The best credit cards, similar to many other aspects of personal finance, can be highly subjective to each individual. All Canadians have different needs when it comes to credit card products, and different desires in what their credit cards offer.

That being said, we are lucky to have access to some excellent credit cards in Canada, and some that we would consider universally good, whether they can be classified in this category as a result of a strong welcome bonus or the benefits that they offer cardholders. The cards we have listed in this article are ones we would recommend to all of our readers, as they stand far above many of their competitors.

Let’s take a look at the best credit cards in Canada for July 2025.

Best Credit Cards in Canada by Financial Institution for July 2025

When it comes to the best credit cards in Canada, six main financial institutions offer the majority of available credit cards: American Express, Bank of Montreal, CIBC, Royal Bank of Canada, Scotiabank, and TD.

Best American Express Credit Cards

American Express credit cards have no income requirements and many of them allow cardholders to earn valuable American Express Membership Rewards points which can be transferred to several frequent flyer and hotel loyalty programs.

Frugal Flyer’s favorite American Express credit card is the American Express Cobalt card as it earns 5x Membership Rewards points on all food and drink purchases, including restaurant and grocery store purchases.

The American Express Cobalt card gives cardholders the opportunity to earn 5x Membership Rewards on eligible restaurant, food delivery, and grocery store purchases.

Check out our American Express Cobalt card review for more details.

15,000 Membership Rewards

$9,000

$300+

$155.88

Yes

–

Below are the top five American Express credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

200,000 Membership Rewards Estimated value: $4,000 Ends Aug 18, 2025 |

|

|

180,000 Membership Rewards Estimated value: $3,600 Ends Aug 18, 2025 |

|

|

140,000 Aeroplan Estimated value: $2,940 Ends Aug 18, 2025 |

|

|

130,000 Aeroplan Estimated value: $2,730 Ends Aug 18, 2025 |

|

|

110,000 Membership Rewards Estimated value: $2,200 Ends Aug 18, 2025 |

|

Click here to see all American Express credit cards in our credit card browser.

Best Bank of Montreal (BMO) Credit Cards

BMO credit cards offer cardholders the opportunity to earn their in-house loyalty currency, BMO Rewards, in addition to a few cards that earn VIPorter points or AIR MILES.

Frugal Flyer’s favorite BMO credit card is the BMO VIPorter World Elite Mastercard as it has a welcome bonus of 70,000 VIPorter Points. The card also comes with complimentary Venture Membership status, which includes a free checked bag, free carry-on bag (regardless of fare), free PorterClassic seat selection, priority check-in/security/boarding, and more.

The BMO VIPorter World Elite Mastercard offers benefits including VIPorter Venture membership and the opportunity to earn an annual round-trip companion pass through spending.

70,000 VIPorter Points

$18,000

$1,175+

$199.00 (FYF)

Yes

Jan 31, 2026

Below are the top five BMO credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

8,000 AIR MILES and $75 FlyerFunds Estimated value: $1,275 Ends Jun 12, 2026 |

|

|

7,000 AIR MILES and $125 FlyerFunds Estimated value: $1,175 Ends Aug 31, 2025 |

|

|

70,000 VIPorter Points and $125 FlyerFunds Estimated value: $1,175 Ends Jan 31, 2026 |

|

|

120,000 BMO Rewards and $100 FlyerFunds Estimated value: $904 Ends Jan 31, 2026 |

|

|

100,000 BMO Rewards and $75 FlyerFunds Estimated value: $745 Ends Dec 13, 2025 |

|

Click here to see all BMO credit cards in our credit card browser or learn how you can earn cash back rebates on BMO credit cards.

Best CIBC Credit Cards

CIBC credit cards earn a few different miles and points currencies, including CIBC Aventura points and Air Canada Aeroplan points.

Frugal Flyer’s favorite CIBC credit card is the CIBC Aventura Visa Infinite card as it offers a welcome bonus of 60,000 Aventura points which can be redeemed via the CIBC Shopping with Points feature for travel purchases at a rate of 1 cent per point!

The CIBC Aventura Visa Infinite card offers benefits that include a $100 NEXUS statement credit and four annual airport lounge passes.

Check out our CIBC Aventura Visa Infinite card review for more details.

60,000 Aventura

$5,000

$1,320+

$139.00 (FYF)

Yes

–

Below are the top five CIBC credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

85,000 Aeroplan Estimated value: $1,785 |

|

|

80,000 Aventura Estimated value: $1,760 |

|

|

60,000 Aventura Estimated value: $1,320 |

|

|

60,000 Aventura Estimated value: $1,320 |

|

|

45,000 Aeroplan Estimated value: $945 |

|

Click here to see all CIBC credit cards in our credit card browser.

Best MBNA Credit Cards

Frugal Flyer’s favorite MBNA credit card is the MBNA Rewards World Elite Mastercard as it offers a welcome bonus of 30,000 MBNA Rewards points which can be redeemed towards travel and more.

The MBNA Rewards World Elite Mastercard also earns 5x MBNA Rewards for every dollar spent on restaurant, grocery, digital media, memberships, and household utility purchases (up to $50,000 in annual purchases per category).

The MBNA Rewards World Elite Mastercard earns 5x MBNA Rewards points on restaurant, grocery, digital media, memberships, and household utility purchases.

Check out our MBNA Rewards World Elite Mastercard review for more details.

30,000 MBNA Rewards

$2,000

$425+

$120.00

Yes

–

Below are the top three MBNA credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

30,000 MBNA Rewards and $125 FlyerFunds Estimated value: $425 |

|

|

10,000 MBNA Rewards and $75 FlyerFunds Estimated value: $175 |

|

|

0 None and $75 FlyerFunds Estimated value: $75 |

|

Click here to see all MBNA credit cards in our credit card browser or learn how you can earn cash back rebates on MBNA credit cards.

Best Neo Financial Credit Cards

Frugal Flyer’s favorite Neo Financial credit card is the Neo Cathay World Elite Mastercard as it offers a welcome bonus of 60,000 Asia Miles, which can be redeemed towards flights on Cathay Pacific or any of their partner airlines.

The Neo Cathay World Elite Mastercard earns an average of 5x Asia Miles on purchases at thousands of Neo partners, 4x Asia Miles on Cathay Pacific flights, and 2x Asia Miles on foreign currency purchases.

Check out our Neo Cathay World Elite Mastercard review for more details.

60,000 Asia Miles

$5,000

$960+

$180.00

Yes

–

Below are the top five Neo Financial credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

60,000 Asia Miles Estimated value: $960 |

|

|

0 cash back and $100 FlyerFunds Estimated value: $100 |

|

|

0 cash back and $100 FlyerFunds Estimated value: $100 |

|

|

0 cash back and $60 FlyerFunds Estimated value: $60 |

|

|

25 cash back and $25 FlyerFunds Estimated value: $50 |

|

Click here to see all Neo Financial credit cards in our credit card browser or learn how you can earn cash back rebates on Neo Financial credit cards.

Best Royal Bank of Canada (RBC) Credit Cards

RBC offers some of our favorite travel-focused credit cards in Canada, giving cardholders the opportunity to earn Avion Rewards, WestJet Rewards, British Airways Avios, and Cathay Pacific Asia Miles.

Frugal Flyer’s favorite RBC credit card is the RBC Avion Visa Infinite card as it offers a welcome bonus of 35,000 Avion Rewards points which can be transferred to a few frequent flyer programs, including the valuable British Airways Avios.

The RBC Avion Visa Infinite card earns 1.25 Avion Rewards points on all travel purchases. Avion Rewards points can be redeemed against travel purchases or transferred to popular frequent flyer programs.

Check out our RBC Avion Visa Infinite card review for more details.

35,000 Avion

$0

$665+

$120.00

Yes

–

Below are the top five RBC credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

70,000 Avion Estimated value: $1,330 |

|

|

60,000 Avios Estimated value: $1,020 |

|

|

35,000 Avion Estimated value: $665 |

|

|

35,000 Avion Estimated value: $665 |

|

|

45,000 WestJet points Estimated value: $450 Ends Oct 21, 2025 |

|

Click here to see all RBC credit cards in our credit card browser or learn how you can earn cash back rebates on RBC credit cards.

Best Scotiabank Credit Cards

Scotiabank has some of the most well-rounded and robust travel credit cards in Canada. All of their cards earn Scene+ points which are anchored at 1 cent per point when redeeming towards travel purchases made on the card.

Frugal Flyer’s favorite Scotiabank credit card is the Scotiabank Gold American Express card as it offers a welcome bonus of 50,000 Scene+ points which are one of the most straightforward currencies to redeem towards any travel purchases.

The Scotiabank Gold American Express card earns up to 6x Scene+ points at Empire grocery stores and charges no foreign exchange fees on purchases made in foreign currencies.

Check out our Scotiabank Gold American Express card review for more details.

50,000 Scene+

$7,500

$650+

$120.00 (FYF)

No

Oct 31, 2025

Below are the top five Scotiabank credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

80,000 Scene+ and $200 FlyerFunds Estimated value: $1,000 Ends Oct 31, 2025 |

|

|

80,000 Scene+ and $200 FlyerFunds Estimated value: $1,000 Ends Oct 31, 2025 |

|

|

50,000 Scene+ and $150 FlyerFunds Estimated value: $650 Ends Oct 31, 2025 |

|

|

45,000 Scene+ and $100 FlyerFunds Estimated value: $550 Ends Oct 31, 2025 |

|

|

200 cash back and $100 FlyerFunds Estimated value: $300 Ends Oct 31, 2025 |

|

Click here to see all Scotiabank credit cards in our credit card browser or learn how you can earn cash back rebates on Scotiabank credit cards.

Best Tangerine Credit Cards

If you are interested in strong cash back earning credit cards that have no annual fees, Tangerine’s credit card lineup has a few great options worth considering.

Frugal Flyer’s favorite Tangerine credit card is the Tangerine World Mastercard as it offers a welcome bonus of $100 cash back plus cardholder’s can customize their accelerated cash back earning categories.

The Tangerine World Mastercard offers cardholders the ability to choose up to three accelerated spending categories to increase their cash back earnings.

Check out our Tangerine World Mastercard review for more details.

$100 cash back

$1,000

$225+

$0.00

Yes

Aug 31, 2025

Below are the top two Tangerine credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

100 cash back and $125 FlyerFunds Estimated value: $225 Ends Aug 31, 2025 |

|

|

100 cash back and $75 FlyerFunds Estimated value: $175 Ends Aug 31, 2025 |

|

Click here to see all Tangerine credit cards in our credit card browser or learn how you can earn cash back rebates on Tangerine credit cards.

Best TD Credit Cards

TD has credit cards that earn both TD Rewards points and Air Canada Aeroplan points.

Frugal Flyer’s favorite TD credit card is the TD First Class Travel® Visa Infinite Card as it offers a welcome bonus of 85,000 TD Rewards points. TD Rewards points can be redeemed towards travel purchases via Expedia for TD at a rate of 0.5 cents per point, or book any way travel at a rate of 0.4 cents per point.

The TD First Class Travel® Visa Infinite* Card earns 8x TD Rewards on purchases at Expedia for TD, plus a $100 Expedia for TD credit and TD Rewards birthday bonus.

Check out our TD First Class Travel® Visa Infinite* Card review for more information.

85,000 TD Rewards

$5,000

$425+

$139.00 (FYF)

Yes

–

Below are the top five TD credit cards based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

85,000 Aeroplan Estimated value: $1,785 |

|

|

40,000 Aeroplan Estimated value: $840 |

|

|

85,000 TD Rewards Estimated value: $425 |

|

|

20,000 Aeroplan Estimated value: $420 |

|

|

350 cash back Estimated value: $350 |

|

Click here to see all TD credit cards in our credit card browser.

Best Credit Cards in Canada by Category for July 2025

If you are interested in adding a credit card to your wallet for a specific need such as increased spending rewards or saving on foreign transaction fees, we’ve captured the best credit cards for those needs below.

Best Credit Cards for Grocery Purchases

Grocery purchases are one of the biggest monthly spending categories for many Canadians, so it absolutely makes sense to hold a credit card that earns big rewards in this purchase category.

Frugal Flyer’s favorite credit card for grocery purchases is the Scotiabank Gold American Express card as it earns 6x Scene+ points at all Empire grocery stores, including Safeway, Sobeys, IGA, and Freshco. If you don’t shop at a grocery store that falls under the Empire banner, you will still earn 5x Scene+ points on purchases at all other eligible grocery stores.

The Scotiabank Gold American Express card earns up to 6x Scene+ points at Empire grocery stores and charges no foreign exchange fees on purchases made in foreign currencies.

Check out our Scotiabank Gold American Express card review for more details.

50,000 Scene+

$7,500

$650+

$120.00 (FYF)

No

Oct 31, 2025

Below are the top five credit cards for grocery purchases based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

50,000 Scene+ and $150 FlyerFunds Estimated value: $650 Ends Oct 31, 2025 |

|

|

335 cash back and $125 FlyerFunds Estimated value: $460 Ends Jan 31, 2026 |

|

|

30,000 MBNA Rewards and $125 FlyerFunds Estimated value: $425 |

|

|

15,000 Membership Rewards Estimated value: $300 |

|

|

200 cash back and $100 FlyerFunds Estimated value: $300 Ends Oct 31, 2025 |

|

If you are interested in learning more, check out our article on the best credit cards for buying groceries for Canadians.

Best Credit Cards for Restaurant & Dining Purchases

If you find yourself dining out frequently with friends and family, adding a credit card that earns bonus rewards on these purchases can go a long way in building your miles and points balances.

Frugal Flyer’s favorite credit card for restaurant and dining purchases is the American Express Cobalt card as it earns 5x Membership Rewards points on these purchases, up to $2,500 CAD per month.

The American Express Cobalt card gives cardholders the opportunity to earn 5x Membership Rewards on eligible restaurant, food delivery, and grocery store purchases.

Check out our American Express Cobalt card review for more details.

15,000 Membership Rewards

$9,000

$300+

$155.88

Yes

–

Below are the top five credit cards for restaurant and dining purchases based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

50,000 Scene+ and $150 FlyerFunds Estimated value: $650 Ends Oct 31, 2025 |

|

|

30,000 MBNA Rewards and $125 FlyerFunds Estimated value: $425 |

|

|

15,000 Membership Rewards Estimated value: $300 |

|

|

80 cash back and $60 FlyerFunds Estimated value: $140 |

|

|

0 cash back and $50 FlyerFunds Estimated value: $50 |

|

If you are interested in learning more, check out our article on the best credit cards for dining out for Canadians.

Best Credit Cards for Purchases in Foreign Currencies

If you regularly travel outside of Canada or make purchases in foreign currencies, adding a credit card that offers no foreign transaction fees will result in savings of 2.5% on every purchase. While this is a powerful benefit, there are only a few cards that offer this benefit in Canada.

Related: The Best Travel Credit Cards in Canada

Frugal Flyer’s favorite credit card for purchases in foreign currencies is the Scotiabank Passport Visa Infinite card which saves 2.5% on all purchases and comes with another valuable travel benefit, six free airport lounge passes via DragonPass.

The Scotiabank Passport Visa Infinite card offers benefits such as no foreign transaction fees and six annual complimentary airport lounge access passes.

Check out our Scotiabank Passport Visa Infinite card review for more details.

45,000 Scene+

$40,000

$550+

$150.00

No

Oct 31, 2025

Below are the top four credit cards for purchases in foreign currencies based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

80,000 Scene+ and $200 FlyerFunds Estimated value: $1,000 Ends Oct 31, 2025 |

|

|

80,000 Scene+ and $200 FlyerFunds Estimated value: $1,000 Ends Oct 31, 2025 |

|

|

50,000 Scene+ and $150 FlyerFunds Estimated value: $650 Ends Oct 31, 2025 |

|

|

45,000 Scene+ and $100 FlyerFunds Estimated value: $550 Ends Oct 31, 2025 |

|

If you are interested in learning more, check out our article on the best credit cards to use for foreign transactions for Canadians.

Best Credit Cards with No Annual Fees

Credit cards that have annual fees aren’t for everyone, and if you are looking for a low-commitment credit card option that still offers rewards and benefits, there are a few options worth considering.

Frugal Flyer’s favorite credit card with no annual fee is the Simplii Financial Cash Back Visa card as it earns 4% cash back on all purchases at restaurants, bars, and coffee shops, for up to $5,000 CAD per year.

The Simplii Financial Cash Back Visa card earns 4% cash back on purchases at restaurants, bars, and coffee shops on up to $5,000 in spending per calendar year.

Check out our Simplii Financial Cash Back card review for more details.

$80 cash back

$1,000

$140+

$0.00

Yes

–

Below are the top five credit cards with no annual fees based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

100 cash back and $125 FlyerFunds Estimated value: $225 Ends Aug 31, 2025 |

|

|

10,000 MBNA Rewards and $75 FlyerFunds Estimated value: $175 |

|

|

80 cash back and $60 FlyerFunds Estimated value: $140 |

|

|

60 cash back and $50 FlyerFunds Estimated value: $110 |

|

|

0 Canadian Tire Money Estimated value: $0 |

|

If you are interested in learning more, check out our article on the best credit cards with no annual fees in Canada.

Best Credit Cards with Low Income Requirements

If you are starting out in your career or are currently a student working part-time, there are still some excellent credit cards that you can be approved for with a lower annual income.

Frugal Flyer’s favorite credit card with low income requirements is the Rogers Red Mastercard as it offers 2% cash back on all purchases for Rogers, Fido, and Shaw customers. Cardholders will receive an effective 3% cash back if they redeem their cash back for Rogers, Fido, or Shaw products and services.

With the Rogers Red Mastercard, Rogers, Fido and Shaw postpaid customers can earn 2% cash back on all eligible purchases and get a 1.5x redemption bonus on Rogers, Fido and Shaw purchases – a 3% cash back value.

Check out our Rogers Red Mastercard review for more details.

$60 cash back

$0

$110+

$0.00

Yes

–

Below are the top five credit cards with low income requirements based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

50,000 Scene+ and $150 FlyerFunds Estimated value: $650 Ends Oct 31, 2025 |

|

|

10,000 MBNA Rewards and $75 FlyerFunds Estimated value: $175 |

|

|

100 cash back and $75 FlyerFunds Estimated value: $175 Ends Aug 31, 2025 |

|

|

80 cash back and $60 FlyerFunds Estimated value: $140 |

|

|

60 cash back and $50 FlyerFunds Estimated value: $110 |

|

If you are interested in learning more, check out our article on the best credit cards with low income requirements for Canadians.

Best Credit Cards for Free Airport Lounge Access

If you are a frequent traveler, free airport lounge access is one of the best benefits to have on a credit card. Airport lounges are a great way to kill time before a flight and often include complimentary food and drink, as well as a much more comfortable place to relax than the public seating in the terminal.

Frugal Flyer’s favorite credit card for free airport lounge access is the American Express Platinum card which comes with unlimited airport lounge access, oftentimes for both the cardholder and a guest, through the American Express Global Lounge Collection.

The American Express Platinum card is a premium card that offers benefits including a $200 travel credit, a $200 dining credit, airport lounge access, instant elite status with Marriott Bonvoy and Hilton Honors, and more.

Check out our American Express Platinum card review for more details.

180,000 Membership Rewards

$50,000

$3,600+

$799.00

Yes

Aug 18, 2025

Below are the top five credit cards that offer free airport lounge access based on current welcome offers:

| Credit Card | ||

|---|---|---|

|

200,000 Membership Rewards Estimated value: $4,000 Ends Aug 18, 2025 |

|

|

180,000 Membership Rewards Estimated value: $3,600 Ends Aug 18, 2025 |

|

|

85,000 Aeroplan Estimated value: $1,785 |

|

|

60,000 Aventura Estimated value: $1,320 |

|

|

45,000 Scene+ and $100 FlyerFunds Estimated value: $550 Ends Oct 31, 2025 |

|

If you are interested in learning more, check out our article on the best credit cards with free airport lounge access for Canadians.

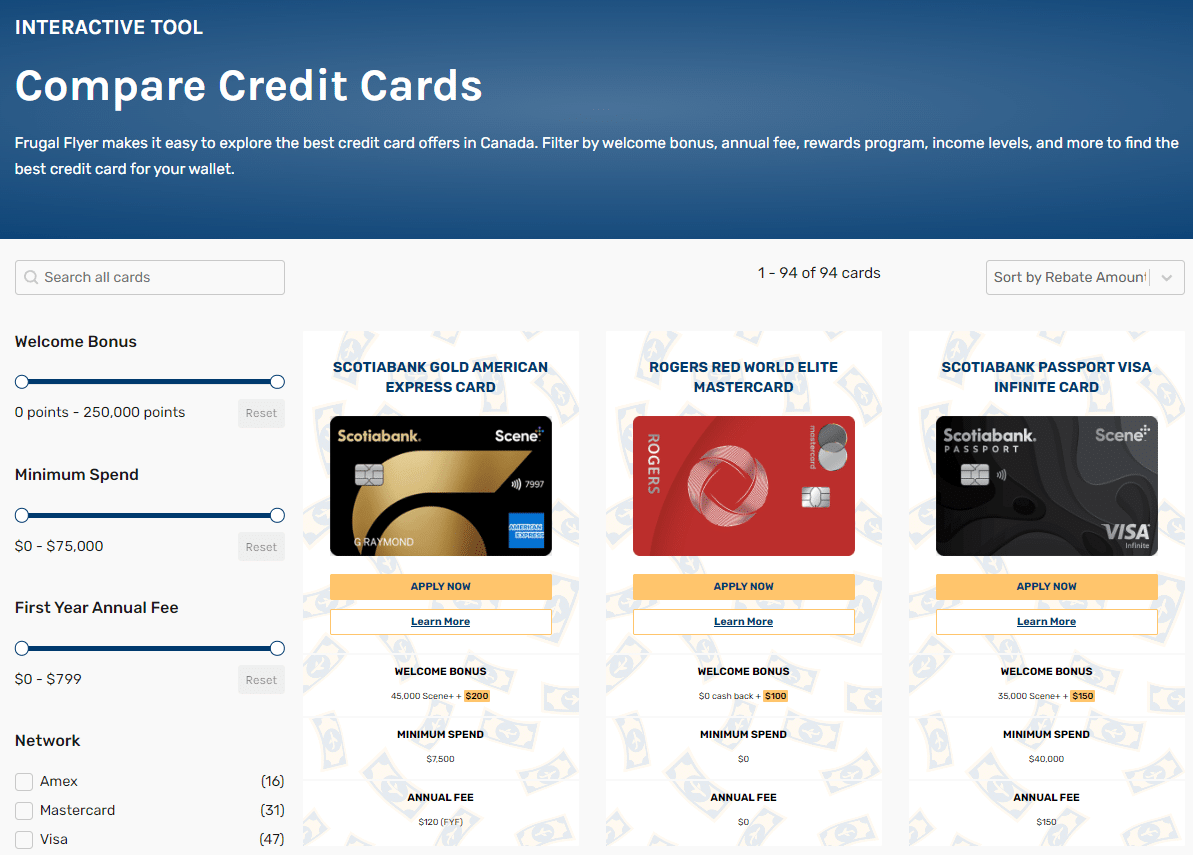

Frugal Flyer’s Credit Card Browser Tool: Find Your Best Credit Card

While we have captured many of what we consider to be the best credit cards in Canada above, we recognize that personal finance is an individual journey and that our favorite cards might not work for everyone.

To help our readers make the best decision possible when adding a new credit card to their wallet, Frugal Flyer’s best credit card comparison tool contains over 90 of the best credit cards available for Canadians.

Readers can filter to find the best credit card to add to their wallet on a variety of criteria, including welcome bonus, minimum spending amount to earn the welcome bonus, first year annual fee, financial institution, rewards program, income requirements, airport lounge access, and more.

Conclusion

Canadians are lucky to have many great credit cards to choose from, no matter their personal financial situation or needs. Whether you are looking to add a high-end travel credit card to your wallet or are simply looking for a new card to increase the rewards earned in a specific spending category, Frugal Flyer is committed to helping you find the best card for your situation.

Josh Bandura

Latest posts by Josh Bandura (see all)

- Which Aeroplan Points + Cash Redemption Option is Best? - Jul 11, 2025

- Earn Cash Back Rebates on Tangerine Bank Accounts - Jul 8, 2025

- New BMO Credit Card Offers (July 2025) - Jul 5, 2025

- New Scotiabank Credit Card Offers (July 2025) - Jul 2, 2025

- Best Credit Cards in Canada (July 2025) - Jul 1, 2025

Great article