Earning credit card points and rewards is a legitimate, if not odd, hobby. Whether you are just starting out in the game or are already well established with significant points balances and trips under your belt, we as miles and points enthusiasts are always looking at how to best scale these opportunities in order to further improve our results.

While we can always apply for more credit cards, or explore the opportunities in the US credit card scene, these opportunities pale in comparison to involving another person in the credit card rewards game.

Enter player two; depending on your situation, this may be a significant other, friend, or family member. An interested and willing player two can make a significant difference in scaling up the earning potential within the miles and points game.

Earning Miles & Points Alone for Two People is Expensive

When it comes to credit card rewards, you may already be seeing success in earning points and redeeming for future vacations. You may also be in a situation where you find yourself earning miles and points to fund vacations for two people.

While it is possible to earn enough points to take yourself and others on vacations, the reality is that it can be difficult to do with only one person earning, especially if there is the desire to indulge in certain luxuries, like business class flights or luxury hotels.

In simple terms, you have a single individual’s points earning potential going up against points redemptions for 2 or more people. Basic math shows us that this is an inefficient way of maximizing the number of vacations and experiences you will be able to redeem for in a year.

While you may have already had success in funding trips for two people, it cannot be ignored that the scalability of this hobby is significant when doubling the involvement and availability of earning points via an additional person.

While I do have vacations that I take with my miles and points friends, I do also travel often with my significant other. Prior to her being involved in the points and miles hobby, I always found it difficult to earn enough points to redeem for the both of us.

This changed once she was willing to join my credit card rewards adventure. The power of double the credit card offers and double the signup bonuses cannot be ignored.

The Power of Two Credit Profiles

Having two credit profiles also allows you to take advantage of strong limited-time offers, such as any of RBC’s offers. Since you are only able to be approved for one new RBC card every 90 days, through having a miles and points partner you can get two cards every 90 days. It is simple scalability that makes all the difference in this hobby in taking your points earning abilities to the next level.

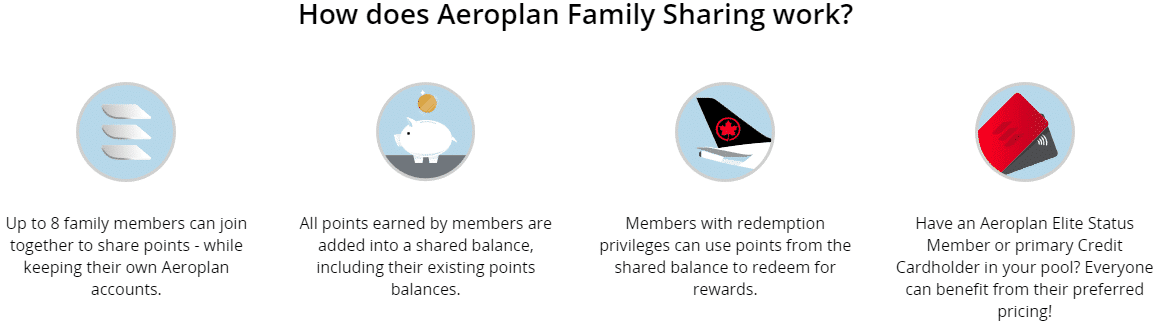

Certain loyalty programs also give you the opportunity to combine miles between multiple users, such as Aeroplan. The Aeroplan Family Sharing program gives Aeroplan members within the same household the opportunity to link their accounts to pool their points for upcoming redemptions.

The British Airways household account presents a similar opportunity for those who want to earn and redeem Avios together. Also, with Marriott Bonvoy you can transfer up to 100,000 points from one account to another per year. This can be more efficient when making large points redemptions for the two of you. Opportunities like this are only possible for those who have involved others to contribute to their points earning endeavours.

The Power of Referrals

Another significant benefit of having a dedicated miles and points partner is the opportunity to refer each other to new credit cards for additional rewards. Back in the day, you were able to self-refer yourself to Amex cards but that practice has since been frowned upon. While self-referring is no longer possible, having a partner to refer to new credit card applications and vice-versa can add a nice chunk of supplemental points to your earnings.

For example, consider if you both hold the American Express Business Platinum card. The ability to earn 20,000 Membership Rewards points per referral to specific cards is nothing to scoff at, especially when you can trade referrals to new American Express cards with your player two.

The American Express Business Platinum card is a premium card that offers benefits including a $200 travel credit, airport lounge access, a $100 NEXUS membership credit, and more.

In 2025, we selected this card to receive the award Best Small Business Travel Card.

Check out our American Express Business Platinum card review for more details.

200,000 Membership Rewards

$90,000

$4,000+

$799

Yes

Aug 18, 2025

Essentially, credit card referrals can become a powerful force when you are working towards a miles and points goal with someone else. Do not forget about them, as you could be leaving tens of thousands of points on the table.

The Power of Results

“Instead of telling you what we can achieve together, why don’t I show you.”

Oftentimes, talking about what is achievable through credit card rewards is helpful when trying to convince a player two to join you. However, it can often just seem like words on a page until you actually experience it. I am a big believer in not only talking about but also showing or living what can be achieved through the understanding of miles and points.

Therein lies the most powerful tool in convincing your player two to earn credit card rewards with you: taking them on a vacation or experience that showcases the benefits of the hobby.

This trip doesn’t need to be the utmost in luxury, but something outside of the typical realm of possibility for them (whether that be a business trip paid on points, a nice hotel, or anything that meets your travel desires). This can go miles in helping P2 realize the experiences that are achievable with this hobby.

For example, I met my significant other in early 2019. She hadn’t done much travel in recent years, but like me, desired to see more of the world.

The turning point was when we took a brief trip to Santorini in August 2020. We flew business round-trip from YEG > YUL > ZRH > ATH > JTR, with the longest legs being on Swiss Airlines. Arriving in a rainy Zurich after being able to get some quality sleep on the plane during the 7-hour flight was a big turning point for my significant other.

From there, we were able to enjoy a gorgeous five-night stay in Santorini and had the opportunity to experience all the island has to offer. Nightly cocktails with gorgeous sunset views were the highlight of the vacation for me, bringing us back to a simpler time before COVID took over. Amazing food, a gorgeous island with stunning architecture, and a round-trip in business class were all it took to convince my significant other to take the plunge into the world of points & miles.

Ultimately, it is best to let the results speak for themselves. When the question turns from “where can we afford to go this year” to “how are we going to fit all of these trips into our limited paid time off”, you’ve flipped the script when it comes to the credit card rewards game.

Finding What Combined Strategy Works For You

If your partner or player two has shown interest in joining the world of credit card rewards, you are more than halfway there. While their interest is a big win, the next logical step is determining their desired level of involvement and how you can accommodate this. As with anything in a personal relationship, this needs to be a conversation and a joint decision.

For example, some player twos may want to be involved with tracking spending, performing manufactured spending, and doing as much on their own as possible. On the other hand, for some player twos, the idea of having to pick up the phone to speak to a bank representative is anxiety-inducing.

Finding the sweet spot between the level of involvement of both parties is imperative in seeing success when earning miles and points with others. Reed and I both have a few different strategies as we both have a different relationship with our player two.

Josh’s Strategy in Travel Hacking with a Significant Other

When it comes to my miles and points relationship with my significant other, I have full control over most aspects. I complete all of the minimum spend requirements, track all of our credit cards, and apply for new cards (with her approval first). I also will cancel cards on her behalf when possible, for example, if the issuer has an online messaging system that allows canceling credit cards online.

If I do need my significant other to call in, such as if an Amex business card application requires more information, then I will write out a script for her with all relevant information surrounding the application; this is even more imperative when asking her to call about US applications.

I also maintain a lower velocity of new card applications to more actively manage her credit history and credit report. Overall, this strategy works great for our relationship since I love the hobby and am more than happy to do 95% of the work and she is happy to reap the rewards.

Reed’s Strategy in Travel Hacking with Family

My P2 and P3 are actually my parents. How did I get my parents involved? Well, once I really got deep into the rabbit hole of points and miles in 2019, I would often discuss with them some of the opportunities I was able to take advantage of, and they’ve also witnessed some of the great trips I’ve been able to take. My mom is retired now and very much wants to travel more, so her interest was piqued. My dad not so much, but he does have a strong appreciation for free money.

Like Josh, I now have a similar relationship with P2/P3 in that I manage almost all aspects of their credit card rewards. Where the situation differs is that my parents are older and actually a bit … technologically challenged. They can barely manage one card, let alone the 20-30 some of us manage. And so in getting them on board, they’ve essentially given me full autonomy to sign up for new cards, do product switches, and cancel when I see fit.

Obviously, I only have so much time, and so managing this for two other people has to be done strategically. My approach has been the following

- I only use P2/P3’s credit to apply for the very best offers – that is, my threshold for signing up for a new offer is higher for P2/P3 than for myself.

- I’ve been exploring Power of Attorney or ‘authorized manager’ type roles with most of the banks and loyalty programs. This allows me, in the cases where something can’t be managed online, to actually call in and make account changes on P2/P3’s behalf.

The Power of Attorney role is actually quite powerful in managing a P2’s accounts, and something for everyone to consider. We will go over this in detail in a follow-up post.

Conclusion

At the end of the day, earning miles and points with a player two, as with anything in a personal relationship, should be a joint effort, if your player two decides they want to be involved. There should never be any pressure in getting them involved, especially since finances can already be a sticky subject for some relationships. If your player two does want to be involved, ensuring you understand their desired level of involvement is key.

I wish you luck in convincing your player two to join you in your miles and points adventure. If you already have a player two, perhaps you might have some chance in securing a player three or four for further benefits 😉

Josh Bandura

Latest posts by Josh Bandura (see all)

- Earn Cash Back Rebates on Tangerine Bank Accounts - Jun 11, 2025

- New BMO Chequing Account Offers (June 2025) - Jun 9, 2025

- Best Credit Cards in Canada (June 2025) - Jun 1, 2025

- Best Bank Accounts in Canada (June 2025) - Jun 1, 2025

- The Best Travel Credit Cards in Canada (2025) - May 25, 2025