There’s a new kid on the block! The Cathay World Elite® Mastercard® powered by Neo Financial takes over the previous Cathay Pacific Asia Miles credit card issued by RBC. It’s not every day that a brand new credit card hits the Canadian market, but is it the right card for you?

Cathay Pacific holds a special place in my heart. Being the de facto flag carrier of Hong Kong, it is the preferred airline of my parents when they visit their hometown! My first flight ever was a Cathay Pacific flight to Hong Kong when I was 2 years old!

Let’s take a look at the new Cathay World Elite® Mastercard® powered by Neo to see if it is worth adding to your wallet.

Overview

Welcome Bonus

The Neo Cathay World Elite® Mastercard® offers a tiered welcome bonus of up to 60,000 Asia Miles for new customers. The bonus is structured as:

- Earn 35,000 Asia Miles upon approval

- Earn 25,000 Asia Miles upon spending $5,000 in the first 3 months

Plus: You can earn an additional $100 FlyerFunds Rebate on the Neo Cathay World Elite Mastercard when you apply through Frugal Flyer Rebates!

The Neo Cathay World Elite Mastercard earns an average of 5x Asia Miles on purchases at thousands of Neo partners, 4x Asia Miles on Cathay Pacific flights, and 2x Asia Miles on foreign currency purchases.

Check out our Neo Cathay World Elite Mastercard review for more details.

60,000 Asia Miles

$5,000

$1,060+

$180

Yes

–

Earning Rates

Beyond the welcome bonus, you will be able to earn Cathay Asia Miles through your everyday spending at the following rates:

- Average of 5 Asia Miles per dollar spent with Neo partners.

- 4 Asia Miles per dollar spent on flights booked directly with Cathay Pacific online.

- 2 Asia Miles per dollar spent on purchases made in foreign currencies.

- 1 Asia Mile per dollar spent on all other purchases in Canada.

Of note, while the Cathay World Elite® Mastercard® offers bonus Asia Miles when using it for purchases outside of Canada, it does charge foreign transaction fees meaning that any purchases in international currency will charge an additional 2.5% fee.

This means that this is not the optimal card to use for these purchases, and instead, we would recommend one of the best credit cards in Canada that has no foreign transaction fees.

Neo Partners

This is a collection of over 12,000 stores, restaurants, and services, both in-store and online, that partner with Neo Financial to offer elevated rewards with spending.

While the list of Neo Partners is not published online, I have access to the collection through a Neo credit card that I currently hold. Some of their more notable partners include Mr. Lube, Freshii, PetValu, Aldo, Hudson’s Bay, and Simons.

Annual Fee

The Cathay World Elite® Mastercard® powered by Neo has an annual fee of $180. This is quite a bit more than the typical airline co-branded Mastercard World Elite or Visa Infinite credit card.

For example, the WestJet RBC World Elite Mastercard has an annual fee of $119, while both the CIBC Aeroplan Visa Infinite card and TD Aeroplan Visa Infinite card have an annual fee of $139.

Benefits

Some of the Cathay-specific benefits offered by the Cathay World Elite Mastercard are free to anyone who signs up for the Cathay Asia Miles loyalty program at their entry-level Green tier. Frankly, this is one of the weaker credit cards on the market in terms of benefits.

The card’s landing page and application are very vague in describing the benefits and perks. Let’s go through each of them and see what they provide.

Priority Check-in for Cathay Flights

While this sounds great at first glance, priority check-in simply means that you will be able to check-in online 48 hours in advance of your flight (rather than the standard 24 hours of most airlines). This perk is available to everyone who signs up for the free Green tier of the Cathay Pacific Asia Miles program.

Extra Baggage on Cathay Flights

Again, another perk that seems great at first glance, but this is simply the ability to redeem Asia Miles for extra checked bags on your flight. This is also offered, for free, to Green tier Asia Miles members.

Extra Legroom Seat Redemption for Cathay Flights

You can use Asia Miles to redeem an extra legroom seat on your Cathay Pacific flights. These seats are typically at the beginning of the row in economy (in front of the washrooms) or seats where the seat in front of you has been removed. Again, this is another perk offered to free, Green tier Asia Miles members.

World Elite Mastercard Benefits

As this is a World Elite Mastercard product, there are a number of standard benefits that are included as well.

DragonPass Lounge Program

As a Mastercard World Elite cardholder, you will receive a DragonPass lounge program membership that gives you the ability to visit a collection of lounges. However, the card does not come with any complimentary visits – each visit to the lounge will cost you $32 USD.

If you are interested in lounge access, consider one of the best credit cards for airport lounge access instead.

Mastercard Airport Security Fast Track

For a fee, you have the ability to purchase fast-track security with this card. However, there are currently no Canadian airports that offer this service.

Mastercard Airport Transfer

For a fee, you have the ability to hire a transfer from the airport to your vehicle. Frankly, I wouldn’t consider this a perk since we would have to pay to utilize this service.

Insurance Coverage

The Cathay World Elite® Mastercard® includes a few types of insurance coverages:

- Auto Rental Collision/Loss

- Car Rental Accidental Death & Dismemberment

- Car Rental Personal Effects

- Delayed and Lost Baggage

- Out of Province/Country Emergency Medical

- Flight Delay

- Hotel and Motel Burglary

- Purchase Security and Extended Warranty

These are underwritten by Chubb Insurance Companies of Canada. For more details about specific coverage, you can view the insurance certificates.

Redeeming Cathay Asia Miles

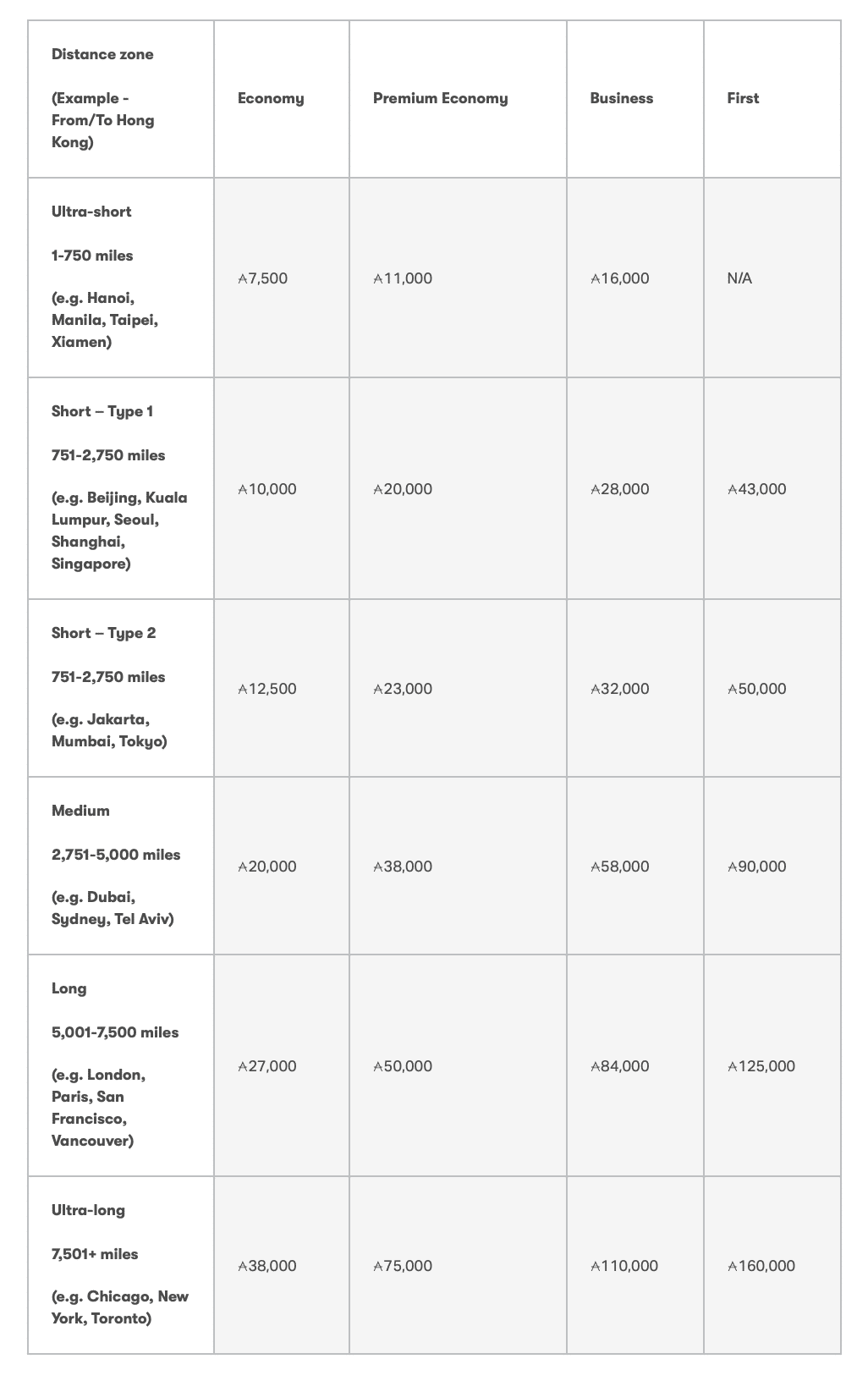

You will be able to redeem Cathay Asia Miles collected from the card for Cathay Pacific flights or their oneworld partners. We value Asia Miles at around 1.5 cents per point. Cathay Pacific is one of the few airlines that still operates and publishes a fixed award chart for Asia Mile redemptions.

There are 4 award charts that are used, depending on how you plan on redeeming your Asia Miles:

- Standard Award Chart is used for flights operated by Cathay Pacific only.

- Partner Award Chart with Oneworld alliance airlines and select other airline partners.

- Oneworld Multi-carrier Award Chart when you book a multi-part journey with Oneworld partner airlines.

- Upgrade Award Chart where you can use Asia Miles to upgrade your flight from economy to premium economy, business, or first class.

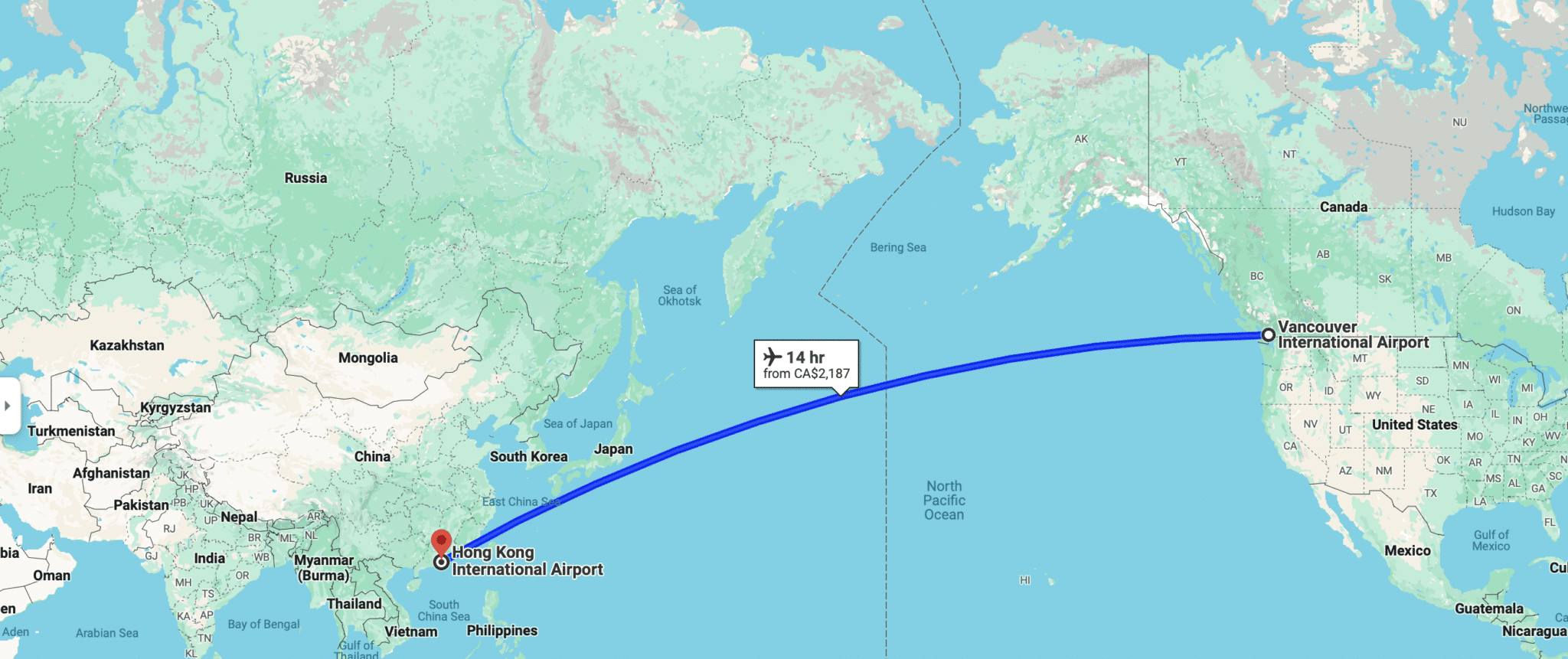

These award charts are all distance-based – the further you fly between your initial location to final destination, the more it will cost. If you’re ever confused, Cathay Pacific offers a flight award redemption calculator. The calculator will search both Cathay Pacific and partner airline flights which is handy!

There are a few sweet spots that we like for Asia Miles that you could use the points earned from the Cathay World Elite® Mastercard® including:

- Vancouver to Hong Kong for 27,000 Asia Miles in economy or 84,000 Asia Miles in business class on Cathay Pacific.

- If you want something more aspirational, you could check out Doha to Hong Kong on Qatar Airways Q-Suites for 63,000 Asia Miles or Qatar Airways First Class for 100,000 Asia Miles.

The Frugal Flyer team has also taken flights on Cathay Pacific First Class and Cathay Pacific Business Class if you want to see what it is like to fly with Cathay.

Comparable Credit Cards

While it is the only co-branded card by Cathay offered in Canada, the Cathay World Elite Mastercard is not the only card that can help you earn Asia Miles.

RBC Avion Visa Infinite Card

The RBC Avion Visa Infinite card was awarded the Best Flexible Points Travel Credit Card in 2024 and is consistently in our wallets. It earns 1.25 Avion points per dollar spent on all travel and a base rate of 1 Avion points per dollar spent on everything else.

The RBC Avion Visa Infinite card earns 1.25 Avion Rewards points on all travel purchases. Avion Rewards points can be redeemed against travel purchases or transferred to popular frequent flyer programs.

In 2025, we awarded this card as the Best Flexible Points Travel Credit Card.

Check out our RBC Avion Visa Infinite card review for more details.

35,000 Avion

$0

$665+

$120

Yes

–

Importantly, the RBC Avion Visa Infinite offers a 1:1 transfer ratio of Avion points to Asia Miles. You may also see transfer bonuses of up to 30% from time to time. Additionally, The card comes with a respectable welcome bonus and strong travel insurance and purchase protections.

American Express Cobalt Card

The American Express Cobalt card was awarded our 2024 Best Credit Card for Grocery Purchases because it offers 5 points per dollar spent on food and drinks, including grocery stores, restaurants, and food delivery services.

The American Express Cobalt card gives cardholders the opportunity to earn 5x Membership Rewards on eligible restaurant, food delivery, and grocery store purchases.

In 2025, we selected this card to receive the award Best Points Credit Card for Grocery Purchases.

Check out our American Express Cobalt card review for more details.

15,000 Membership Rewards

$9,000

$300+

$156

Yes

–

American Express Canada Membership Rewards points transfer at a ratio of 5:4 to Asia Miles. While not as strong as Avion’s 1:1 rate, it will still yield 3.75 Asia Miles per dollar spent on groceries!

American Express US Membership Rewards Cards

If you have ventured into the world of US credit cards, American Express US Membership Rewards points transfer 1:1 to Asia Miles. This makes cards such as the American Express Platinum card (US), American Express Gold card (US), American Express Green card (US), and American Express Blue Business Plus card (US) strong choices for earning Asia Miles.

If you haven’t yet started with US credit cards, check out our guide as to how you can access US credit cards as a Canadian.

Who is the Cathay World Elite® Mastercard® for?

If you’re missing 30,000 Asia Miles for a flight redemption you are looking to book as soon as possible, the Cathay World Elite® Mastercard® can get you there quite quickly.

However, even if you are a Cathay Pacific enthusiast and love flying to Asia, because of the weak benefits, an annual fee that is higher than most competitors, and sub-par earning categories, we think you are better off with one of the comparable cards discussed above.

This card is still extremely new. We’re hopeful that there will be some updates in the future by Cathay and Neo Financial that could make this card a strong player in the market.

Conclusion

It’s not often that we get a brand new credit card in Canada, so it is exciting that the Cathay World Elite® Mastercard® powered by Neo has joined the party! As the only credit card that directly earns Asia Miles, it can be useful to quickly add to our pool of Asia Miles for our next points redemptions. We’re hoping that improvements will come to the card in the near future that will make it a stronger contender in the Canadian travel credit card market.

Quentin Tsang

Latest posts by Quentin Tsang (see all)

- Best Hotel Credit Cards in Canada - Jun 16, 2025

- Review: Cathay World Elite® Mastercard® powered by Neo - Jun 1, 2025

- What Frequent Flyer Programs Allow Members to Combine Miles? - May 12, 2025

- Definitive Guide: Aeroplan Family Sharing - Mar 28, 2025

- Marriott Bonvoy Elite Benefit Guarantees Explained - Mar 7, 2025

Stay away! If you forget your anniversary date, you will have to pay $180 for a second year, and they will refuse to reverse that charge.

This is all truth and real. I just tried to purchase two cx air tickets and got declined coz the amount is too high. So I applied for a CX affiliated-air ticket credit card to buy the CX air tickets and it got declined. The reason provided for the decline x 3 was the amount is too high. For a credit card that charges 180 annual fee, they should expect the person to use their card to make bigger than usual fast food joint purchases or skip the dishes type purchases. This is a mickey mouse company trying to play the big game and is frustrating and disappointing. I will not renew, and in fact I am trying to cancel card with the 180 being returned to me.

Really disappointed with card and will not renew. No problem getting the welcome offer. My experience is not getting purchases at some retailers credited the first purchase bonus points or getting the prurchase credited where you have to make a number of purchases to get a bonus. I’ve had to contact them about five different merchants where the bonus points offers they show on the app never actually get credited to my account. At 180$ a year it’s not worth the hassle and lack of other benefits. Better to just collect Avion points and transfer 1-1

Neo Financial is a scam. I had never applied for a card with them. I had a profile a long time ago but I never applied for anything from them. I applied for a Cathay card. No bonus points. They claimed that because I had a profile with them I was not eligible., It did not matter if I applied for a product as long as I had a profile no points.

I looked around the Asia Miles site and the miles for Vancouver to HKG are ONE WAY and not return. So you need double to redeem for a return trip. Each leg is on the rewards chart separately. You need to login on Asia Miles for this to become obvious.

They seem to be having lots of issues giving the bonus Asia miles upon approval.

Card is NOT available presently for residents of Quebec

Thank you for pointing that out! You are correct! As of today, the card is not available to Quebec residents. Fingers crossed that Neo sorts that out and makes this available to our friends in Quebec!