Update December 6, 2021: ATB has decided to terminate the development of its Brightside banking platform to focus on ATB’s main digital banking experience. The application will cease to exist by the end of March 2022.

Today we’re going off the beaten path and reviewing a very niche prepaid spending card: the Brightside Spend card issued by ATB Financial. ATB, or Alberta Treasury Branch, is a financial institution in Alberta, and the Brightside card offers some benefits and features that make it quite unique. In particular, we will discuss Brightside’s local partnerships, in app ‘bucket’ features, and in a post mortem, a juicy summer promotion that a few friends were able to abuse quite heavily 😉

What is the Brightside Spend Card?

Brightside is a reloadable prepaid Mastercard debit card issued by ATB Financial. As such it requires no credit check. Brightside has a cashback earning rate of 0.5% across the board, making it comparable with Koho prepaid Mastercard.

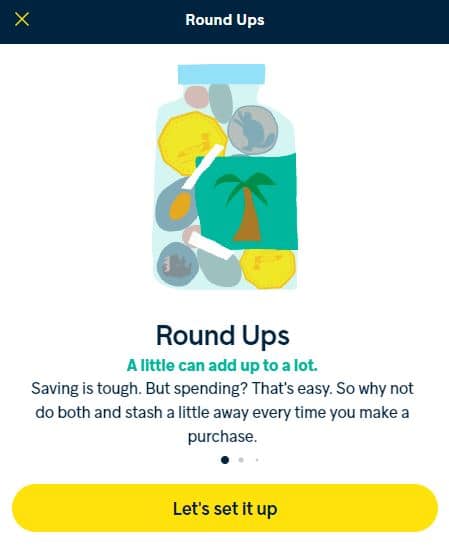

Brightside also markets itself as a savings app, offering budgeting and savings features such as transaction rounding up to promote healthy savings habits.

Importantly, there are no outstanding fees associated with Brightside, including

- No account fees or minimum balances

- Unlimited, free transactions and use of Interac e-Transfer

- Free ATM withdrawals at ATB Financial ABMs (and no ATM fees imposed by Brightside)

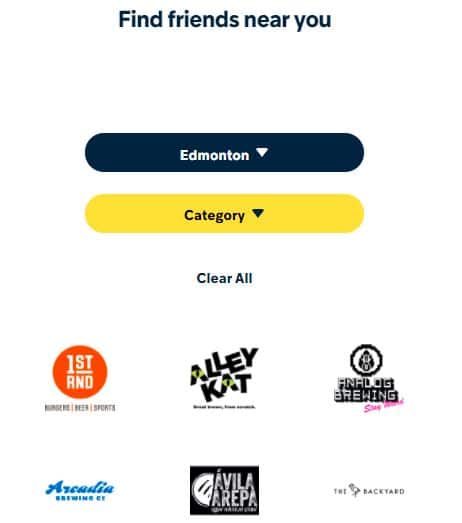

What is Brightside’s Friends with Benefits?

Brightside Friends with Benefits are local and mostly small businesses that partner with Brightside to offer discounts to ‘Brightsiders’. Whenever you spend using your Brightside card at a ‘Friends with Benefits’ partner, Brightside will give you a bonus top-up of up to $1.

The way this works is that Brightside will round up your purchase amount to the next (not nearest, subtle distinction) dollar. So for example, if you spend $9.50 at a partner, Brightside will pay you $0.50 (5% return, not bad). If you spend $9.90, you will only get $0.10, and on the other hand if you spend $9.00 you will get a full $1.00.

You can find a list of Brightside Friends here. While the $1 doesn’t seem like much, if one of your favorite local shops is on the list, the savings on small purchases can add up over time. This is especially true if your usual transaction amount is on the lower side of a dollar.

In addition, there are individual promotions that Brightside runs from time to time. One of these was the infamous Takeout and top up promotion. We discuss how several friends abused this promo in our article The Not So Bright Brightside $10 Cashback Promotion.

Even right now, there is a Landmark promotion for 5x the top-ups for the rest of 2021. This means for any purchase at Landmark you get $4-5 back from Brightside.

Of course, you can imagine how an individual who is thinking outside the box would abuse this promotion. Buy $10 e-gift cards and get $5 back on each one. If you are a movie buff, you now have 50% off movies for the rest of 2021 😉

In-app Features of Brightside Spend

Besides juicy top-ups, Brightside has a small suite of features in their banking app designed to help you be more financially responsible. This includes:

- Buckets: Exactly what they sound like, these are accounts to organize spending and allocate your various budgets.

- Scheduled Savings: You can set up scheduled transfers of money from your bank accounts to any of your Buckets to suit your budget. Transfers can be weekly, bimonthly, or monthly. As an example, if you and your girlfriend have a $500 entertainment budget per month, you could allocate $500 to go to your entertainment bucket on the 1st of each month.

- Savings Roundups: This will round up your transactions on either your Brightside card or your bank account by your choice of $1, $2, or $5 and put them in a savings bucket (or another bucket of your choice). The rounded amounts are calculated and deposited once per week.

How Does Brightside Compare to Other Reloadable Prepaid Cards?

Brightside is a very niche card, but for Albertans it is actually quite competitive with other leading prepaids such as Stack, Revolut, and Koho. Like Koho, it has 0.5% cashback. Like Stack and Revolut, it has no foreign transaction fees. Couple this with local frequent (and small denomination) purchases at Brightside partners and one could argue Brightside is one of the best value propositions for a prepaid spending card in Canada.

|  |  |

|

|---|---|---|---|

| Card | Revolut (Standard/free) | Koho (Standard/free) | Mogo |

| Network | Visa | Visa | Visa |

| Partner Bank | Bank of Lithuania | People's Trust | People's Trust |

| Exchange Rate | Interbank rate (Visa) | Interbank rate (Visa) | Interbank rate (Visa) |

| Currency Exchange Maximum | $8,000 per month, then 0.5% fee | n/a | n/a |

| Foreign Transaction Fee | 0.0% (1.0% for THB, RUB and UAH) | 1.5% | 2.5% |

| Load Methods | Visa Debit, Credit Card (usually codes as cash advance) | e-Transfer, Direct Deposit (payroll), EFT | e-Transfer, Visa Debit, Canada Post |

| Credit Check | Soft | Soft | Soft |

| ATM Withdrawal Fee | $0 | $2-3 (1 free exchange with *premium) | $1.50 domestic, $3.00 international |

| ATM Withdrawal Limits ($CAD) | $400 per month, then 2% fee | $300 per withdraw, $600 per day, $3000 per month | $500 per day |

| Cashback Rate | 0% | 0.5% | |

| Automatic Savings | Yes (Vaults-roundups, savings goals, recurring payments) | Yes (roundups and saving goals, full savings account coming) | No |

| Rewards Program | No | Yes | No |

| Rewards Partnerships | n/a | Altitude Sports, Chef's Plate, Frank and Oak, Greenhouse Juice, Indigo, JJ Bean, Mary Brown's, Pizza Pizza, Pizza 73, Public Mobile, Sunwing, Well.ca | n/a |

Of note, ATM withdrawal in Canada may be a less attractive option with Brightside, which only offers free withdrawals at ATB Financial ABMs. However, like Stack, Brightside doesn’t impose any ATM withdrawal fees abroad (although other banks may impose fees on you). If you’re curious about strategies for that topic, check out our post on Foreign Currency for Travel Abroad.

Frequently Asked Questions

No.

At ATB Financial ABMs, there are no withdrawal fees. Otherwise, Brightside charges no ATM fees but other banks may charge their own fee.

Every Friday.

Yes. Sort of. You can pay any bills that accept Mastercard. You can also set up direct deposit or pre-authorized PAD to come from your Brightside buckets. You cannot however make direct bill payments from the Brightside app.

Yes, according to Brightside’s about page: “All funds deposited at Brightside are covered by ATB’s Deposit Guarantee through the Government of Alberta.”

Check out the detailed support page on hibrightside.ca.

Reed Sutton

Latest posts by Reed Sutton (see all)

- Earn Cash Back Rebates on National Bank Credit Cards - Jun 29, 2025

- Review: Starlux Airlines Premium Economy (A350-900) - Jun 23, 2025

- Review: Hotel Proverbs Taipei, a Member of Design Hotels - Jun 18, 2025

- Review: ZIPAIR “Full Flat” Business Class (787-8) - Jun 4, 2025

- Booked: Morocco & Portugal 2025 - May 18, 2025

I have been a brightside user since the start and am sad that it is ending.

I am looking for something else with “buckets” as I use it to organize my money a lot. Any suggestions on what would be best?

Doesn’t neccessarily have to be digital. I saw PC has a goal savings similar to Koho. I just need something I can move money into and out of often (I use this a lot to organize my bills / keep the money out of my main account).

Any thoughts?

Thanks for the article, brightside definitely had a bright moment in its history… Note on your comparison chart, mogo hasn’t been 2% cashback (btc) in a while, but you get 2% tree planted or some bs now…? Not that that stops them from spamming your inbox with their in house btc insights…

Thanks Gregory, just fixed that. Yes I and many others were quite sad when Mogo axed their 2% bitcoin cashback. The tree planting isn’t quite the same incentive…