straightforward, and worked with ITIN and Canadian phone number without any convoluted verification process.

Credit Builder Loans

Credit builder loans are very small loans that are usually secured by a cash deposit. You provide the deposit to the lender, and they loan you back the same amount so that on paper, you have a loan reporting to the credit agencies. In reality, the money is guaranteed for the lender, but this allows them to give you a near 0% interest rate.

It’s most common for credit unions to offer these types of loans, along with a few challenger fintech companies, such as Chime.

As with other methods discussed above, the biggest hurdle is often finding a lender who will accept ITIN instead of SSN. We’ve dug into a few of them below, but the number of possible lenders who offer this type of loan is endless.

| Loan | Interest Rate (APY) | Accepts ITIN | Requires In-person Appointment | |

|---|---|---|---|---|

| Affinity Credit Union | Kickstart Credit Loan | ❓ | ❓ | Yes |

| Alltru Credit Union | Credit Builder Loan | 12% | ✅ | ❓ |

| Express Credit Union | Credit Builder Loan | ❓ | ✅ | ❓ |

| Lending Circles | Group Loan | 0% | ✅ | Yes |

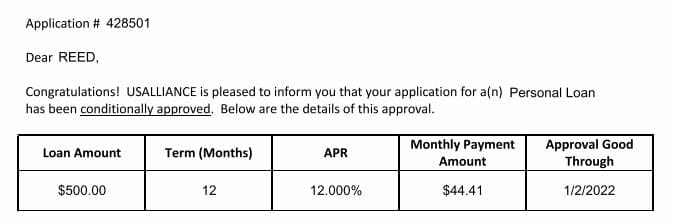

| US Alliance Financial | Credit Builder Loan | 12% | ✅ | No |

I personally applied to US Alliance Financial for credit builder loans and was pre-approved within 24 hours. I then had to provide a copy of my passport and ITIN letter. From there, a credit builder savings account was set up and the loan was funded.

PayPal Line of Credit

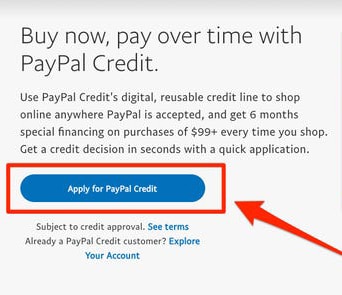

A few times when making PayPal purchases on my US PayPal account, I’ve noticed an offer for PayPal credit. This is a similar idea to Buy Now Pay Later, but functions as an actual reusable credit line.

PayPal credit is subject to credit approval, and I can only assume that balances are reported to the credit bureaus. I have no first-hand experience, but if you see a pre-approved offer it might not hurt to give it a try and add it to your credit account mix.

Let us know in the comments if you have any experience with PayPal credit!

Buy Now Pay Later

We’ve previously written about Buy Now Pay Later, a new payment scheme offered on many eCommerce checkouts. Some of these BNPL providers also offer credit-building services by reporting your payments to the bureaus. For example, Sezzle has Sezzle Up, which reports your payments to TransUnion and Equifax.

Signing up for Sezzle Up as a Canadian is a bit tricky. You’ll need a US phone number in order to set your billing country to the US. I was able to do this using my Google Fi number.

From there, you can link a bank account or credit card, which will be charged when you make purchases using Sezzle (25% installments).

There is no hard credit check for Sezzle or Sezzle Up. In fact there is really no downside to using it, as long as your linked bank/credit card aren’t declined, you won’t ever be charged extra by Sezzle.

The main limitation of Sezzle is that it can only be used at partner stores, which at present are mostly boutique and niche retail stores. Target and Bass Pro Shops are the only large chains I recognized.

Finmasters has a comprehensive review of Sezzle Up if you’re interested to learn more.

Conclusion

If you’ve just ventured into the US credit card game, don’t get discouraged or feel that you’re starting from scratch in terms of credit history. Most new Canada-to-US miles and points enthusiasts simply accept the reality that they won’t be able to ramp up their card application rate to what they’re used to in Canada for years (or god forbid, even manage to get their first Chase credit card).

We feel that being aggressive in establishing your credit profile as best you can as early as you can is a superior and overlooked strategy. Follow what we’ve discussed above. Get multiple personal cards as fast as possible, even if it means also signing up for a secured card.

If you can afford it, pay a bit extra to add another account type, be it a credit builder loan, or Extra. And if you really want to pay to play, consider buying an aged tradeline. Combining these tips can get you on your way to a good credit score in minimal time.

We’d love to hear the experiences of any of our readers venturing into the US credit card game. How long did it take you to get additional credit cards in the United States? Have you used any of the above providers? Are you aware of any other ways to build credit history not mentioned here? Let us know in the comments!

Reed Sutton

Latest posts by Reed Sutton (see all)

- Frugal Flyer Presents: Best Credit Card Awards (2026) - Jan 30, 2026

- Frugal Flyer Presents: Best Bank Account Awards (2026) - Jan 16, 2026

- Miles & Points in 2025: Year in Review - Dec 31, 2025

- Edmonton Miles & Pints Meetup (Feb 2026) - Dec 4, 2025

- Review: The St. Regis La Bahia Blanca Resort, Tamuda Bay - Dec 3, 2025

Not sure if anything has changed recently but I have had zero luck in signing up with Credit Strong, Self or Varo Believe. Credit Strong wants to do a SSN validation (which naturally with an ITIN fails), after a couple of phone calls with Self attempting to validate identity I was told a SSN is now mandatory and an ITIN won’t cut it. Varo Believe simply said my application was not approved without further reason but perhaps it’s because the 24/7 Parcel address I use has been flagged?

Great info thanks

Self requires you to confirm you are a citizen or PR – then next step is confirmation of non resident alien but need to select the visa type you are on and country (H1B, L1 or student)

Credit Strong didn’t require info and was able to