At Frugal Flyer, we are big proponents of diversifying your miles and points ‘revenue’ streams. One of the best ways to do that right now is to take part in both the Canadian (or your home country) and US markets.

While you can get started with your first US credit card most simply using Nova Credit, you need to secure something called an ITIN number to ensure staying power in the US market.

At Frugal Flyer we offer a simplified service to acquire an ITIN number: ITIN Service: Get US Credit Cards as a Canadian. Our service prepares the ITIN application and required tax documentation to help you to apply to the IRS for your ITIN.

However, we find there is a lot of confusion surrounding the overall process, particularly in regard to proof of identity and your options for physically submitting the application. So in this article, we aim to clarify the overall process and what you can expect at each step.

What is an ITIN?

The ITIN is an Individual Taxpayer Identification Number (ITIN), which is an individual processing number issued by the Internal Revenue Service (IRS) of the United States government. ITIN is used to help individuals comply with US tax law, by serving as a tax number for individuals to file tax returns and payments. In particular, it is for individuals with foreign status who do not qualify for a Social Security Number (SSN), whether resident or nonresident.

There are plenty of reasons to want/need an ITIN number in order to file a US tax return, including:

- taxable income from employment in the U.S.

- taxable trade or business income in the U.S.

- taxable rental income from U.S. real estate

- royalties received from U.S. sources

- winnings from lotteries, gambling, or prizes

- the sale of U.S. property (real property tax act)

- applying for an exemption from U.S. withholding taxes

However for miles and points enthusiasts, you want an ITIN for another reason.

Why You Should Get an ITIN as a Canadian or Non-US Person

From a points and miles perspective, you want an ITIN because it will allow you to apply for US credit cards and take advantage of US credit card sign-up bonuses (and bank account bonuses from time to time) across a broad range of issuers. Banks like Chase, Bank of America, Citi, CapitalOne, and of course American Express. The US points and miles market is the most lucrative in the world, and you are missing out by not partaking.

As a Canadian in particular, you shouldn’t wait to get an ITIN number!

Particularly as of late 2022, many of Canada’s most lucrative point generators are drying up. There are numerous examples, but Aeroplan’s pricing changes, American Express cracking down on repeat bonuses, TD and RBC cracking down on product switching, and so on.

Furthermore, credit card welcome bonuses are entering an uncertain period as a result of new laws around credit card processing fees (interchange) being passed on to consumers. It is unknown how many merchants will implement this and what effect it will have on the profitability of credit card products. There is definitely the potential this could in turn affect welcome bonuses in Canada though.

Finally, the very method outlined in this article could be in jeopardy. Previously it was possible to use a letter generated by Amazon/Smashwords with the W7 application, however, the IRS changed policy and stopped accepting W7 applications without an accompanying tax return. This is to say that IRS policies and practices are subject to change at any time.

As a Canadian miles and points enthusiast, you should want to embed yourself in the US market as soon as you can! Learn more about how you can get started with US credit cards as a Canadian.

Steps Involved to Get an ITIN

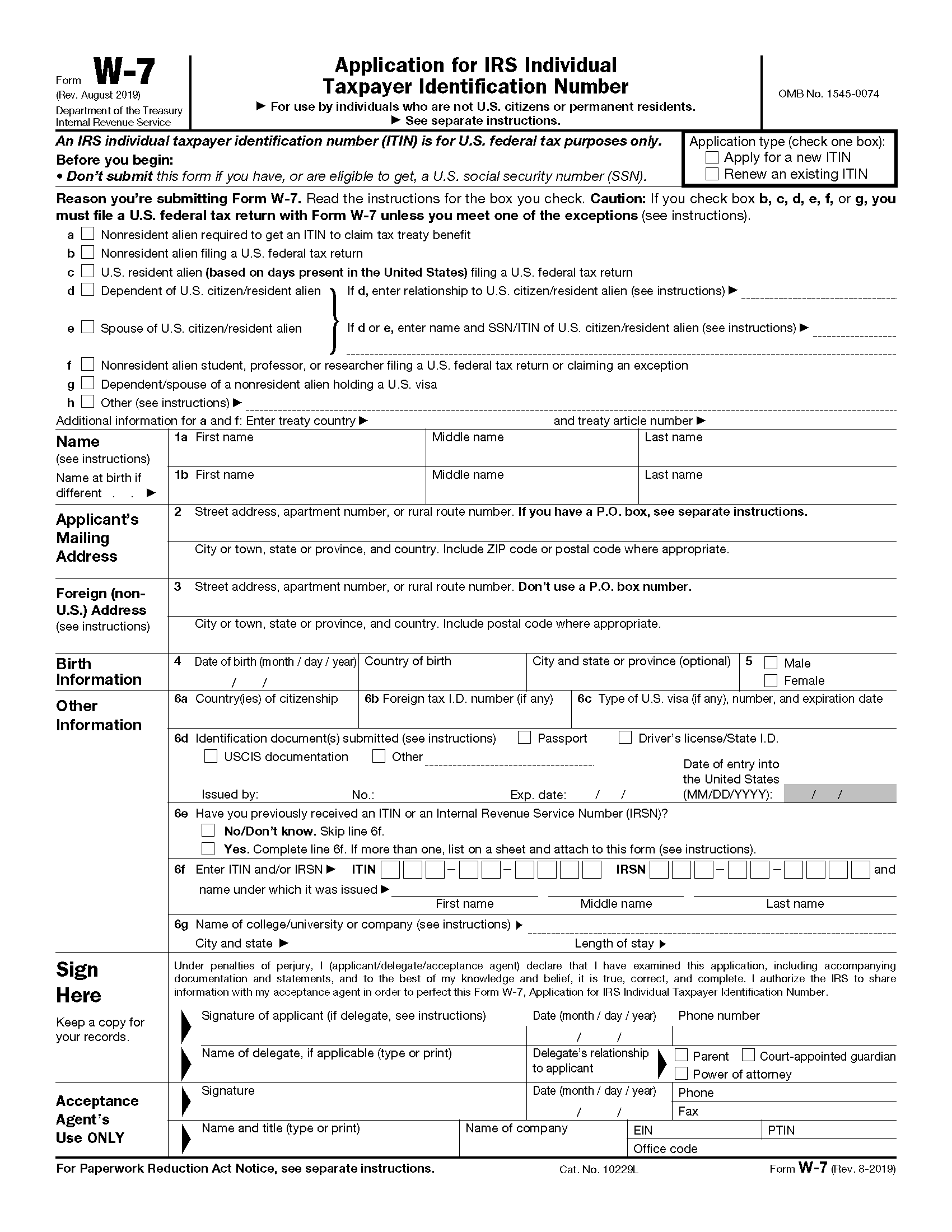

Step 1. Complete Form W-7- Application for Internal Revenue Service Individual Taxpayer Identification Number

Form W-7 is the ITIN application form and can be used both to apply for a new ITIN or renew an existing ITIN.

The form looks as follows.

Essentially only section 1-6 needs to be completed. Section 2 is left out in most cases as it refers to a US address. Section 2 is not relevant for anyone residing outside the US, instead, foreign addresses go in section 3.

Notice also that we selected “Nonresident alien filing a U.S. federal tax return as the reason in the first section, meaning that a tax return must be attached to the application. That tax return is the next step – Form 1040-NR.

Step 2. Complete Form 1040-NR – U.S. Nonresident Alien Income Tax Return

Form 1040-NR is a paper tax return form for U.S. nonresident aliens.

As a nonresident alien, if you earn more than $5 USD of income in the US, you are technically obligated to file a tax return. Of course, nobody actually does file for these small amounts nor is the IRS going to chase you down for the same. Similarly, few businesses will issue you a 1042-S for such an amount. However, you can self-report your earnings by filing a Form 1040-NR and in order to do so you need an ITIN!

The self-declared income can be sourced from US-based online casinos, which we find is the simplest type of income to generate and file. So you don’t even need to set foot in the USA to claim US-source gambling income. It is also extremely unlikely that you will ever need to have actual proof that you earned this income, as you are reporting tax owing and paying money to the IRS, rather than claiming a tax refund.

If you prepare a return with this type of income you will also need to attach two additional forms to the Form 1040-NR:

- Schedule 1: Additional Income, and

- Schedule OI: Other Information

You will need to provide the following information:

- A listing of dates you were physically present in the USA for the tax year you are filing (eg. if you are filing in 2022, the tax year is 2021). Note that this can be zero.

- The total number of days in the USA for each of the three previous years, including the current tax year. Note that these can be 0.

- Your Social Insurance Number (Canada)

- Your Passport Information

While Form W-7 is straightforward, completing a Form 1040-NR is fairly complicated, which is why we offer our Frugal Flyer ITIN service (details below).

Step 3. Prepare Proof of Identity and/or Foreign Status Documents

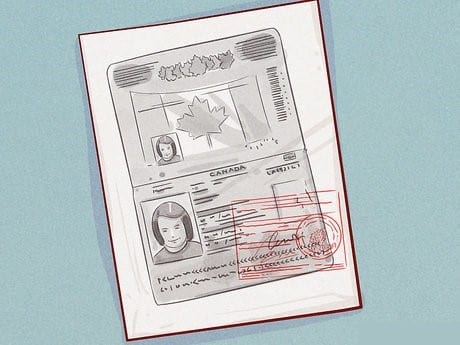

As part of your ITIN application you will need to provide documentation that proves your identity and foreign status. The easiest and recommended form of documentation that works for citizens of almost any country or residency is a passport.

In terms of actually presenting your identification verification documents, you have the following options:

Internal Revenue Service Taxpayer Assistance Center (In-person)

If you visit the US frequently, you can avoid having to mail anything at all by visiting an IRS Taxpayer Assistance Center in person to submit your Form W-7 + Form 1040-NR. You will be required to present your identification document (passport), which the agent will validate and return to you on the spot.

Original Documents (Mail)

Another option, you can send in your original documents to the IRS. The IRS will return the document by mail to you regardless of whether your application is approved or declined. However, the major downside to this is that it may take up to 5 months to get the document(s) back. Longer even than the ITIN itself in some cases.

As an alternative to parting with your passport, you can consider sending in replacement or duplicate copies of two other documents that meet the IRS standards for proof of identity and foreign status. Most typical would be a civil birth certificate and foreign driver’s license. These can be obtained for relatively little cost from most provincial government services across Canada:

| Province | Driver's License | Birth Certificate |

|---|---|---|

| Alberta | $28 (link) | $20 (link) |

| British Columbia | $17 (link) | $27 (link) |

| Manitoba | $10 (in-person) | $30 (link) |

| New Brunswick | $22 (link) | $40 (link) |

| Newfoundland & Labrador | $25 (link) | $30 (link) |

| Nova Scotia | $25 (in-person) | $33 (link) |

| Ontario | $35.75 (link) | $35 (link) |

| Prince Edward Island | $20 (in-person) | $25 (link) |

| Quebec | $15 (link) | $37 (link) |

| Saskatchewan | $15 (link) | $55 (link) |

Certified Documents (Mail)

The most common method we see, you can send a certified true copy of your passport to the IRS. A certified true copy is a copy of the original document that has been stamped as authentic by the original agency which issued the document. It is NOT the same as a notarized copy and the IRS has indicated that notarized documents will not suffice for ITIN applications.

For Canadian passport holders, getting a certified true copy of your passport is fairly straightforward. You can request them from Service Canada in-person or by mail. If you are looking to go the in-person route, we recommend booking an appointment in advance. Some Service Canada offices take walk-in appointments, but your mileage may vary. For requesting certified copies by mail, you will need to mail in your passport but can expect to receive it back in as little as three weeks.

Notice: IRS Rejection of Certified True Copies of Canadian Passports

If you have a foreign, non-Canadian passport, the process for certified copies may be different. You can contact the issuing agency to inquire, or the U.S. Embassy and Consulates in Canada may be able to certify your foreign passport.

Luckily, we’ve written an in-depth guide that takes you through the entire process: Obtaining Certified True Copies of your Passport.

Apply via an Acceptance Agent (In-person)

The final way to validate your identity to the IRS is to apply for your ITIN via a Certified Acceptance Agent, which is an individual who has been authorized by the IRS to accept and assist with ITIN applications on the behalf of the IRS. These agents should be able to accept your Form W-7 + Form 1040-NR and validate your passport without requiring you to mail it in, like an IRS Taxpayer Assistance center.

There are numerous Certified Acceptance Agents throughout Canada, and you can view a list here. However, do note that there is a cost associated with using these agents (~$300-500).

I do not personally know any customers who’ve used this option, but would be curious to hear from anyone who has. Email us or leave a comment!

Step 4. Submit Everything to the Internal Revenue Service – Mail or In-person

Once you’ve got your proof of identity documents, completed Form W-7, and Form 1040-NR, you are ready to submit everything to the IRS, either by mailing in original/certified documents or in person via IRS taxpayer assistance center or certified acceptance agent, as outlined in Step 3 above.

If you are mailing your form in, you will mail everything to the following address:

Internal Revenue Service ITIN Operation P.O. Box 149342 Austin, TX 78714-9342 USA

We recommend mailing via registered mail with Canada Post (cost of $10-$15), as this will give you proof of delivery and tracking.

Note: if you apply via a private delivery service (PDS), you will need to mail to a different address as outlined on this page.

Internal Revenue Service ITIN Operation Mail Stop 6090-AUSC 3651 S. Interregional, Hwy 35 Austin, TX 78741-0000 USA

In-person

On the other hand if you decide to visit a Taxpayer Assistance Center in the USA, you must book an appointment in advance. See a directory of TACs here: TAC Locations Where In Person Document Verification is Provided | Internal Revenue Service (irs.gov).

You can book a TAC appointment up to 2 months in advance, and spots can fill up quite quickly, especially in busy cities. Some applicants have reported difficulty calling from a Canadian number. If this is the case, try 1) using a US-based VoiP number to make the appointment, and 2) calling early in the morning. Both of these tips have apparently led to greater success.

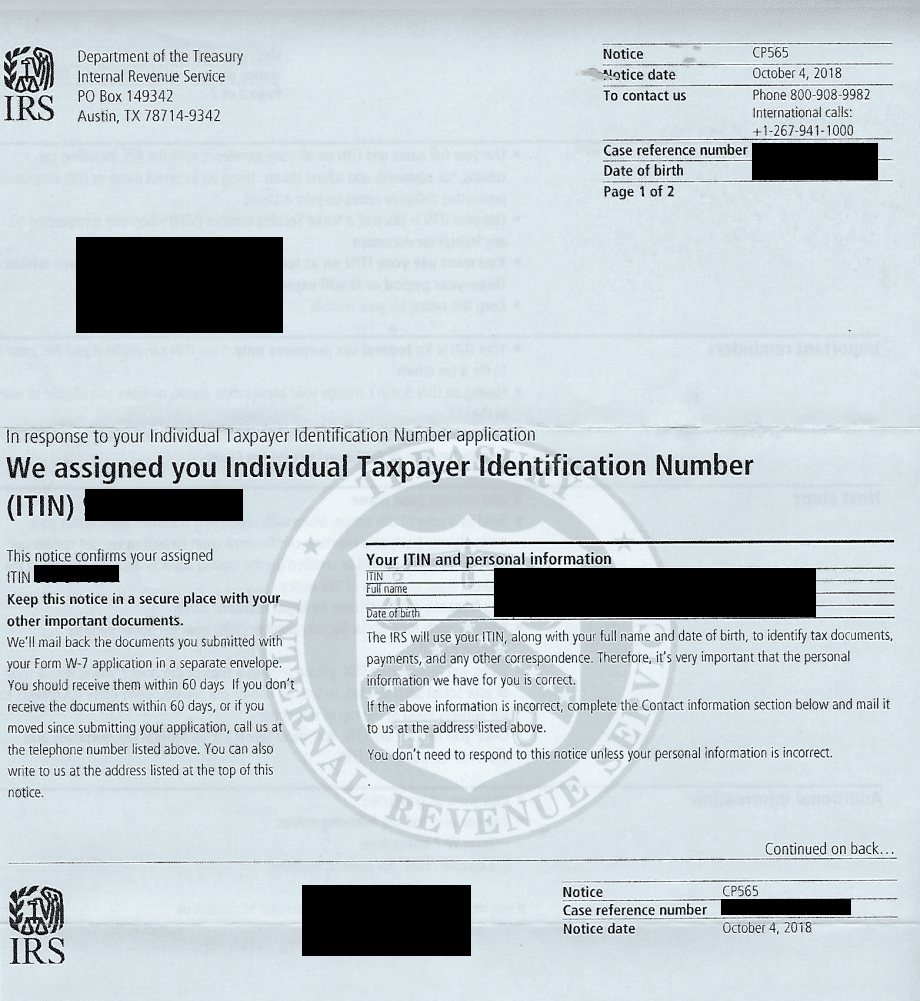

Step 5. Receive Your ITIN and Pay Your US Taxes

If everything has been done correctly, you should receive a letter (Notice CP565) from the IRS containing your new individual tax identification number, in approximately 3-5 months (average: 4 months) from the time of submission. As mentioned, any documents you provided can take a little longer.

Once you receive your ITIN, you should immediately pay your taxes owed. We’ve found the best method is to pay using a credit or debit card via payUSAtax.com.

Frugal Flyer’s In-house ITIN Service

As we’ve mentioned, Frugal Flyer offers a bespoke service to our readers that simplifies the above application process significantly. For $140 CAD (+tax), we will pre-fill the Form W-7, Form 1040-NR along with Schedule 1 and Schedule OI on your behalf. Along with that, we will send you detailed instructions for submitting your application via the methods outlined above, and provide email support along the way.

Ultimately you will be responsible for submitting the application package and following up with the IRS if required. We are proud to say that all of our customers have successfully received their ITINs, including customers from Canada, the United Kingdom, Japan, Australia, Singapore, Germany, and many other countries.

See our reviews on Trustpilot and Google if you need any more convincing!

Conclusion

Securing an ITIN is one of the best ways to amp up your travel hacking game (well, that and convincing your player 2 to get into the world of credit card rewards). Hopefully, this article has helped to clarify the overall process. If you still have any questions or concerns at all, please leave a comment below!

Frequently Asked Questions

For any questions related to the ITIN and the Frugal Flyer ITIN Service specifically, please see the FAQ section on our ITIN Service page.

Reed Sutton

Latest posts by Reed Sutton (see all)

- Review: Starlux Airlines Premium Economy (A350-900) - Jun 23, 2025

- Review: Hotel Proverbs Taipei, a Member of Design Hotels - Jun 18, 2025

- Review: ZIPAIR “Full Flat” Business Class (787-8) - Jun 4, 2025

- Booked: Morocco & Portugal 2025 - May 18, 2025

- Vancouver Miles & Pints Meetup (July 2025) - May 14, 2025

Once you apply for the ITIN Number, would the first return be of $0 value because i only need it to open a CC?.

The first return is included with the ITIN (W7) application and would be for a nominal amount of around $100, which amounts to ~$10 USD in taxes owed.

How is expiration calculated? If I got my ITIN in 2021, then what is third consecutive year? Will it expire in 2024 or in 2025?

Thank you!

If you got it in 2021, assuming that was filing for the 2020 tax year (which may not be true if you received it in say January 2021), then after not filing for 2021, 2022, and 2023 tax years, it would expire December 31, 2024.

Source: https://www.irs.gov/individuals/itin-expiration-faqs

I am from germany and I used your ITIN service with success. It took only 10 weeks to get my ITIN. Thanks for the great service and your help here in the blog.

Claudio

Used your ITIN service. IRS website states you will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete. I received my ITIN in 7 weeks less a day from the date I mailed the application lol. Thanks for the service. Very happy I decided to use it to get the ITIN!

If using your in house service, are you able to report income from any other sources aside from gambling winnings by any chance?

Typically not, but email us at [email protected] with more details and we can let you know.

Thanks for the team and was not expecting everything is so easy. From the start of ITIN application (using Frugal’s service) to getting my first Chase credit card, it only takes 3 month. Now I have one AMEX US, Chase Checking and Saving and Chase credit card. Thanks a lot everyone at Frugal.

Fantastic to hear Michael! All the best 2024 🙂

Hi, how were you able to get the chase bank and credit card so quick? Did you go in person at all or was it all online and by phone?

In person as recommended by most. The banker at the branch very friendly and didnot ask much as long as you have all they need. It was the banker encouraged me to apply for a chase credit card. One thing to mention is to use email address to receive OTP since you will not get the OTP via text message on Canadian cell number.

Hi

One more question – If I obtain an American credit card, won’t I have currency exchange fees using it only in Canada?

Many (maybe even most) US credit cards have no FX fees. Particularly Amex and Chase cards.

Hi

Any potential harm or cons filing for a ITIN?

There is no harm in applying for an ITIN.

Do you have to file a US tax return every year or just initially to obtain the ITIN.

I presume that you would not have to if you had no income & you now have the ITIN to obtain cards! How long does the # last? If renewing, the fact that you may have not filed for a few years, is a reason for the IRS to deny renewals??

No need to file every year if you have no income.

The ITIN will go inactive if you don’t file for three consecutive years.

Once its expired you can file a renewal W7 form with a tax return: https://frugalflyer.ca/itin-renewal/.

Hello Reed,

Once you have your ITIN, do you need to provide this to your bank in order to have it associated with your credit file?

Thanks!

Hi Singh,

Provide it on your next credit application and it will be associated with your credit file.

I can’t speak for every bank, but for Amex they aren’t able to retroactively add an ITIN to a credit product. This shouldn’t stop you from getting approved however.

Regards,

Reed

I have submitted a request for a tax refund that I won at the Rocky Gap Casino in Maryland. In accordance with my Canada Post tracking my request was received on Nov 16th 2022 at your office

Internal Revenue Service

PO Box 149342

Austin, TX 7814-9342

Could you please let me know the status of my Claim from my Rocky Gap Taxes that was taken from me.

Your assistance in helping me would be greatly appreciated.

Respectfully

Judy Shanks

Y

Hi Judy – this is a travel blog, not the website of the government of the Unites States.