The Capital One Venture X Rewards card is a premium travel credit card in the US market that can take our points and miles game to the next level. It features amazing airport lounge access, great transfer partners, and essentially pays you to keep the card year after year.

While we typically recommend our readers look into how you can obtain US credit cards as a Canadian for the amazing welcome bonus and some travel perks, it’s rare that we think it makes sense to put daily spending on them. However, the Capital One Venture X Rewards credit card actually makes a strong case to be a “catch-all” card for all of our spending, even in Canada.

In this article, we’ll give a comprehensive review of the Capital One Venture X Rewards card, why it makes a strong case to be in our wallets, and how you can get approved as a Canadian!

Overview

Welcome Bonus

The Capital One Venture X Rewards card currently has a welcome offer in which new eligible cardholders can earn up to 75,000 Capital One Miles:

- Earn 75,000 Capital One Miles upon spending $4,000 in the first 3 months

The Capital One Venture X Rewards card earns Capital One Miles and offers unlimited airport lounge access for the cardholder and their authorized users. The card also offers an annual $300 USD travel credit to be used on the Capital One Travel Portal.

Click to learn how to obtain and optimize the Capital One Venture X Rewards card as a Canadian!

75,000 Capital One Miles

$4,000

$1,388+

$395

No

–

We value Capital One Miles at 2 cents per point, which would make this welcome offer worth around $1,500.

Historically, we have seen a welcome offer of 100,000 Capital One Miles, but this is few and far between. However, 75,000 Capital One Miles is still one of the strongest welcome bonuses in the market!

Earning Rates

All spending on the Capital One Venture X Rewards credit card will earn you valuable Capital One miles in the following fashion:

- 10 Capital One Miles per dollar spent on hotels through Capital One Travel.

- 5 Capital One Miles per dollar spent on flights through Capital One Travel.

- 2 Capital One Miles per dollar spent on all other purchases.

While there aren’t many category bonuses unlike other popular credit cards, the Capital One Venture X Rewards card really shines when using it through the Capital One Travel Portal or as a catch-all credit card as it earns 2 Capital One Miles per dollar spent on all purchases.

Annual Fee

The Capital One Venture X Rewards card is a premium credit card that comes at a relatively higher annual fee of $395 USD.

While this may seem like a hard pill to swallow at first glance, it’s actually very easy to make up the entirety of the annual fee and often come out ahead, making this a premium credit card you will want to renew annually! We’ll go over this later in the article.

Benefits

Being a premium credit card, the Capital One Venture X Rewards credit card comes with all the perks and benefits that you would expect to elevate your travel experience to new heights.

Airport Lounge Access for the Cardholder & Authorized Users

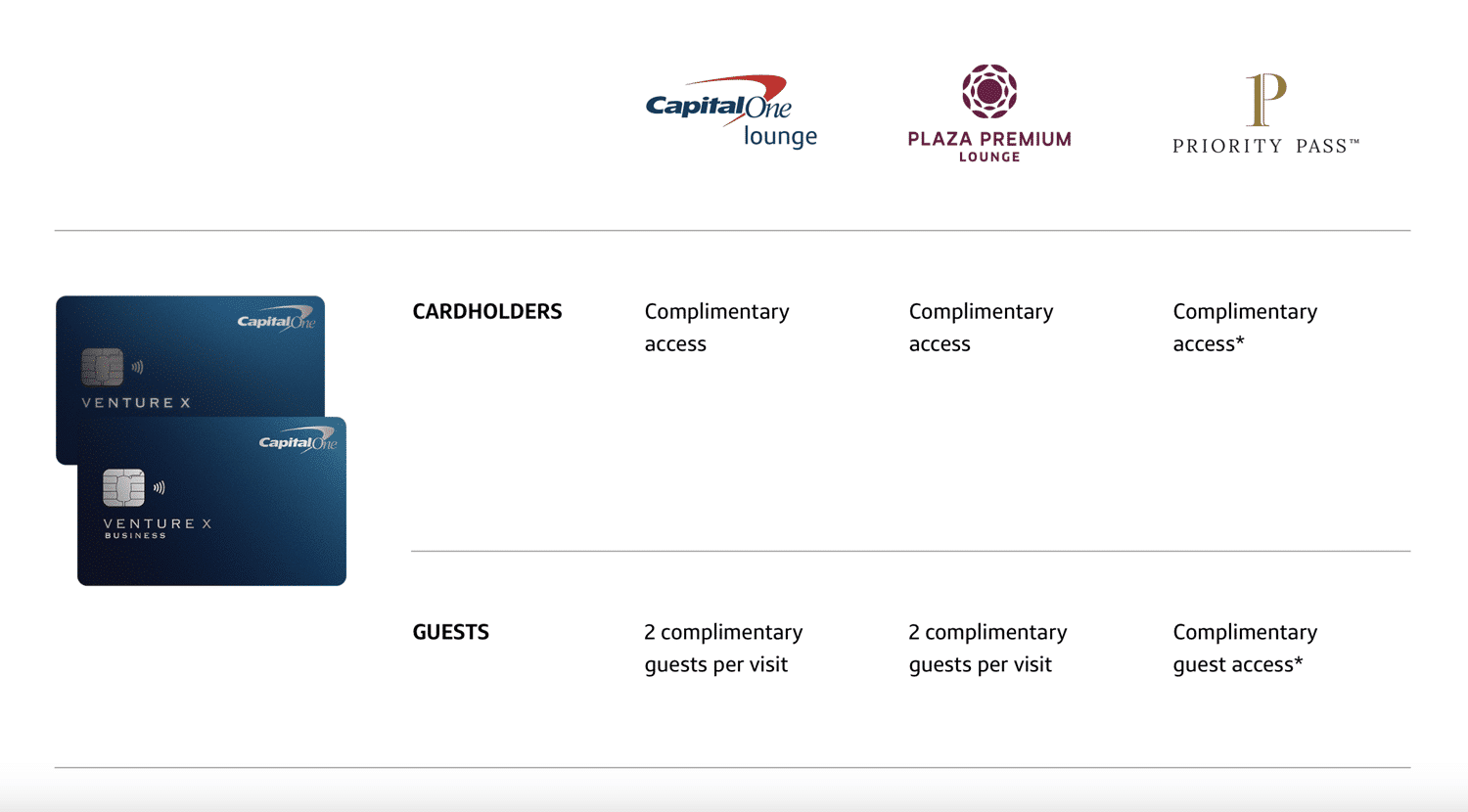

Airport lounge access is where the Capital One Venture X Rewards card is overpowered. Not only do you get complimentary Priority Pass, Plaza Premium, and Capital One Lounge memberships with unlimited lounge access for you and 2 guests, but so do each of your authorized users. Better yet – authorized users are completely free to add to your account!

So what does this mean in practical terms? Well, if you have the Capital One Venture X Rewards card, you can sign up to 4 family or friends for authorized user cards for free and each one of them will have unlimited Priority Pass, Plaza Premium, and Capital One Lounges access!

For example, I have the Capital One Venture X Rewards credit card and got an authorized user card for my partner. Now, she also has unlimited complimentary access to airport lounges, even if we’re not traveling together and she can take her parents, her friends, or whoever else she may be traveling with into the lounge!

It gets even better. You actually do not need to input a US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to add someone as an authorized user. If you and your loved ones travel multiple times per year, this perk alone may pay for the entirety of the $395 annual fee.

On the note of Capital One Lounges – this is a lounge network owned and operated by Capital One, similar to the American Express Centurion Lounges. Currently, they are located at Dallas-Fort Worth (DFW), Denver International (DEN), and Washington Dulles (IAD). I had the chance to visit the Capital One Lounge at Washington Dulles and it is excellent, so this benefit is well worth taking advantage of if you fly out of any of these cities.

Capital One has stated that they plan to continue to expand this network to more major airports in the future.

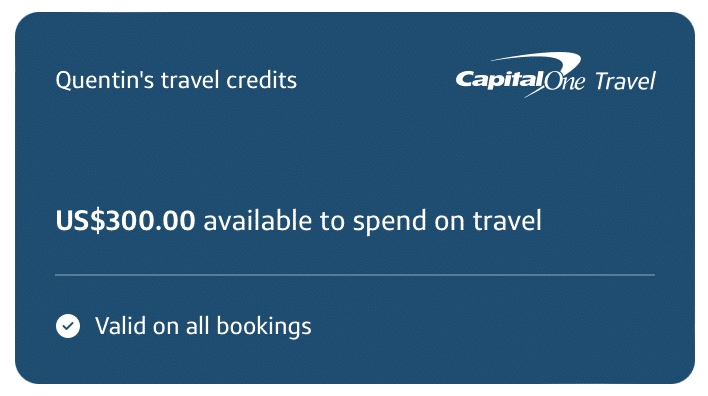

Annual $300 Travel Credit

Cardholders will receive a $300 USD travel credit every year that you hold the Capital One Venture X Rewards credit card, starting with the day that you get approved. This credit must be used on the Capital One Travel Portal and in practice, is a $300 USD coupon that gets deducted from your checkout price.

Our tip with this travel credit is to use it on airfare, as you will still be able to attach your airline loyalty number to the itinerary to earn points and qualify for elite status. Conversely, if you book hotels, they are not obligated to honor elite status benefits or earn elite status qualifying nights and reward points for stays.

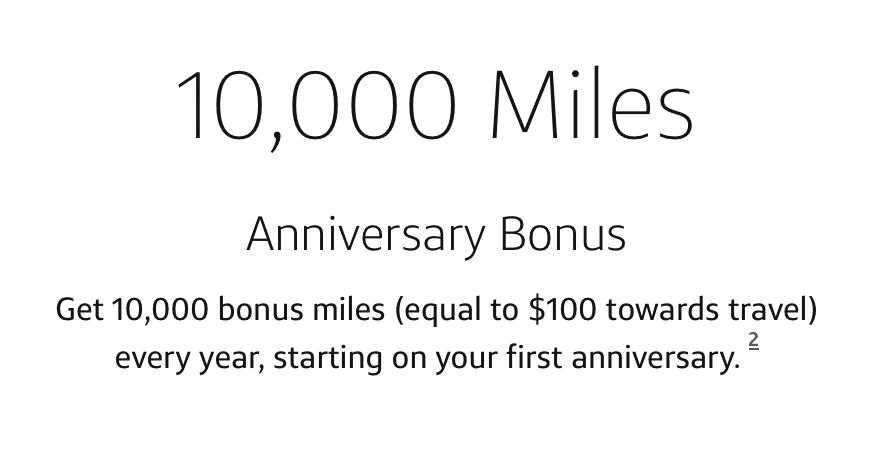

Anniversary 10,000 Capital One Miles

On every anniversary you have the Capital One Venture X Rewards card, you will receive 10,000 Capital One Miles as a “thank you” from Capital One for renewing your card. For example, if you were approved for the card in March 2024, you will receive your first anniversary bonus miles in March 2025.

We value these bonus points at $200 USD, which is an enticing way to keep the card year after year!

Capital One Premier Collection Hotels

Capital One’s answer to American Express Fine Hotels and Resorts, the Capital One Premier Collection is a portfolio of luxury hotels bookable using the Venture X. You will receive a $100 credit, daily breakfast for 2, free wifi, early check-in, late check-out, and suite upgrades (when available) on every stay at a Premier Collection hotel.

In addition to hotels, Capital One is expanding its portfolio of vacation rentals as part of the Premier Collection. Think AirBnB, but luxury! These are great options for large groups to rent out together for a stay.

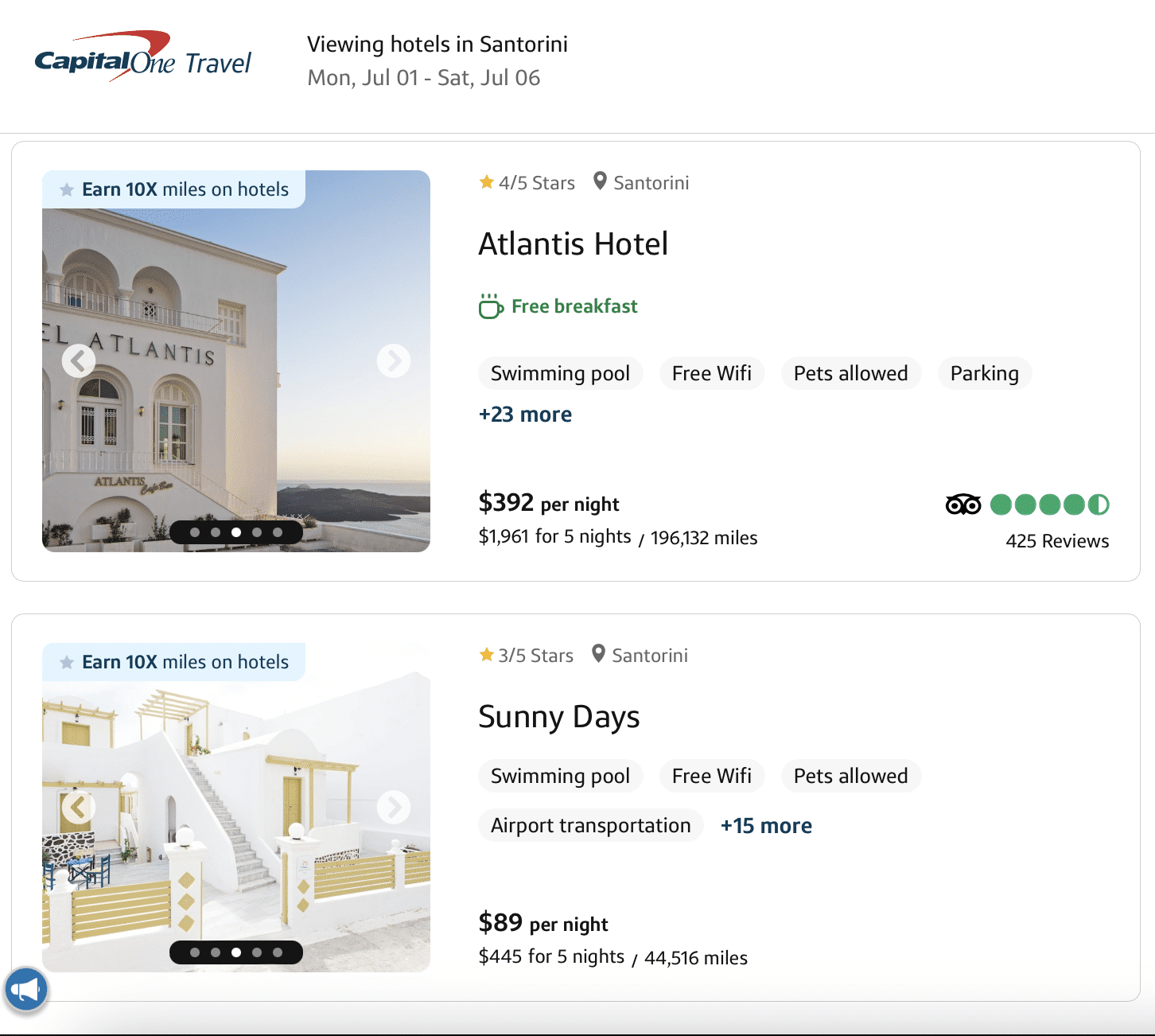

You can also use your $300 travel credit towards a booking with Premier Collection and earn 10x Capital One Miles on paid stays as these hotels must be booked through Capital One Travel.

Hertz President’s Circle

You will receive complimentary Hertz President’s Circle with the Capital One Venture X Rewards credit card, giving you front-of-the-line access at rental desks and complimentary vehicle upgrades. However, this perk will leave the card at the end of 2024. It has not been announced whether Capital One will replace this with a different rental car company.

No Foreign Transaction Fees

Similar to other US travel credit cards, the Capital One Venture X Rewards card does not have foreign transaction fees. As it earns 2 Miles per dollar, this makes it a very strong catch-all card while traveling abroad, or even using it for daily spend in Canada considering that there are very few credit cards in Canada with no foreign exchange fees.

Primary Collision Damage Waiver Coverage & Other Insurance

As long as you pay for the rental car with the Capital One Venture X Rewards card and decline insurance when renting your car, you will be covered by the card’s comprehensive primary collision damage waiver. This will save you quite a bit of money when using rental cars because the insurance offered by the rental company can cost over $20 per day!

In addition, you’ll receive an array of travel insurance coverage, including:

- Trip cancellation and interruption coverage up to $2000 per traveler.

- Trip delay compensation for flights delayed more than 6 hours, up to $500 per traveler.

- Travel accident insurance.

- Lost or damaged baggage.

If you happen to have a US phone service plan, consider using the Capital One Venture X Rewards credit card to pay your monthly phone bill for comprehensive cell phone coverage insurance.

For more information about all the coverage provided, make sure you read the Capital One Venture X Reward card’s insurance certificate.

Redeeming Capital One Miles

Capital One Miles can be transferred out to transfer partners (including various hotel loyalty and frequent flyer programs) or redeemed for statement credits, travel purchases, or gift cards.

Frequent Flyer & Hotel Loyalty Transfer Partners

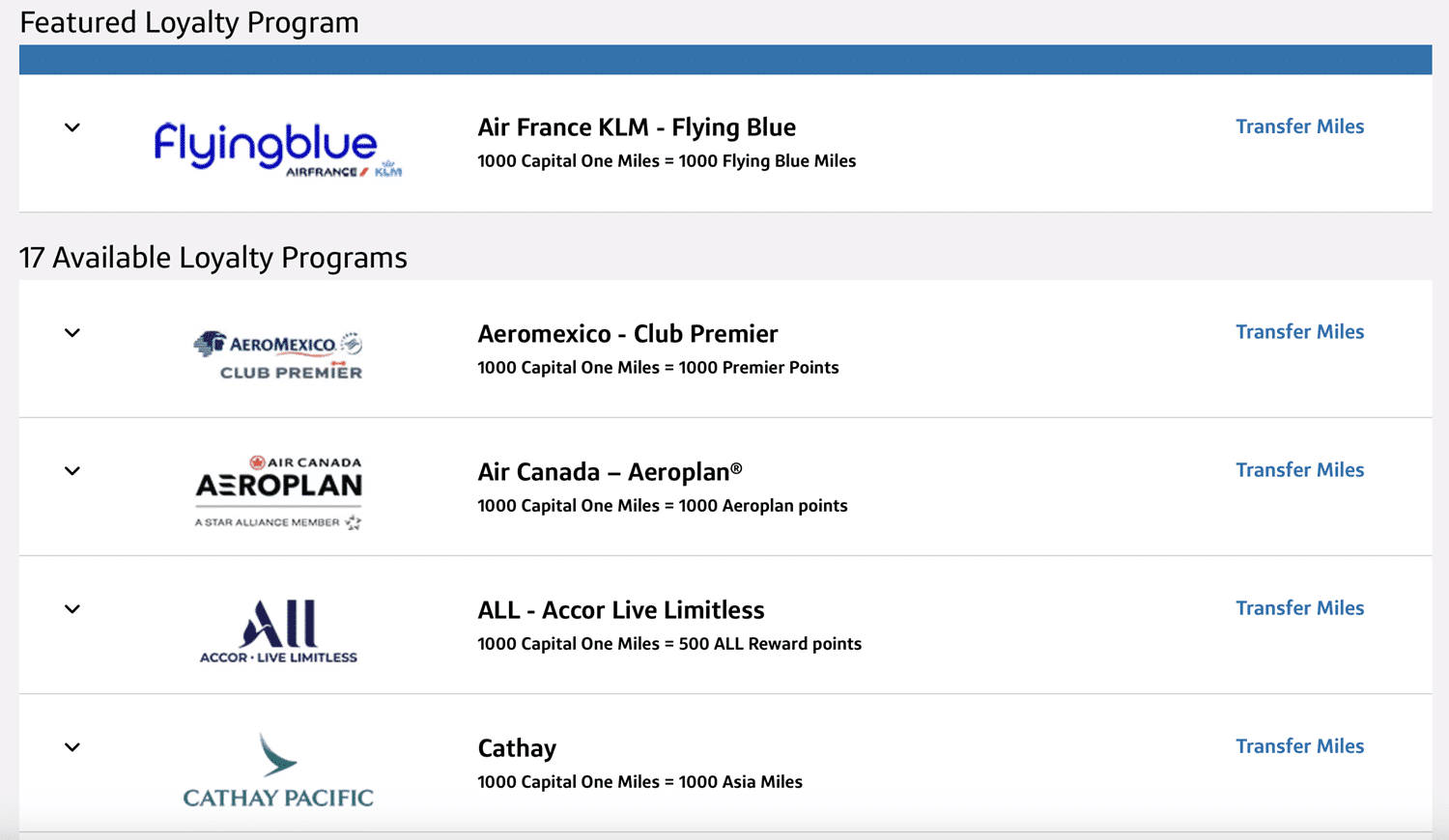

Capital One Miles can be transferred out to one of their 18 transfer partners (15 airlines and 3 hotel brands). This is, hands-down, the best way to use your Capital One Miles to maximize their value of 2 cents per point (and often even higher). Here is a list of partners and their transfer ratios:

| Airline Transfer Partners | Hotel Transfer Partners |

|---|---|

| Aeromexico Club Premier (1:1) | Choice Privileges (1:1) |

| Air Canada Aeroplan (1:1) | Wyndham Rewards (1:1) |

| Cathay Pacific Asia Miles (1:1) | Accor Live Limitless (1:0.5) |

| Avianca LifeMiles (1:1) | |

| British Airways Avios (1:1) | |

| Emirates Skywards (1:1) | |

| Etihad Guest (1:1) | |

| Finnair Avios (1:1) | |

| Air France KLM Flying Blue (1:1) | |

| Qantas (1:1) | |

| Singapore Airlines KrisFlyer (1:1) | |

| TAP Miles&Go (1:1) | |

| Turkish Airlines Miles&Smiles (1:1) | |

| Virgin Red (1:1) | |

| EVA Air (1:0.75) |

These are excellent transfer partners and open up some partners that we do not have in Canada. Of note, Avianca LifeMiles, Turkish Airlines Miles&Smiles, Singapore Airlines KrisFlyer, and Virgin Red are all very strong airline loyalty programs unavailable to us through credit cards in Canada. If you are loyal to Air Canada, Aeroplan will always be a strong transfer partner for your Capital One Miles.

Some partners also transfer at a better ratio than our Canadian options. The most enticing one would be Air France KLM Flying Blue, which transfers at 1:1. This makes booking a Flying Blue Promo Reward that much more amazing!

In addition, we also get access to 3 new hotel partners that we can consider to transfer our Capital One Miles out to. I think the best one would be Wyndham Rewards for Las Vegas hotels or Vacasa Vacation Rentals.

If you want to see if there are any bonus promotion opportunities when transferring Capital One Miles, check out our Miles & Points Transfer Tool.

Statement Credit

You can “erase” purchases made with the Capital One Venture X Rewards credit card by using your Capital One Miles for a statement credit. However, this is the worst way to use your hard-earned miles because Capital One values miles at 0.5 cents per point when used this way. This is substantially less than the 2 cents per point that we value Capital One Miles.

If you are making a purchase through Amazon or PayPal, you get a slight boost for your points – they will be worth 0.8 cents per point when “erasing” these purchases. We still do not recommend using your miles this way.

Travel Purchases

Similar to the statement credit previously described, you can use Capital One Miles to “erase” travel-related purchases. When used this way, Capital One will value your miles at 1 cent per point. This is still a very low-value use for our Capital One Miles.

The one case I could justify using this method to redeem miles is if you are booking a hotel through the Capital One Travel Portal because you earn 10x miles per dollar spent on that purchase when using your Venture X Rewards card. You would then “erase” the hotel booking as a statement credit at 1 cent per point, but because you earned 10x points on the purchase, it would increase the value of each mile used for the redemption.

Gift Cards

You can redeem Capital One Miles for gift cards at over 100 different retailers at a rate of 1 cent per point. Some popular merchants include Nike, Amazon, Starbucks, Sephora, etc. However, 1 cent per point is still a low value for our miles, so we can’t recommend that you redeem this way.

A note if you decide to go for a gift card redemption: these are US gift cards, and while we share many of the same retailers as our Southern neighbors, only some of these are valid for use in Canada. For example, I know that Sephora gift cards can be used in both Canada and the US, however, Amazon US gift cards are only valid in the US. Make sure you do a quick search on whether you can use them in Canada if that is your intention.

Why the Capital One Venture X Rewards Card is Great for Canadians

By now I hope we have convinced you that the US credit card market is extremely lucrative when it comes to points and miles and we highly recommend you get started with your US credit card journey as soon as possible. We think the Capital One Venture X Rewards card is one of the strongest credit cards for Canadians. Let’s take a look at our rationale.

Strong Catch-all Card in Canada & Beyond

We often recommend signing up for a US credit card for an awesome welcome bonus and then only putting a few dollars on it every once in a while to keep it active. However, there is a strong case to be made for the Capital One Venture X Rewards credit card to be consistently used as your catchall card for daily spending that is not part of any category bonus in Canada (and abroad during travel).

As the Capital One Venture X Rewards card earns 2 miles per dollar spent on all purchases, and each Capital One Mile is worth around 2 cents when transferred out to partners, you will return at least 4% on all of your non-category purchases (2 miles per dollar x 2 cents per point = 4%). This makes it an extremely strong contender to be used as a catch-all card. In addition, you won’t pay any foreign transaction fees.

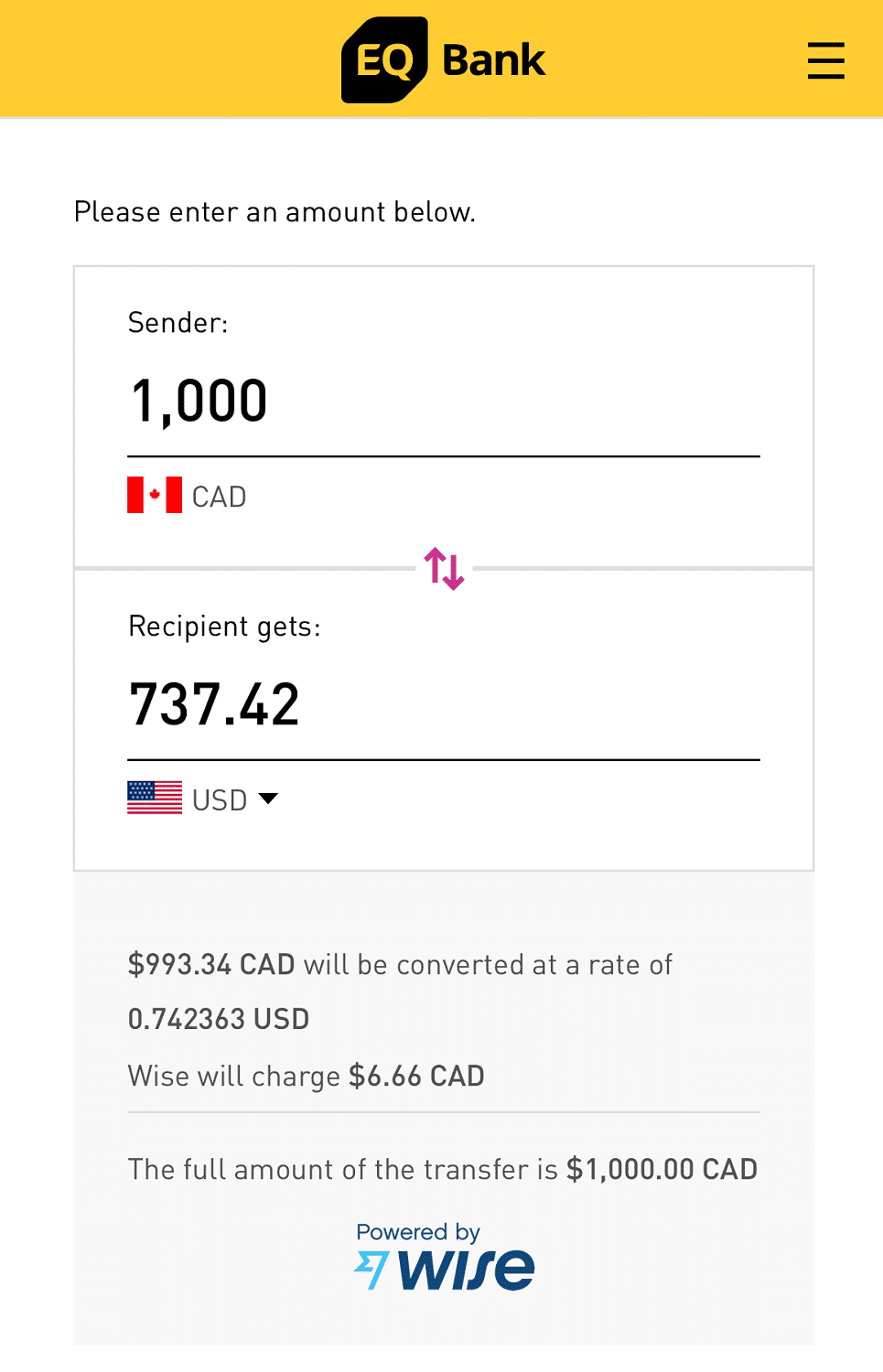

You might ask, what about the cost of exchanging CAD to USD to pay the credit card bill? Your typical brick-and-mortar bank will often charge an arm and a leg to exchange currency, on top of a terrible exchange rate. While there are a number of best ways to exchange CAD to USD, we recommend you use Wise, an online currency exchange service that uses the rate you would typically find on Google and only charges a ~0.5-0.6% fee. This makes currency exchanges substantially less than a traditional bank (e.g., $1000 CAD to USD would cost around $6 CAD).

Pro tip: I recommend opening a free digital checking account with EQ Bank as their international transfers use the Wise network and cost less than Wise.com itself.

Now, let’s do the math – 4% return on spend, minus 0.6% cost of transferring CAD to USD, would yield, at least, 3.4% on all purchases when transferred out to partners. This is substantially more valuable than any Canadian credit card on the market for non-category spending! Yes, it’s a bit annoying that you lose 0.6% due to exchange fees, but like my father always says, “There is no free lunch in this world.”

Transfer Partners

Capital One has an impressive list of partners that we can transfer our Capital One Miles to. The most relevant here would be Air Canada Aeroplan, where we can consistently get amazing value for our points. Additionally, Air France KLM Flying Blue transfers 1:1, which is a better rate than what is available to us in Canada. This allows us to get amazing value through the Flying Blue program for fewer points!

However, where the Capital One Venture X Rewards card shines is that it opens up partners that we don’t have access to in Canada, like Avianca LifeMiles, Turkish Miles&Smiles, Virgin Red, and Choice Privileges. It is always important to be diverse and open-minded in the world of points and miles. The more choices we have to transfer our points, the more amazing opportunities we will have for great travel experiences!

Airport Lounge Access

As a premium travel credit card, the Capital One Venture X Rewards card is loaded with benefits to elevate your travel experience. The strongest benefit that comes with the card is the unlimited Priority Pass, Plaza Premium, and Capital One Lounge memberships for you and 4 additional authorized users, at no cost.

This would mean that every member of your family could take themselves and 2 guests to airport lounges. We think this perk alone is worth a couple hundred dollars!

Capital One Travel Portal

I admit, when thinking of booking travel, I rarely think about using a travel portal because I would rather book directly with the airline or hotel. However, there is a good reason to use Capital One Travel.

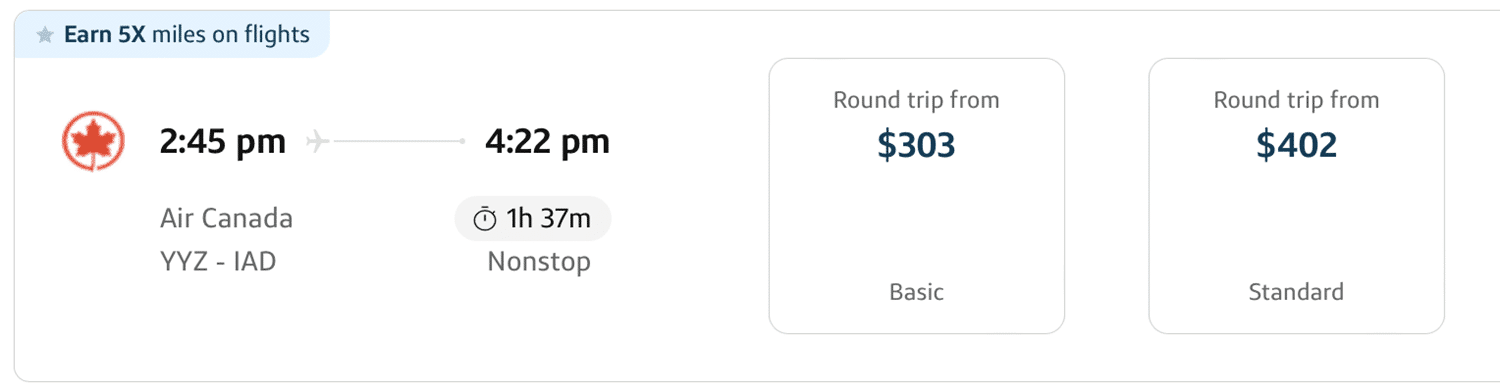

If paying cash for airfare, I would consider going through Capital One Travel to earn 5 Capital One Miles per dollar spent. I would still be able to attach my frequent flyer membership number to earn points and enjoy elite status perks. If you don’t have a credit card that earns more than 5 points per dollar on airfare, I would strongly consider using the portal paired with the Capital One Venture X Rewards card.

Where the travel portal shines is booking smaller boutique hotels that are not part of a large chain. For example, when we went to the Greek Islands, there were basically no options to use points for a hotel award redemption because the large hotel chains did not have a footprint there. Instead, I had to use cash. If you run into a situation like this, I would immediately head to the Capital One Travel portal, as you will earn 10 miles per dollar spent. Plus, you can then “erase” this travel booking using points.

Better yet, the Capital One Travel Portal price matches all purchases made within 24 hours – if you find a cheaper flight, hotel, or car rental online, you can call Capital One Travel and they will refund the difference as a travel credit.

No Net Annual Fee

At first glance, an annual fee of $395 USD is quite a lot to swallow. I admit it scares me sometimes to think about it. However, if we crunch the numbers of the value we get every year from the Capital One Venture X Rewards card, we can actually see that we have no net annual fee. Let’s take a look:

- Every year, we get a $300 USD travel credit. I value this as good as cash, so we can subtract $300 from the annual fee.

- Beginning at our first cardholder anniversary, you will receive 10,000 Capital One Miles. At the minimum, if redeemed for travel, this is worth $100 USD. However, as we mentioned, we value each mile at 2 cents per point when transferred to partners. Thus, we can expect around $200 USD in value from this anniversary gift.

- Net annual fee = $395 – $300 – $200 = a gain of $105 USD.

This calculation doesn’t take into account lounge access and miles earned from spending! So just by holding the card, Capital One “pays” us to keep the card every year! I have yet to find a card so easy to extract value from.

How to Apply for the Capital One Venture X as a Canadian

If you are new to getting US credit cards as a Canadian, we highly recommend you check out our step-by-step guide. In short, you will need a US address, a US-domiciled bank account, and an ITIN. Consider using our ITIN service to take the guesswork out of that process!

There are a few things to be aware of before applying for this card.

Make sure that you have at least 18 months of US credit history. Capital One will not approve you for any of their Venture-branded cards with a “thin” credit profile. I waited for 2 years of US credit history before trying to get approved.

It is best practice to apply for the Capital One Venture X Rewards card earlier in your US credit card journey. Capital One tends to not approve people with a lot of credit cards because they are not deemed as profitable by their system.

For example, I had 2 American Express US and 2 Chase personal credit cards when I applied. This was considered acceptable by Capital One, but we’ve heard of people with 8+ credit cards who can’t seem to get approved.

With these details in mind, let’s take a look at my process of getting approved for the Capital One Venture X Rewards credit card.

Step 1: Venture X Pre-approval Tool

Capital One gives a handy pre-approval tool to see if you have a good chance of getting approved for the Capital One Venture X Rewards card.

You’ll want to go through the questions, including your name, birthday, US address, and social security number or ITIN. The good thing about this pre-approval tool is that this is a “soft credit pull” on your US credit report and will have no impact on the number of inquiries on your report or your credit score.

One of two things will happen:

- You’re pre-approved! 99% of the time, this will mean that if you continue the application, you will be approved. If you want to proceed, click on the “Apply Now” button to proceed to the application. Most of it will be pre-filled from the information that was provided with the pre-approval tool!

- You are not pre-approved. While you can still try to apply for the Capital One Venture X Rewards card on the website, we highly recommend that you wait. It took 2 months of trying the tool to get the pre-approved message, so don’t lose hope. Try again in a few weeks!

Step 2: Complete Your Application

If you previously used the pre-approval tool, this part will be very straightforward. You will simply have to confirm that the information entered in the tool is correct, read the standard disclosures about the annual fee and interest rates, and accept them and consent to electronic statements.

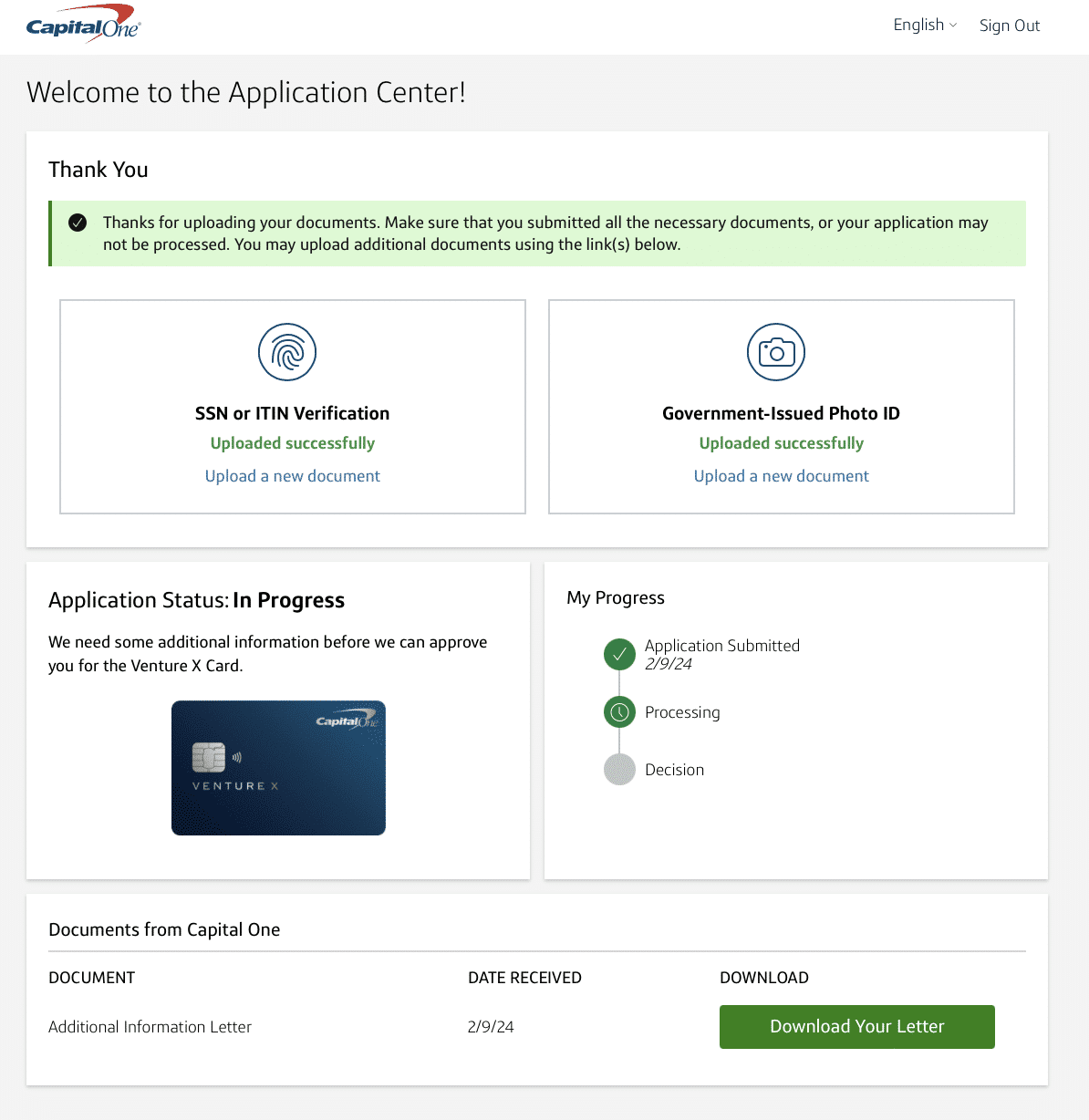

Step 3: Instant Approval or Pending Application

Here is where things take a bit of a turn. You may get lucky and get instantly approved for the Capital One Venture X Rewards card! This usually happens to people who are residents/citizens of the US and have social security numbers.

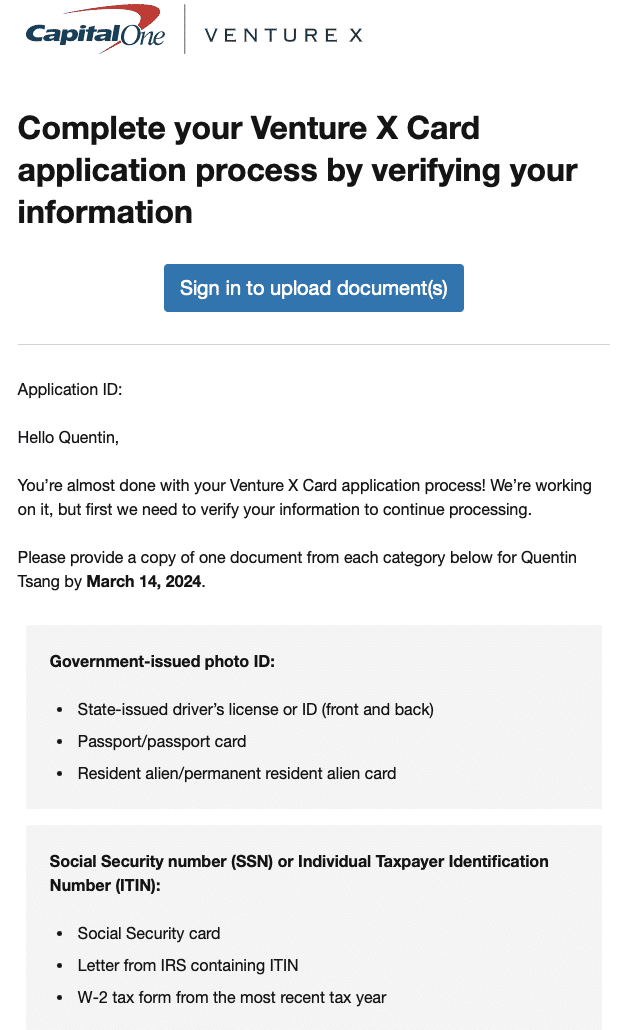

If you’re like me and are not a citizen and applied using an ITIN, chances are you’ll arrive at a screen that says “We’ll contact you in 7-10 business days with a decision.” I won’t lie to you — this made my heart drop because I thought this was not a good sign. However, after 5 minutes, I received an email from Capital One:

For the government-issued photo ID, I used my Canadian passport and for the ITIN proof, I scanned the document using the Notes app on my iPhone.

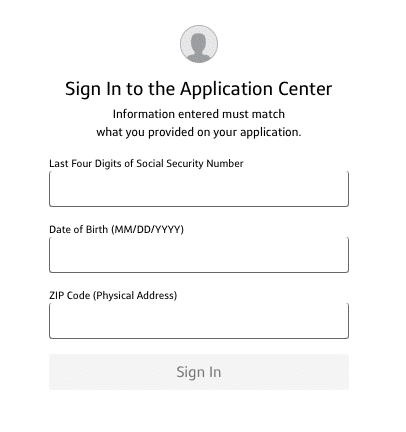

You’ll need to log into the Capital One Application Centre by clicking the link in the email and entering the last 4 digits of your ITIN, your date of birth, and the ZIP code of your US address.

Once logged in, you’ll be able to upload both documents for them to be reviewed by Capital One before they can approve you for the Capital One Venture X Rewards card.

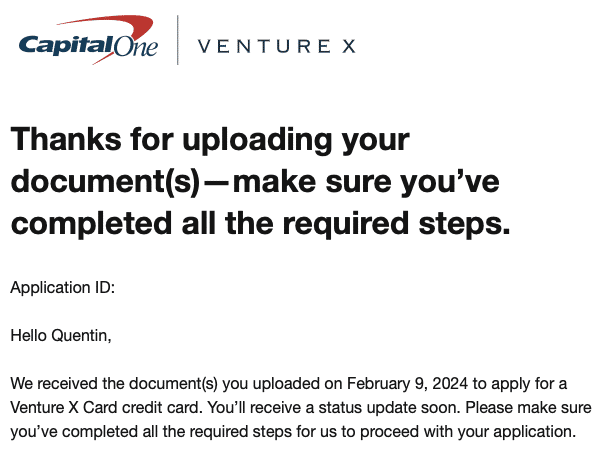

Step 4: Wait

After submitting your documents, you’ll receive a follow-up email confirming that they have been received by Capital One.

Now is the hardest step of this entire process, especially if you’re like me. We have to wait 7-14 days for Capital One to review these documents and get back to us. Unlike other credit card issuers, there is no way of speeding up this process. Believe me, I tried.

I called twice a day for 3 days to try to get them to review my documents and was met with the same answer every time: “We will get to your documents in 7 to 14 days.” Alas, I sat patiently, contemplated the meaning of life, and waited for Capital One’s decision.

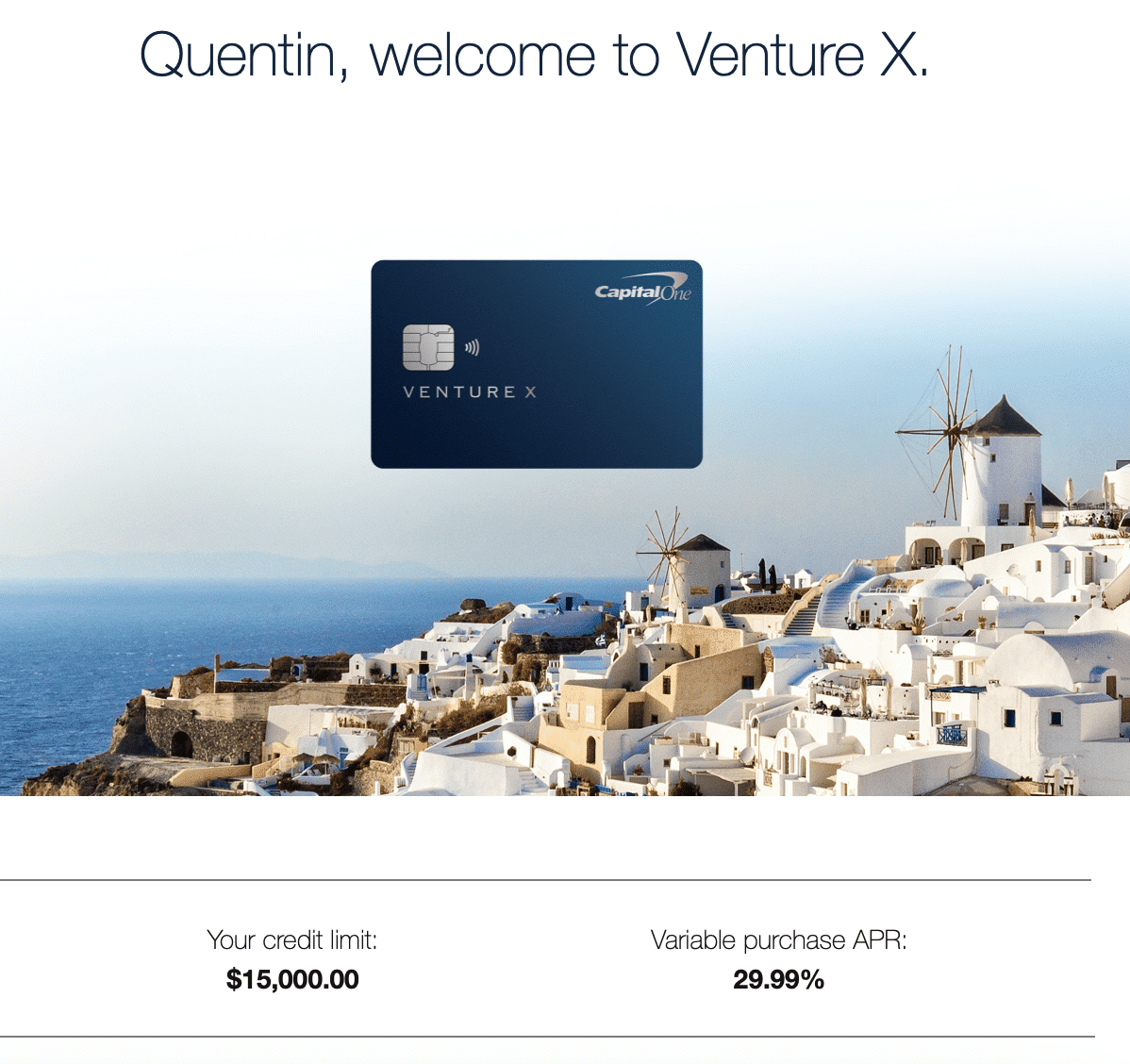

Step 5: Approval!

After 5 days, I received an email: “Welcome to Venture X, Quentin.”

I was over the moon! For reference, I applied for the card on February 9th and submitted my documents the same day. I was approved for the card on February 14th.

After doing some research, I learned that if you are pre-approved through the tool and receive the “7-10 days” message after finishing the application, 99% of the time, you are approved, and Capital One just needs to verify your identity! If I had known this beforehand, I would have been less anxious!

A Few Final Notes

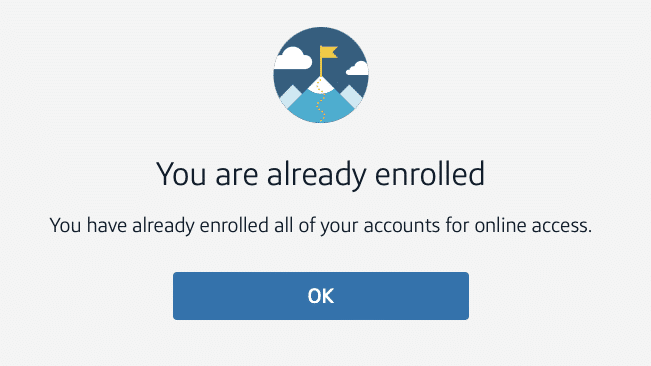

Online Access

In your approval email, you’ll see a link to set up your online account. However, if you had to go through this authentication process, you will not be able to set up an online profile. This was actually a huge source of frustration for me because I could not figure it out and the Capital One customer service line was not helpful.

You’ll get a message either saying that you’ve set up online access for all of your accounts or that online access has been locked for security reasons.

It turns out that anyone who goes through this authentication process must wait until Capital One manually creates your account details on the backend. If you receive similar error messages, I wouldn’t bother calling Capital One because you won’t be able to do anything about it. For reference, after being approved on February 14th, I was able to set up my online profile on February 18th.

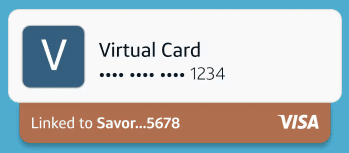

Virtual Card

Capital One advertises that they will provide a virtual card number upon approval. This would mean that you could use your card instantly before it arrives and start working at the welcome bonus.

However, this is not the case if you applied with an ITIN or had to undergo additional verification. To gain access to the virtual card feature, you must wait for the physical card to arrive because you need to enter its details to fully activate your account. Sadly, this means there is no way to get a headstart on spending before the card arrives at your US address.

Conclusion

The Capital One Venture X Rewards card makes a strong case to be a catchall card for non-category spending, even when using it in Canada. Earning 2 miles per dollar spent on all purchases is unheard of in the Canadian market and can allow us to quickly collect points for our next vacation! Combined with premium travel benefits, lounge access, and no effective annual fee, I think the Capital One Venture X Rewards card is a no-brainer for anyone in the points and mile game!

Quentin Tsang

Latest posts by Quentin Tsang (see all)

- Best Hotel Credit Cards in Canada - Jun 16, 2025

- Review: Cathay World Elite® Mastercard® powered by Neo - Jun 1, 2025

- What Frequent Flyer Programs Allow Members to Combine Miles? - May 12, 2025

- Definitive Guide: Aeroplan Family Sharing - Mar 28, 2025

- Marriott Bonvoy Elite Benefit Guarantees Explained - Mar 7, 2025

Thanks and great info always! My US credit history only 6 months old, so I’m not going to apply for the Venture X card now. But do you think I should apply for the quicksilver card now to start a relationship with Cap 1?

just wondering, should I put in the US mail forward address for the VentureX preapproval tool?

Yes. Use whichever US address you use that you have a statement to back it up (eg bank or utility statement), and that is present on your credit profile.

But then the cross border US bank account is using the Canadian address.

You will want to change the cross border account’s address to be a US address.

How to calculate the capital one miles as 2 cents per mile?

Hey Neupur,

It is a bit arbitrary, depending on the type of redemption. But if you look at US blogs like TPG and many others, they will assign a value to Capital One Miles of around 1.5-2.0 centers per points (USD). We don’t currently do our own internal calculations of these values, just look broadly at what others who do are finding.

Does the eq USD account allow to make payment to the capital one? Or have to open a USD account in the states?

Hi Neupur.

You will likely need a US domiciled account to make payments to US companies like Capital One.

do you know of any US banks where you don’t need to be in the States to open a checking account?

BMO Harris. CIBC US. TD Bank.

Is their an email I could ask for further questions of this credit card?

An email for Capital One to contact them? You would probably need to phone them.

Thanks! To clarify, is it worth using this card on Canadian purchases? Is a currency conversion cost charged on each purchase (cad to usd) since it’s an American card? It still sounds great but perhaps only optimized when used on US purchases.

There is no forex fee on this card, so it is definitely viable for use in Canada. As Quentin elaborated on in the article, Capital One points are great, and a 2% earn across the board is as competitive as it gets for non-category spending.

Hi FF team,

Is it true that with this card, for the Priority Pass lounges, you can bring unlimited number of guests traveling with you each time (no limit of 2 guests)?? That sounds surreal.

Hi Backe,

You can add up to four authorized users on the Capital One Venture X Rewards card. Each authorized user gains access to unlimited lounge access for Priority Pass, Plaza Premium, and Capital One Lounges. Refer to the specific lounge you are looking to access in regards to how many guests you can bring/how to access that lounge.

Thanks for your response Josh. The chart just says “Complimentary Guest Access*” with no mention of how many so I just wanted to see if anyone knew what the * meant.

Got it – you can read more details on the Capital One site here. It is the cardholder + 2 guests for both the personal and business version of the Venture X Rewards card.

Each Venture X cardholder can create a Priority Pass account and take 2 guests with them for each visit (you have unlimited visits).

You can also add four authorized users to the account, each of whom can create a Priority Pass account and take two guests with them for each visit (they also have unlimited visits).

So, assuming you and your authorized users travel together, the five of you can take 10 guests.

A refreshing read; thank you for compiling.

I have had this card since 2022 and couldn’t be happier.

I have yet to use the transfer of points to travel partners, but the list is impressive, and I plan to do so soon. The travel portal is great for booking flights and hotels at competitive rates.

I’d like to add that Venture X covers Nexus fees every five years, but you need to call customer service and request the credit manually since it is a $50 fee (vs. the standard $100 for TSA Pre and Global Entry), which the bank may automatically recognize.

I’m assuming the earning rate is 2 points per $1 USD. So as a Canadian using this card as an everyday catchall in Canada, the earning rate would be about 2 points for every $1.36 CAD or 1.47 points per $1 CAD, depending on the exchange rate. While still a decent return (plus all other perks), but when comparing against other Canadian credit cards wouldn’t points/$CAD be more fair?

Hi Al.

That comparison breaks down when you consider that US points tend to be worth more than Canadian points. A good example: you could make the same statement about US Membership Rewards. However US MR have higher redemption value and transfer value than CA MR. So whether you earn 1.47 US MR or earn 2 CA MR for the same spend in Canadian dollars, its the same value because the 1.47 US MR is worth roughly 2 CA MR.

To actually do a fare comparison you’d have to standardize not only the currency but also the points redemption value in that same currency.