Bank accounts are an essential component of personal finance for Canadians. Most Canadians are fiercely loyal to the bank that they use. However, the best chequing and saving accounts available to Canadians are spread across different financial institutions. Therefore, understanding the available options will significantly benefit your personal financial situation.

Similar to credit cards, it’s worth considering if your bank account is meeting your needs or if any better options exist. You may be interested in diversifying account types and want to add a high interest savings account into the mix. Either way, there is likely to be a new account out there that will better fit your needs.

Let’s take a look at the best bank accounts in Canada for July 2025.

Best Chequing Accounts in Canada for July 2025

When it comes to the best chequing accounts in Canada, there are several excellent options available including traditional brick-and-mortar banks or digital-focused banks. While there are many similarities between banking products, there are a few best accounts that stand out in certain categories.

Best Chequing Accounts with Welcome Bonuses

The BMO Performance Chequing account offers a welcome bonus of up to $750 which can be earned after completing several requirements in a set period of time.

The BMO Performance Chequing account has a monthly fee of $17.95 which can easily be waived by holding a minimum balance of $4,000 at all times.

The BMO Performance Chequing account offers unlimited debit and Interac e-Transfer transactions. Account holders are entitled to one free monthly ATM withdrawal in Canada and a $40 BMO credit card annual fee rebate.

Up to $750 welcome bonus + $50 FlyerFunds on approval

Chequing

Monthly fee waived with a minimum daily closing balance of $4,000 $17.95

The Scotiabank Preferred Package account offers a welcome bonus of up to $700 which can be earned after completing several requirements in a set period of time.

The Scotiabank Preferred Package account has a monthly fee of $16.95 which can easily be waived by holding a minimum balance of $4,000 at all times.

The Scotiabank Preferred Package account offers unlimited debit and Interac e-Transfer transactions. Account holders are entitled to one free monthly ATM withdrawal in Canada and a full annual fee rebate on eligible Scotiabank credit cards (up to $150).

Up to $700 welcome bonus + $75 FlyerFunds on approval

Chequing

Monthly fee waived with a minimum daily closing balance of $4,000 $16.95

The RBC Signature No Limit Banking account offers a welcome bonus of $549 which can be earned after completing several requirements in a set period of time.

The RBC Signature No Limit Banking account has a monthly fee of $16.95, which cannot be waived by holding a minimum balance in the chequing account. At most, the monthly fee can be reduced to $5.00 with RBC’s Value Program Rebate.

The RBC Signature No Limit banking account offers unlimited debit and Interac e-Transfer transactions, plus a $48 annual fee rebate on an eligible RBC credit card.

Up to $549 welcome bonus

Chequing

$16.95

Click here to see all chequing accounts that have welcome bonuses.

Best Premium Chequing Accounts

The BMO Premium Chequing account offers unlimited transactions, free ATM withdrawals worldwide, an annual fee rebate on an eligible BMO credit card, and a discount on a safety deposit box.

The BMO Premium Chequing account has a monthly fee of $30.95 which can easily be waived by holding a minimum balance of $6,000 at all times.

The BMO Premium Chequing account offers unlimited debit, Interac e-Transfer, and worldwide ATM withdrawal transactions. Account holders are entitled to a $150 annual fee rebate on a BMO credit card, a safety deposit box discount, and more.

Up to $750 welcome bonus + $50 FlyerFunds on approval

Chequing

Monthly fee waived with a minimum daily closing balance of $6,000 $30.95

The Scotiabank Ultimate Package account offers unlimited transactions, free ATM withdrawals worldwide, an annual fee rebate on an eligible Scotiabank credit card, and a complimentary small safety deposit box.

The Scotiabank Ultimate Package account has a monthly fee of $30.95 which can easily be waived by holding a minimum balance of $6,000 at all times.

The Scotiabank Ultimate Package account offers unlimited debit and Interac e-Transfer transactions. Account holders are entitled to a $150 Scotiabank credit card annual fee rebate, free safety deposit box, no-fee global money transfers, and more.

Up to $700 welcome bonus + $100 FlyerFunds on approval

Chequing

Monthly fee waived with a minimum daily closing balance of $6,000 $30.95

The TD All-Inclusive Banking account offers unlimited transactions, an annual fee rebate on an eligible TD credit card, plus a complimentary small safety deposit box, certified cheques, money orders, and personalized cheques.

The TD All-Inclusive Banking account has a monthly fee of $29.95 which can easily be waived by holding a minimum balance of $5,000 at all times.

The TD All-Inclusive Banking account offers unlimited debit and Interac e-Transfer transactions. Account holders are entitled to receive a full annual fee rebate on an eligible TD Canada Trust credit card (up to $139), in addition to a free small safety deposit box and more.

Up to $450 welcome bonus

Chequing

Monthly fee waived with a minimum daily closing balance of $5,000 $29.95

Best Chequing Accounts with No Monthly Fees

The Simplii No Fee Chequing Account offers unlimited transactions and free withdrawals at CIBC ATMs across Canada, all with no fees!

If you want a more in-depth look at the value this account can add and are interested in moving towards a more digital-focused banking experience, read our article on why the Simplii Financial No Fee Chequing account is the best no-fee bank account in Canada.

The Simplii No Fee Chequing account offers unlimited debit transactions, Interac e-Transfer transactions, and withdrawals at CIBC ATMs.

Check out our Simplii No Fee Chequing Account review for more details.

Up to $300 welcome bonus + $60 FlyerFunds on approval

Chequing

$0.00

The Innovation Federal Credit Union No-Fee Chequing account offers unlimited transactions and free ATM usage at over 4,800 ding free® ATM locations in Canada. While there are no monthly fees, it may cost $5 to join the credit union, which is refunded upon leaving the credit union.

The includes unlimited transactions and free ATM access across Canada.

Earn $45 FlyerFunds on approval

Chequing

$0.00

The Tangerine No-Fee Daily Chequing Account offers unlimited transactions and free ATM withdrawals at Scotiabank and Tangerine ATMs in Canada. New account holders will also receive 50 cheques via mail for free.

The Tangerine No-Fee Daily Chequing account includes unlimited debit and Interac e-Transfer transactions with no monthly fees.

Up to $500 welcome bonus + $70 FlyerFunds on approval

Chequing

$0.00

Click here to see all chequing accounts that have no monthly fees.

Best Chequing Accounts That Reduce Credit Card Annual Fees

If you are looking for an efficient pairing of a bank account and a credit card, there are several bank accounts that offer an annual fee rebate on eligible credit cards.

The Scotiabank Preferred Package account offers a credit card annual fee rebate of up to $150 on an eligible Scotiabank credit card. The Scotiabank Ultimate Package account also offers this annual fee rebate but has a much higher monthly fee and balance requirement to waive the account fee.

This annual fee rebate will occur on the first eligible card that is opened after the bank account is opened and will be received a maximum of once per year even if the account holder opens multiple eligible Scotiabank credit cards.

The best Scotiabank credit cards that are eligible for this annual fee rebate are the Scotiabank Gold American Express card, the Scotiabank Passport Visa Infinite card, and the Scotiabank Momentum Visa Infinite card.

The Scotiabank Preferred Package account offers unlimited debit and Interac e-Transfer transactions. Account holders are entitled to one free monthly ATM withdrawal in Canada and a full annual fee rebate on eligible Scotiabank credit cards (up to $150).

Up to $700 welcome bonus + $75 FlyerFunds on approval

Chequing

Monthly fee waived with a minimum daily closing balance of $4,000 $16.95

The RBC VIP Banking account offers up to a $120 annual fee rebate each calendar year on an eligible RBC personal credit card. The lower-tier RBC Signature No Limit Banking account also offers an annual fee discount, however it is only up to $48.

The best RBC credit cards that are eligible for this annual fee rebate are the RBC Avion Visa Infinite card, the WestJet RBC World Elite Mastercard, and the RBC British Airways Visa Infinite card.

The RBC VIP Banking account offers unlimited debit, Interac e-Transfer, and worldwide ATM withdrawal transactions. Account holders are entitled to a $120 annual fee rebate on an eligible RBC credit card, a safety deposit box discount, and more.

Up to $549 welcome bonus

Chequing

$30.00

The TD Unlimited Chequing account offers a one-time credit card annual fee rebate of up to $139 on an eligible credit card. The TD All-Inclusive Banking account also offers this annual fee rebate but has a much higher monthly fee and balance requirement to waive the account fee.

This annual fee rebate can only be received once even if the account holder has multiple eligible TD credit cards. The rebate will be applied to the credit card with the highest annual fee and may take up to 2 monthly statements from when the annual fee was charged to be applied.

The best TD credit cards that are eligible for this annual fee rebate are the TD Aeroplan Visa Infinite card, the TD First Class Travel Visa Infinite card, and the TD Cash Back Visa Infinite card.

The TD Unlimited Chequing account offers unlimited debit and Interac e-Transfer transactions. Account holders are entitled to receive a full annual fee rebate on an eligible TD Canada Trust credit card (up to $139).

Up to $450 welcome bonus

Chequing

Monthly fee waived with a minimum daily closing balance of $4,000 $16.95

If you are interested in learning more, check out our article on the best bank accounts that reduce credit card annual fees.

Best Chequing Accounts for Students

The BMO Student Performance Chequing account offers all of the same benefits as the normal BMO Performance Chequing account, except that students at a full-time university, college, or registered private vocational school will receive the account with no monthly fees or minimum balance requirements.

The BMO Student Performance Chequing account offers unlimited debit and Interac e-Transfer transactions. Account holders are entitled to one free monthly ATM withdrawal in Canada and a $40 BMO credit card annual fee rebate.

Up to $125 welcome bonus

Chequing

$0.00

The Scotiabank Preferred Package for Students and Youth offers unlimited transactions with no monthly fees for students who can provide proof of enrollment. Account holders will also earn Scene+ points on all debit purchases.

The Scotiabank Preferred Package for Students and Youth offers unlimited debit and Interac e-Transfer transactions with no monthly fees for full-time students.

Up to $125 welcome bonus + $60 FlyerFunds on approval

Chequing

$0.00

The RBC Advantage Banking account for students offers unlimited transactions and no ATM fees in Canada for full-time students who provide proof of enrollment. Account holders can earn RBC Avion Rewards on all purchases by enrolling in the RBC Value Program.

The RBC Advantage Banking account for students is a premier student bank account that gives you more perks for less, with no monthly fee for full-time students, no minimum balance, and free Interac e-Transfer transactions.

Up to $100 welcome bonus

Chequing

$0.00

Click here to see all chequing accounts that are made for students.

Best Savings Accounts in Canada for July 2025

If you want to put your money to work and start earning interest, there are a few high interest savings accounts in Canada that are worth opening. Many of the below accounts offer stellar promotional interest rates and consistent regular interest rates, creating great utility within your personal finance portfolio.

Best Savings Accounts with High Promotional Interest Rates

The Simplii High Interest Savings account offers the best promotional interest rate of 4.25%. Past the promotional interest rate period, Simplii High Interest Savings account holders will receive interest according to a tiered system, based on the total dollar amount in the account.

The Simplii High Interest Savings account offers a varying interest rate depending on the total account balance and a promotional interest rate of 4.25%.

Earn 4.25% interest for 4 months + $40 FlyerFunds on approval

Savings

$0.00

The Scotiabank MomentumPlus Savings account is another great option as it offers a promotional interest rate of up to 5.00%. Past the promotional interest rate period, Scotiabank MomentumPlus Savings account holders will receive a standard interest rate of 0.55%.

The Scotiabank MomentumPlus Savings account offers a regular interest rate of 0.55% and a promotional interest rate of up to 5.00%.

Earn up to 5.00%* for the first 3 months + $50 FlyerFunds on approval

Savings

$0.00

The Tangerine Savings account offers a promotional interest rate of up to 4.50%. Once the promotional interest rate period has ended, Tangerine Savings account holders will receive a standard interest rate of 0.30%.

The Tangerine Savings account offers a regular interest rate of 0.30% and a promotional interest rate of 4.50%.

Earn 4.50% Savings rate for 5 months + $70 FlyerFunds on approval

Savings

$0.00

If you are interested in learning more, check out our article on the best high interest savings accounts for Canadians.

Best Savings Accounts with High Regular Interest Rates

If you don’t want to always move funds between high interest savings accounts that offer promotional rates, there is nothing wrong with settling on one savings account with high regular interest rates as there are a few accounts that fit the bill.

The Neo Cash Account offers the highest standard interest rate of 2.50%.

The Neo Cash account offers a regular interest rate of 2.50% and unlimited transactions.

Earn $10 FlyerFunds on approval

Savings

$0.00

The EQ Bank Notice Savings account offers varying interest rates based on the withdrawal request period that is set by the account holder. A 10 day withdrawal request period earns 2.85% and a 30 day withdrawal request period earns 3.00%.

The EQ Bank Notice Savings Account earns interest based on the withdrawal request period selected by the account holder. A 10 day withdrawal request period earns 2.85% and a 30 day withdrawal request period earns 3.00%.

Get 3.00% with 30 Day Notice

Savings

$0.00

The Wealthsimple Cash Account offers a standard interest rate of 1.75% on all deposits. Premium clients, who have at least $100,000 in Wealthsimple will receive 2.25% interest, and Generation clients, who have at least $500,000 in Wealthsimple will receive 2.75% interest.

The Wealthsimple Cash account offers a regular interest rate of 1.75% on all deposits.

Savings

$0.00

Click here to see our list of all savings accounts available for Canadians.

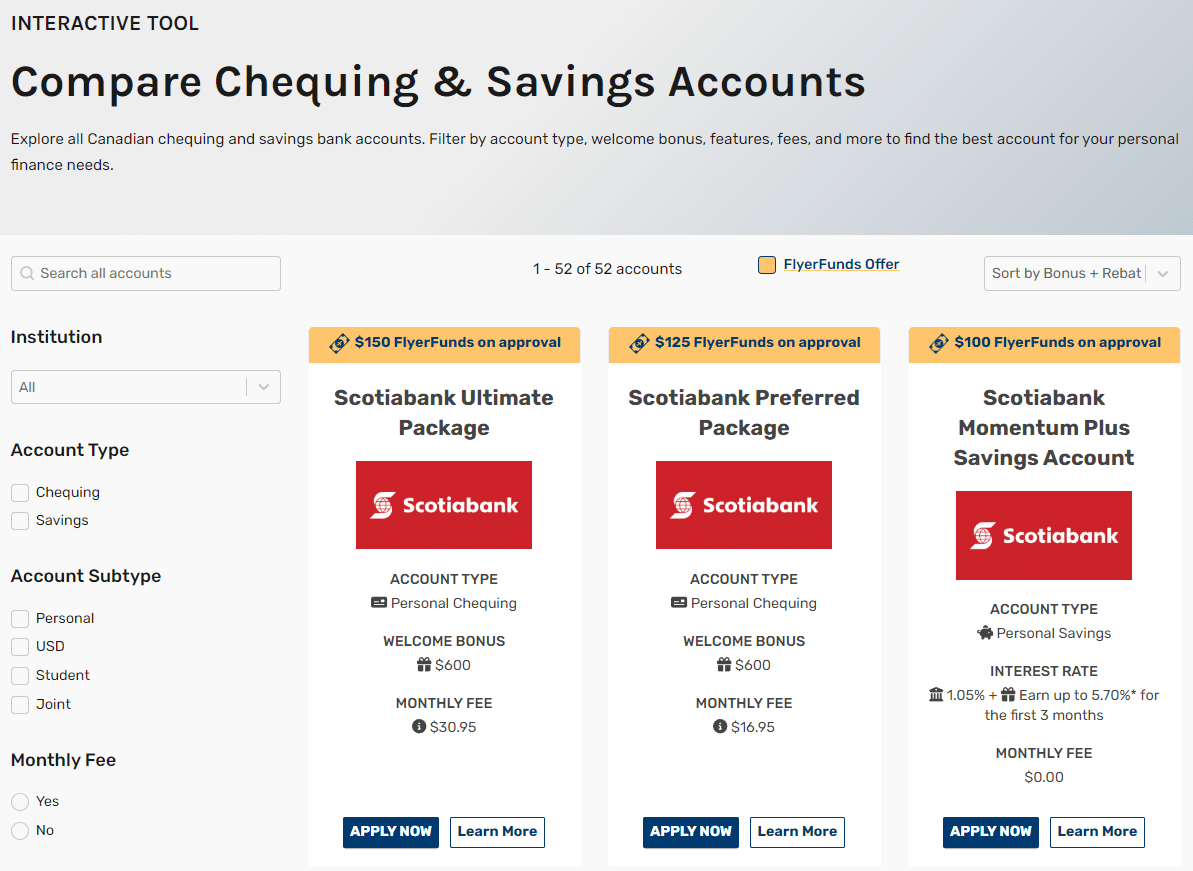

Frugal Flyer’s Bank Account Browser Tool: Find Your Best Bank Account

If you are still unsure as to what is the best chequing account or savings account for your personal needs, take some time to play around with Frugal Flyer’s best bank account comparison tool which contains over 50 of the best banking products available for Canadians.

Readers can filter to find the best bank account to open based on a variety of criteria, including welcome bonus, monthly fee, account type, promotional interest rates, and more.

Conclusion

Choosing the right bank account can be the cornerstone of a good personal finance setup, as bank accounts are the most frequently used financial product by Canadians.

Whether you are interested in opening a new chequing account to save money and to access more benefits, or you are interested in leveraging a high interest savings account to generate wealth, any of the best bank accounts on this list would be worth looking into.

Josh Bandura

Latest posts by Josh Bandura (see all)

- Which Aeroplan Points + Cash Redemption Option is Best? - Jul 11, 2025

- Earn Cash Back Rebates on Tangerine Bank Accounts - Jul 8, 2025

- New BMO Credit Card Offers (July 2025) - Jul 5, 2025

- New Scotiabank Credit Card Offers (July 2025) - Jul 2, 2025

- Best Credit Cards in Canada (July 2025) - Jul 1, 2025