For most Canadians (and people), groceries are one of their largest purchase categories. Everyone has to put food on the table. Unfortunately, healthier food options are expensive and not getting any cheaper with the current inflationary economic environment.

Credit cards are one of many ways to save money on food and groceries in Canada, and they should not be overlooked by anyone who can use them responsibly. Many powerful credit cards offer strong grocery category bonuses, meaning you will be earning significant rewards on all grocery purchases.

But which credit card should you use to buy groceries if you want to maximize the return on your purchases? Let’s look at the best credit cards for buying groceries for Canadians.

The Value of a Credit Card That Earns Maximum Rewards on Grocery Purchases

The reality is that if you pay with a debit card when buying groceries you’re effectively foregoing 4-6% in cash back or rewards on every transaction. Many of the best credit cards for grocery purchases also offer valuable benefits, increasing the value these cards bring to cardholders who add them to their wallets.

Considering groceries are often one of the biggest monthly expenses for Canadian families, it only makes sense to add a credit card to your wallet that rewards this spending category with bonus points.

While you can often optimize for every spending category if you are interested in keeping several credit cards in your wallet, groceries are the one category we absolutely recommend optimizing as the thousands of dollars spent every year will add up to significant rewards with the right credit card.

The Best Credit Cards for Buying Groceries

Scotiabank Gold American Express Card

In our opinion, the Scotiabank Gold American Express credit card is the best card for grocery purchases in Canada, and this is a result of the Scene+ Rewards partnership with Empire.

The Scotiabank Gold American Express card earns Scene+ Rewards points and gives cardholders the opportunity to earn 5x Scene+ points on grocery, restaurant, and entertainment purchases. This card charges no foreign exchange fees.

Check out our Scotiabank Gold American Express card review for more details.

45,000 Scene+

$7,500

$450+

$120 (FYF)

No

Oct 31, 2024

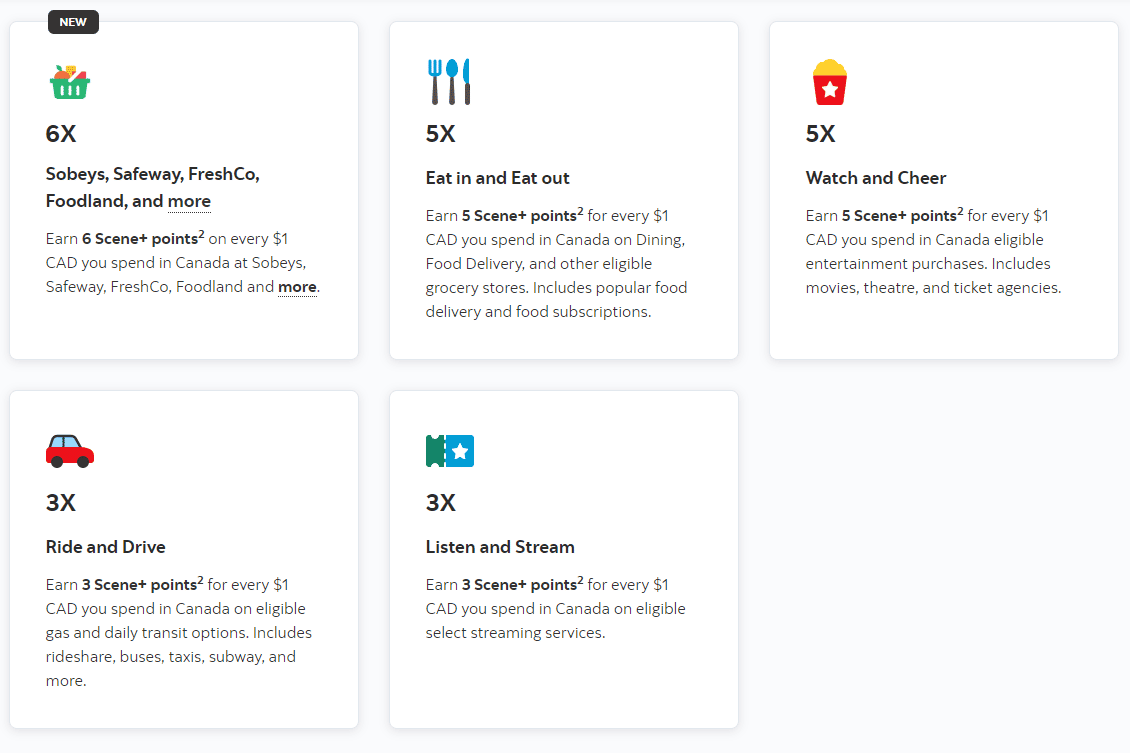

The Scotiabank Gold Amex card now earns 6 Scene+ points per dollar spent at eligible grocery stores including Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op.

You can think of the Scotiabank Gold Amex as earning effectively 6% cashback if you shop at the above stores for your groceries.

In addition, the card earns 5 Scene+ points per dollar spent at

- Restaurants (including food delivery)

- Other grocery Stores

- Entertainment (movies, theatres, ticketing agencies)

Scene+ points can be redeemed for travel rewards easily and flexibly via “Apply Points to Travel”, which garners a value of 1 cent per point. The refundable hotel trick works with this method as well.

Furthermore, this card is one of the few credit cards in Canada with no foreign transaction fees, and although issued by Scotiabank, it is eligible for Amex Offers and has strong insurance coverage including mobile device insurance and car rental insurance.

American Express Cobalt Card

The American Express Cobalt credit card is still one of the best credit cards for grocery spending in Canada.

The American Express Cobalt card earns Membership Rewards points and gives cardholders the opportunity to earn 5x Membership Rewards on eligible restaurant, food delivery, and grocery store purchases.

In 2024, we selected this card to receive the award Best Credit Card for Grocery Purchases.

Check out our American Express Cobalt card review for more details.

15,000 Membership Rewards

$9,000

$174+

$156

Yes

–

At an earning rate of 5 Membership Rewards (MR) points per dollar spent on grocery stores, food delivery, restaurants, bars, and convenience stores, it should be considered at least a 5% return on spending.

Of course, many would still argue that the American Express Cobalt card is #1 because American Express Membership Rewards points can be transferred to many other points programs like Aeroplan, Marriott Bonvoy, or Hilton Honors. When redeemed via these programs, you can certainly get better value than 1 cent per point, Aeroplan has a value of 2 cents per point when redeemed wisely.

One drawback of the American Express Cobalt card is its annual fee and welcome bonus structure. The annual fee is charged monthly at $12.99, giving the card an approximate yearly cost of $155.88.

Now, you might be thinking, “But I shop at Loblaws stores which don’t accept American Express!” Fret not, as there are workarounds to use Amex stores at Superstore and Loblaws ;).

BMO CashBack World Elite Mastercard

Suppose you’re looking for a credit card with higher merchant acceptance than American Express, or looking for a simple cashback rewards structure instead of points like Scene+ Rewards or American Express Membership Rewards. In that case, the BMO CashBack World Elite Mastercard should be a strong consideration.

The BMO CashBack World Elite Mastercard earns cash back and offers cardholders the opportunity to earn up to 5% cash back on all grocery purchases. As a result, for 2024 we selected this card for the award for Best Cashback Credit Card for Grocery Purchases.

Check out our BMO Cashback World Elite Mastercard review for more details.

$250 cash back

$2,500

$250+

$120 (FYF)

Yes

Nov 30, 2024

The BMO CashBack World Elite Mastercard earns 5% cash back on grocery purchases. Do beware of the monthly spending cap of $500. This means if you spend $1000 on groceries per month, you would get 5% on the first $500 ($25), and then 1% on the second $500 ($5), which does handicap the card a bit for those who spend a lot on groceries.

The card also earns strong rates in several other spending categories:

- 4% on transit (on the first $300 you spend monthly)

- 3% on gas and electric vehicle charging (on the first $300 you spend monthly)

- 2% on recurring bill payments (on the first $500 you spend monthly)

Receiving your cashback earned each billing cycle is easy and flexible. You can either have your cashback applied as a statement credit or deposit it into a BMO bank account or Investorline account.

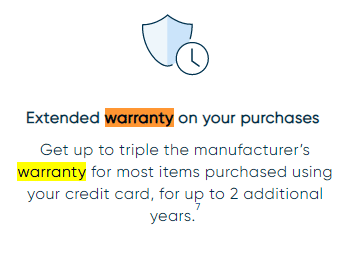

The BMO CashBack World Elite comes with two additional notable benefits: an extended manufacturer’s warranty of 2 additional years for eligible purchases, and free roadside assistance (provided by Dominion Automobile Association and the benefits of their BMO Roadside Assistance Program – Basic Coverage).

National Bank World Elite Mastercard

The National Bank World Elite Mastercard is one of our favorite credit cards for several reasons, one of which is its exceptional earning potential.

The National Bank World Elite Mastercard earns À la Carte Rewards points and offers cardholders benefits such as $150 in annual travel credits and access to the National Bank VIP lounge in the YUL International terminal. Due to its stellar travel insurance and purchase protection benefits, we deemed this card the Best Overall Insurance Credit Card of 2024.

Check out our National Bank World Elite Mastercard review for more details.

0 À la carte Rewards

$0

$-150+

$150

Yes

–

The National Bank World Elite Mastercard earns:

- 5 À la Carte Rewards points per dollar on grocery and restaurant purchases

- 2 À la Carte Rewards points per dollar on gas, electric vehicle charging, and recurring bills

- 1 À la Carte Rewards point per dollar on all other purchases

Related: National Bank À la Carte Rewards: Complete Guide

There is a spending cap on the 5X earn rate of $2,500 monthly. This means once you spend $2,500 in a monthly billing cycle (on any purchase category), you will earn only 2X on grocery and restaurant purchases thereafter.

The National Bank World Elite has several tangible benefits:

- Exceedingly strong extended warranty coverage which triples the manufacturer’s warranty, up to 2 additional years, on eligible purchases.

- Travel credit of $150 per calendar year, redeemable towards airport parking, baggage fees, seat selection, airport lounge access, and airline ticket upgrades.

- Complimentary lounge access to the National Bank Lounge at Montreal-Trudeau International Airport (YUL)

MBNA Rewards World Elite Mastercard

The MBNA Rewards World Elite Mastercard earns 5x MBNA Rewards points on all grocery purchases and since it is a Mastercard, is widely accepted at many Canadian grocers.

The MBNA Rewards World Elite Mastercard earns MBNA Rewards points and gives cardholders the opportunity to earn 5x MBNA Rewards on restaurant, grocery, digital media purchases, and more.

Check out our MBNA Rewards World Elite Mastercard review for more details.

30,000 MBNA Rewards

$2,000

$180+

$120

Yes

–

This card has a high annual category spend limit of $50,000 per category. This means you can not only earn 5x MBNA Rewards points on up to $50,000 in grocery purchases, but also 5x on up to $50,000 in restaurant, digital media, memberships, and household utility purchases. This can add up to a ton of MBNA Rewards points if you are strategic with your purchases.

Cardholders will also receive “birthday bonus points” when holding this card, which can be up to 15,000 MBNA Rewards points (calculated as 10% of the total amount of points earned in the last 12 months leading up to the cardholder’s birthday).

The real value of using this card for grocery spending is that MBNA Rewards points will be transferrable to the Alaska Airlines Mileage Plan at a ratio of 1:1 within the next year. Alaska Miles are hard to come by for Canadians and are highly coveted as they present some fantastic business and first class flight redemptions.

Alternatively, if you do not meet the income requirements or are looking for a no annual fee option, the MBNA Rewards Platinum Plus Mastercard offers 2x MBNA Rewards on grocery purchases up to $10,000 per calendar year. This card is also one of the best no annual fee credit cards in Canada.

Scotiabank Momentum Visa Infinite Card

The Scotiabank Momentum Visa Infinite card is another strong cash back earning credit card that Canadians may want to utilize to earn more rewards on their grocery purchases.

The Scotiabank Momentum Visa Infinite card earns cash back and gives cardholders the opportunity to earn 4% cash back on grocery purchases, eligible recurring bill payments, and subscription purchases.

Check out our Scotiabank Momentum Visa Infinite card review for more details.

$200 cash back

$2,000

$200+

$120 (FYF)

Yes

Oct 31, 2024

The Scotiabank Momentum Visa Infinite card earns 4% on groceries, recurring bill payments, and subscription services, such as:

- Insurance premiums, utilities, gym memberships, etc.

- Meal kits

- Netflix and other streaming services

Furthermore, the card earns 2% on gas and daily transit purchases, including Uber and rideshare. It earns 1% on everything else.

The Scotiabank Momentum Visa Infinite card has only an annual cap on spending before the earning rate drops to 1% across the board: $25,000. This means, depending on your spending habits, you might choose it over the BMO CashBack World Elite even though the latter technically earns 5% on groceries.

RBC ION+ Visa Card

If you don’t like annual fees, an honorable mention among the best credit cards for grocery purchases is the RBC Ion+ Visa card which only has an annual fee of $48.

The RBC ION+ Visa card earns Avion points and gives cardholders the opportunity to earn 3x Avion on groceries, restaurants, food delivery, transportation purchases, digital purchases, and more.

12,000 Avion

$0

$180+

$48

Yes

Nov 4, 2024

The RBC ION+ Visa card has a slightly lower earning rate of 3 Avion points for every dollar spent on groceries, as well as:

- Dining and food delivery

- Transportation, including gas, rideshare, daily public transit, and electric vehicle charging

- Streaming, digital gaming, and subscriptions

It earns 1 Avion point per dollar spent on all other purchases.

The Avion Rewards program is a flexible points program and can be redeemed for a minimum of 1 cent per point (eg. hotel.com gift cards or transferring to WestJet dollars), and higher if used for travel redemptions.

Comparison Summary of The Best Credit Cards for Buying Groceries

| Credit Card | Earning Rate at Grocery Stores | Other Earning Rates | Earn Rate Spending Cap for Grocery Purchases | Other Notable Benefits | Annual Fee |

|---|---|---|---|---|---|

| Scotiabank Gold American Express Card | 6X Scene+ Rewards at Empire stores (Safeway, Sobeys, etc) 5X Scene+ Rewards at other non-Empire grocery stores | 5X Scene+ Rewards on dining and entertainment purchases 3X Scene+ Rewards on transportation and streaming | $50,000 per year | No foreign transaction fees Access to American Express Offers | $120 |

| American Express Cobalt Card | 5X Membership Rewards on grocery purchases | 5x Membership Rewards on dining purchases 3X Membership Rewards on streaming 2X Membership Rewards on travel and transit | $30,000 per year ($2,500 per month) | None | $12.99 monthly fee |

| BMO CashBack World Elite Mastercard | 5% cash back (up to $500 per statement period) on grocery purchases | 4% cash back on transit 3% cash back on gas 2% cash back on recurring bills | $500 per statement period | None | $120 |

| National Bank World Elite Mastercard | 5X À la carte rewards points at grocery stores | 5X À la carte rewards points at restaurants 2X À la carte rewards points on gas and recurring bill payments | $2,500 per month for all charges on the card | $150 annual travel credit Access to the National Bank Lounge at Montreal Airport | $150 |

| MBNA Rewards World Elite Mastercard | 5x MBNA Rewards points at grocery stores | 5X MBNA Rewards points on restaurants, digital media, memberships, and household utility purchases | $50,000 per year (per category) | Birthday bonus of up to 15,000 MBNA Rewards points | $120 |

| Scotiabank Momentum Visa Infinite Card | 4% cash back at grocery stores | 4% cash back on recurring payments 2% cash back on gas and daily transit | $25,000 per year | None | $120 |

| RBC ION+ Visa Card | 3x Avion Premium points at grocery stores | 3x Avion Premium on dining out, food delivery, gas, rideshare, public transit, streaming, and gaming | None | None | $48 |

Conclusion

Although we have ordered the above list according to our subjective ranking of the best grocery credit cards available to Canadians, the best card for you will depend on your personal financial situation, spending habits, and preferences.

If you tend to shop at Empire stores, the Scotiabank Gold American Express card is hard to beat with its effective 6% cash back on all purchases. On the other hand, Costco shoppers are tied to Mastercard and might find the BMO CashBack World Elite Mastercard more attractive.

People who want to maximize return and/or rack up travel points will lean towards the American Express Cobalt card, whose points can then be transferred to Aeroplan and redeemed for exceptional value. Regardless of what card ends up being right for you, we hope this article has helped narrow down your decision.

Frequently Asked Questions

In the past No Frills, like Costco, only accepted Mastercard. They now accept both Mastercard and Visa in-store. You’re still out of luck with American Express, however.

Use the BMO CashBack World Elite Mastercard to earn 5% in cash back at No Frills or the National Bank World Elite Mastercard to earn 5 À la Carte Rewards points per dollar spent at No Frills. content.

Here are the credit cards you should consider for buying groceries in 2024:

• The Scotiabank Gold American Express credit card – 6X Scene+ points at Empire stores like Safeway, Sobeys, FreshCo, etc.

• The American Express Cobalt credit card – 5X Membership Rewards on groceries and restaurants.

• The BMO CashBack World Elite Mastercard – 5% cashback on groceries and restaurants.

• The National Bank World Elite Mastercard – 5X À la Carte Rewards points on groceries

• The Scotiabank Momentum Visa Infinite – 4% cashback on groceries, recurring bill payments, and subscriptions.

Walmart is uniquely categorized differently on different credit card networks. For Visa and Amex, Walmart is classified as a department store. However, for Mastercard, Walmart Supercenters are classified as grocery, whereas non-supercenters are classified as department stores.

This means that for Walmart Supercenters, the best credit card to use to maximize return is either the BMO CashBack World Elite Mastercard or the National Bank World Elite Mastercard.

One trick is to buy gift cards at grocery stores for purchases you intend to make at other non-grocery retailers. For example, you can buy a Canadian Tire or Home Depot gift card at the grocery store to earn your 5X points or 5% cashback, and then use that gift card to make the purchase at Canadian Tire or Home Depot.

You will want to be careful that you don’t need purchase protection or an extended warranty when using this method, as you won’t have proof you purchased the item with your credit card.

Reed Sutton

Latest posts by Reed Sutton (see all)

- Ultimate Guide to Flight Award Release Dates - Oct 18, 2024

- Review: Chiang Mai Marriott Hotel - Oct 12, 2024

- Review: Renaissance Koh Samui Resort & Spa - Sep 11, 2024

- Review: Moxy NYC Lower East Side - Aug 28, 2024

- Edmonton Miles & Pints Meetup (August 2024) - Aug 6, 2024

the FAQ should be updated. No Frills does accept Visa. I haven’t encountered any No Frills where my Visa was not accepted. I believe them not accepting Visa was before….

Thanks!