When I was traveling for my racing career, airport lounges seemed like this faraway land made of pure unobtanium. I still remember the first time I entered a Plaza Premium Lounge and paid my $40 entry fee on a debit card, long before my days of entering the world of miles and points.

Paying for access to lounges can sometimes be worth it, but it can add up if you are a frequent traveler or are flying with family or friends. Needless to say, the savvy Canadian traveler does not need to pay for airport lounge access as it comes as a benefit on many travel-oriented credit cards.

With that in mind, let’s look at the value that an airport lounge can add to your next vacation and the best credit cards with airport lounge access in Canada that Canadians can consider adding to their wallet.

The Value of Airport Lounges

Those travelers who have had the opportunity to experience airport lounges during their travels know that visiting these lounges is a far more desirable option than sitting in the terminal while waiting for your flight.

Airport lounges offer a quieter space where passengers can relax as they sip beverages and enjoy a hot meal, all for no additional cost. Depending on the lounge, showers may be available, which are an absolute treat after 10+ hours on a plane.

It’s important to note that not all airport lounges are created equal. Some offer little more than basic food and drink options, whereas others offer extensive cocktail menus, showers, sleeping rooms, and more. Ultimately, it depends on the individual lounge and brand that the lounge is under, but even the least desirable lounges are still better than waiting in the terminal.

On the whole, if you are spending any time in an airport in the near future, having access to airport lounge programs can improve your experience significantly.

Summary of the Best Credit Cards with Airport Lounge Access in Canada

| Credit Card | ||

|---|---|---|

|

200,000 Membership Rewards Estimated value: $4,000 Ends Aug 18, 2025 |

|

|

180,000 Membership Rewards Estimated value: $3,600 Ends Aug 18, 2025 |

|

|

85,000 Aeroplan Estimated value: $1,785 |

|

|

80,000 Aventura Estimated value: $1,760 |

|

|

60,000 Aventura Estimated value: $1,320 |

|

|

80,000 Scene+ and $200 FlyerFunds Estimated value: $1,000 Ends Oct 31, 2025 |

|

|

80,000 Scene+ and $200 FlyerFunds Estimated value: $1,000 Ends Oct 31, 2025 |

|

|

90,000 BMO Rewards and $125 FlyerFunds Estimated value: $728 Ends Jan 31, 2026 |

|

|

45,000 Scene+ and $100 FlyerFunds Estimated value: $550 Ends Oct 31, 2025 |

|

|

0 À la carte Rewards Estimated value: $0 |

|

Best Credit Cards with Airport Lounge Access

Canadians are lucky to have several cards that offer airport lounge access and, in some cases, unlimited lounge access for the cardholder and their guest(s). The credit cards listed below range from having reasonable annual fees to high premium annual fees, making it possible for every Canadian to find a card that works for them.

Let’s take a look at some of the best credit cards that include airport lounge access as a benefit.

American Express Platinum & Business Platinum Cards

If you travel frequently and are interested in always having access to an airport lounge no matter where you go, the best credit cards to add to your wallet are either the American Express Platinum card or the American Express Business Platinum card.

The American Express Business Platinum card is a premium card that offers benefits including a $200 travel credit, airport lounge access, a $100 NEXUS membership credit, and more.

Check out our American Express Business Platinum card review for more details.

200,000 Membership Rewards

$90,000

$4,000+

$799.00

Yes

Aug 18, 2025

The American Express Platinum series of cards grants extensive airport lounge access and thus, are a great option if you are looking for one card to hold for all your lounge access needs. These cards offer unlimited access to airport lounges, and as a result, either of these is a very valuable credit card to have in your wallet.

Not only can you access the coveted American Express Centurion lounges, but you also have access to the American Express Global Lounge Collection which offers access to over 1,200 lounges in over 130 countries.

Most lounges allow the cardholder plus one guest to enter. However, it’s advised to always check entry requirements before promising a free glass of bubbly to your travel companion. You can check all of the entry information at this link.

The Plaza Premium Lounges are the most useful partner in this program for domestic Canadian travelers. This franchise has locations in Vancouver, Edmonton, Winnipeg, and Toronto, they also operate the Air France Lounge in Montreal.

For Canadians that frequent south of the border, flying Delta is incentivized by offering access to their Sky Clubs no matter what type of ticket you purchase. However, if you’re at an airport with a Centurion lounge, such as the Denver Centurion Lounge or Las Vegas Centurion Lounge, those will generally be much nicer and should often be your lounge of choice.

Finally, both of these cards offer complimentary Priority Pass membership. Priority Pass Membership grants access to priority pass lounges, often for both the primary cardholder and a guest. Cardholders can enroll in this benefit by using Amex live chat or calling in and can refer to the Priority Pass website to determine what lounges they are eligible to visit in addition to entry requirements.

Scotiabank Passport Visa Infinite Card

The Scotiabank Passport Visa Infinite card easily takes the cake for the best and most accessible credit card with free airport lounge access, as it offers a superior total of six airport lounge passes.

The Scotiabank Passport Visa Infinite card offers benefits such as no foreign transaction fees and six annual complimentary airport lounge access passes.

Check out our Scotiabank Passport Visa Infinite card review for more details.

45,000 Scene+

$40,000

$550+

$150.00

No

Oct 31, 2025

If you’re interested in miles and points but don’t want to cannonball into the deep end, this card will give you a glimpse of a better travel experience with a minor commitment.

Not to mention, this card has a welcome bonus of 45,000 Scene+ points. Scene+ points are super easy to redeem towards any travel purchase of your choice at a rate of 1 cent per point, so this is a loyalty program that is definitely worth participating in.

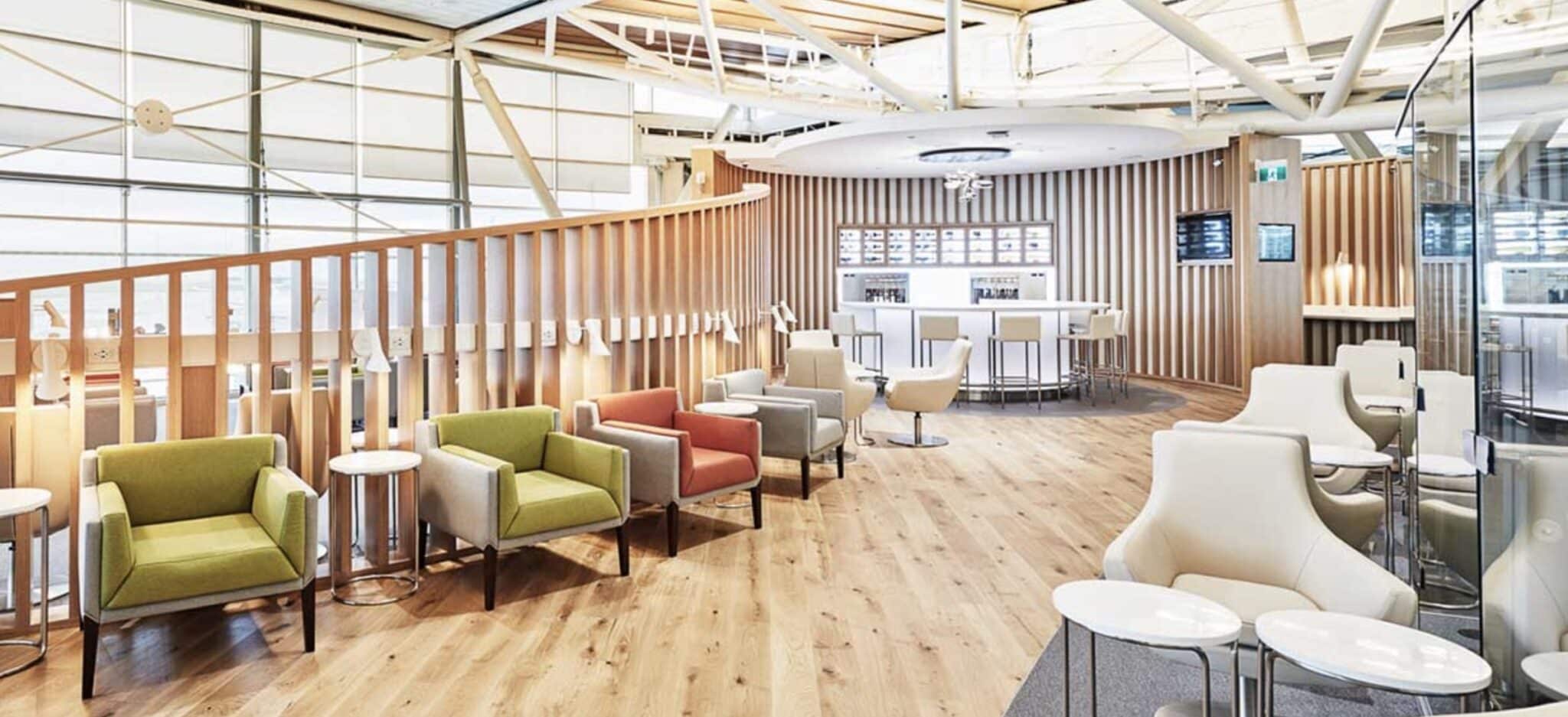

Premium Aeroplan Cards

There are a few premium Aeroplan credit cards in Canada that come with unlimited access to North American Maple Leaf Lounges when flying with Air Canada, which is why they’re a favorite amongst points and miles enthusiasts. Most notable are the TD Aeroplan Visa Infinite Privilege card, the CIBC Aeroplan Visa Infinite Privilege card, and the American Express Aeroplan Reserve card.

The TD® Aeroplan® Visa* Infinite Privilege* Card offers a variety of Air Canada benefits including priority boarding, free checked baggage, and Maple Leaf lounge access.

Check out our TD® Aeroplan® Visa* Infinite Privilege* Card review for more details.

85,000 Aeroplan

$24,000

$1,785+

$599.00

Yes

–

It’s important to note that these are premium credit cards and, as a result, command some of the highest annual fees in Canada. But they also come with some other benefits, including free checked baggage on Air Canada flights, priority check-in and boarding, and a hefty bonus of Aeroplan points upon sign-up.

Maple Leaf Lounges are on a significant upswing after being somewhat disappointing during the pandemic. With new food and drink options and showers returning to service, I have been pleasantly surprised by my recent experiences.

For a more in-depth look at Maple Leaf Lounge access, check out our guide to Air Canada Maple Leaf Lounges.

Scotiabank Platinum American Express Card

The Scotiabank Platinum American Express card offers 10 complimentary airport lounge passes annually that can be used at Priority Pass airport lounges and Plaza Premium airport lounges.

The Scotiabank Platinum American Express card offers benefits such as no foreign transaction fees and ten annual airport lounge access passes.

Check out our Scotiabank Platinum American Express card review for more details.

80,000 Scene+

$10,000

$1,000+

$399.00

No

Oct 31, 2025

The Scotiabank Platinum American Express card also has no foreign transaction fees plus a welcome bonus of 80,000 Scene+ Rewards points which can absolutely make it worth adding this premium credit card to your wallet.

Scotiabank Passport Visa Infinite Privilege Card

The Scotiabank Passport Visa Infinite Privilege card is another premium card on this list that comes with ten annual airport lounge passes.

The Scotiabank Passport Visa Infinite Privilege card offers benefits such as a $250 travel credit for Scene+ Travel, no foreign transaction fees, and ten annual airport lounge passes.

Check out our Scotiabank Passport Visa Infinite Privilege card review for more details.

80,000 Scene+

$20,000

$1,000+

$599.00

No

Oct 31, 2025

The ten airport lounge passes are issued via the Visa Airport Companion program, meaning they can be used at over 1,300 lounges worldwide that are part of the DragonPass Lounge Network. The Scotiabank Passport Visa Infinite Privilege card also comes with a $250 travel credit per membership year and charges no foreign transaction fees, a major benefit for travelers.

CIBC Aventura Visa Cards

Two of the more accessible credit cards with airport lounge access are the CIBC Aventura Gold Visa card and the CIBC Aventura Visa Infinite card, thanks to their reasonable annual fees.

The CIBC Aventura Visa Infinite card offers benefits that include a $100 NEXUS statement credit and four annual airport lounge passes.

Check out our CIBC Aventura Visa Infinite card review for more details.

60,000 Aventura

$5,000

$1,320+

$139.00 (FYF)

Yes

–

Individuals who hold either the CIBC Aventura Visa Infinite or Gold card will receive four annual complimentary lounge visits, which makes these cards great for a traveler who takes one or two trips per year and wants to access airport lounges without paying a high annual fee. These lounge passes are issued via the Visa Airport Companion Program and are good at more than 1,300 airport lounges worldwide.

On the other hand, the more premium CIBC Aventura Visa Infinite Privilege card also provides six complimentary lounge visits but at a much higher annual fee than its counterparts. It does come with some additional benefits including an annual $200 travel credit that can be worth adding it to your wallet.

The CIBC Aventura Visa Infinite Privilege card offers benefits that include an annual $200 travel credit, two $100 NEXUS credit rebates, and six airport lounge passes.

80,000 Aventura

$25,000

$1,760+

$499.00

Yes

–

If you do find yourself interested in a CIBC Aventura credit card, all three of these cards often have strong welcome bonuses and CIBC Aventura points are easy to redeem.

The CIBC Aventura credit cards provide passes for lounges within the DragonPass lounge program, which has a decent footprint in Canada as they partner with Plaza Premium lounges and a few airline lounges, such as the SkyTeam Lounge in YVR. If you are flying out of Edmonton, the Plaza Premium Lounge at Edmonton International Airport is actually a solid offering as well.

If you have one of these cards, check out our Definitive Guide to DragonPass lounge access so your next trip can start more comfortably.

National Bank World Elite Mastercard

The National Bank World Elite Mastercard offers unlimited access to only one airport lounge in Canada, but it is an all-around great card with phenomenal insurance coverage, even on award flights.

The National Bank World Elite Mastercard offers benefits that include an annual $150 travel credit and access to the National Bank VIP airport lounge in the Montreal Airport International terminal.

Check out our National Bank World Elite Mastercard review for more details.

0 À la carte Rewards

$0

$0+

$150.00

Yes

–

The card is generally considered a long-term keeper as it is one of the best credit cards for travel insurance on award flight bookings. If you charge the taxes and fees of your points ticket to this card, its comprehensive travel insurance will cover you, which is rare to find in Canada.

The lounge access for this card is niche, as it only allows access to the National Bank lounge in the international terminal of the Montreal-Trudeau Airport (YUL). Access is granted for the cardholder, one guest, and two children under the age of 12.

With that being said, the card has an easy-to-use $150 annual travel credit and a $150 annual fee. Holding this card year after year means free lounge visits and access to excellent travel insurance coverage, which is quite valuable.

If Montreal is your home airport or you find yourself traveling internationally from there often, this card may be worth picking up so you can indulge in the complimentary lounge access whenever you are departing internationally.

BMO Ascend World Elite Mastercard

Another dark horse on this list is the flagship BMO Ascend World Elite Mastercard, which comes with 4 complimentary DragonPass Lounge visits included in the annual fee.

The BMO Ascend World Elite Mastercard earns 5x BMO Rewards on travel purchases and offers four airport lounge passes annually.

90,000 BMO Rewards

$34,500

$728+

$150.00 (FYF)

Yes

Jan 31, 2026

While the BMO Rewards program has its flaws, being a fixed value currency at 0.67 cents per point, this is the Mastercard with the best lounge access in Canada.

Like the National Bank World Elite Mastercard, the BMO Ascend World Elite Mastercard also has some of the best travel insurance on the market. If you’re looking for a good and simple credit card solution that offers complimentary airport lounge access and earns rewards on purchases at Costco, this card may appeal to you!

Is Holding a Credit Card with Airport Lounge Access Worth It?

If you ask any member of the Frugal Flyer team, complimentary airport lounge access is a benefit that they all value greatly. Since it is a benefit offered on so many Canadian credit cards, accessing airport lounges for free is absolutely obtainable even for the less frequent traveler.

When it comes to airport lounges, at a minimum, you can expect hot food and a selection of alcoholic and non-alcoholic beverages, all for no cost. Certain lounges even have bartenders and special craft cocktail menus, making visiting an airport lounge an elevated experience. From time to time there may be an additional charge for premium alcoholic selections, but there is always a free option of beer, wine, and well spirits.

If you compare what you can receive for free to having a hot meal and a pint of beer in a terminal restaurant, it can save upwards of $30 per person, per visit! Lounges will also have fast and reliable WiFi available. If the airport you’re flying out of doesn’t have a free WiFi program, this can be a lifesaver.

We covered everything you need to know about airport lounges’ value and how you can access them in Episode 9 of Miles Ahead: How to Lounge in Airport Luxury. Give it a listen if you want to learn more about the Frugal Flyer team’s tips and tricks about getting into airport lounges for free.

Conclusion

Airport lounges are a nice escape from the hustle and bustle of an airport terminal. While there are options to pay for entry, we would like to use our dollars for more trips in the future. And besides, who doesn’t love more free stuff?! We highly recommend that all travelers hold at least one credit card that provides airport lounge access as an easy way to improve their travel experience.

There is a wide variety of credit card options for Canadians who are interested in this benefit, and as a result, everyone should be able to find a credit card that offers lounge access at a price that is right for them. When considering your next credit card, always check in advance if complimentary airport lounge access is included as part of the benefits!

Daniel Burkett

Latest posts by Daniel Burkett (see all)

- Which Canadian Airline is Best? Ranked by a Frequent Flyer - Jul 7, 2025

- Review: Orlando World Center Marriott - Jul 2, 2025

- The Tech You Need for Travel Days - May 26, 2025

- Review: Los Angeles Airport Marriott - May 21, 2025

- How to Avoid Fees When Converting CAD to USD - May 19, 2025

For a family of four 2 adults and 2 kids making three travel per year

will it make sense to have the platinum + the additional platinum ?

You could also consider adding an authorized user to the card to gain additional access.