The hotel credit card market is very sparse in Canada, and as a result, Canadians may find it very difficult to accrue a meaningful amount of hotel points and hotel status, compared to their American counterparts.

However, there is a beacon of light: American Express Canada offers two co-branded Marriott Bonvoy credit cards. These cards are two of the best hotel credit cards in Canada and are a great way to accrue Marriott Bonvoy points, work towards elite status, and enjoy a few Marriott-specific benefits.

Let’s dive into our American Express Marriott Bonvoy card review.

Overview

Welcome Bonus

The American Express Marriott Bonvoy card currently has a welcome offer in which cardholders can earn up to 110,000 Marriott Bonvoy points:

- Earn 65,000 Marriott Bonvoy points upon spending $3,000 in the first 3 months

- Earn an additional 30,000 points upon spending a total of $20,000 within the first 12 months

- Plus, earn 15,000 points when you make a purchase between 15 and 17 months of cardmembership

The Marriott Bonvoy American Express card offers benefits that include an annual Marriott Bonvoy free night certificate and 15 elite qualifying nights towards Marriott Bonvoy elite status.

Check out our American Express Marriott Bonvoy card review for more details.

110,000 Marriott Bonvoy

$20,000

$990+

$120

Yes

Aug 18, 2025

This offer does not have an expiry date.

Earning Rates

The earning structure on the American Express Marriott Bonvoy card is very straightforward. Cardholders can expect to earn Marriott Bonvoy points on all eligible card purchases:

- 5 Marriott Bonvoy points for every dollar spent on purchases at Marriott properties and at Marriott branded online stores (including spend on Marriott gift cards).

- 2 Marriott Bonvoy points for every dollar spent on all other purchases.

As expected, you can expect the greatest return on your spending when using the card at Marriott properties. Earning 5 Marriott Bonvoy points per dollar works out to a rough 4.5% return on all spending at Marriott properties, considering we value Bonvoy points at around 0.9 cents per point.

While the 2 Marriott Bonvoy points per dollar spent on all other purchases are nothing to scoff at (roughly a 1.8% rate of return), it would be worth considering other credit cards that earn multipliers at various categories of retailers, such as restaurants and grocery stores, to maximize your earnings.

Annual Fee

The American Express Marriott Bonvoy credit card has an annual fee of $120. As we will touch on below, it is very easy to receive more than the annual fee in value from this card in a calendar year, making it a strong card to keep year after year in your wallet.

Benefits

The American Express Marriott Bonvoy card comes with some strong Marriott-related benefits, in addition to insurance coverage.

Annual Free Night Certificate

The biggest benefit of the American Express Marriott Bonvoy card is that the cardholder will receive an annual free night certificate to be used at Marriott hotels, worth 35,000 Marriott Bonvoy points.

This free night certificate is issued on the cardholder’s anniversary. This means it is not part of the welcome bonus, and a new cardholder will have to wait until their first year anniversary of card membership to receive their first free night certificate.

Considering the credit card has an annual fee of $120, provided you can use your free night for a hotel stay that would cost you more than $120, you are profiting from holding this card year after year.

Additionally, you can top up your Marriott free night certificate with up to an additional 15,000 Marriott points if the redemption you are looking to make is more expensive. This gives added flexibility to the free night certificates and makes them much more useful.

There are many hotels, some more optimal than others, to consider redeeming your free night certificate at; see our article on the 18 best hotels in North America to redeem your Marriott Bonvoy free certificate for more details.

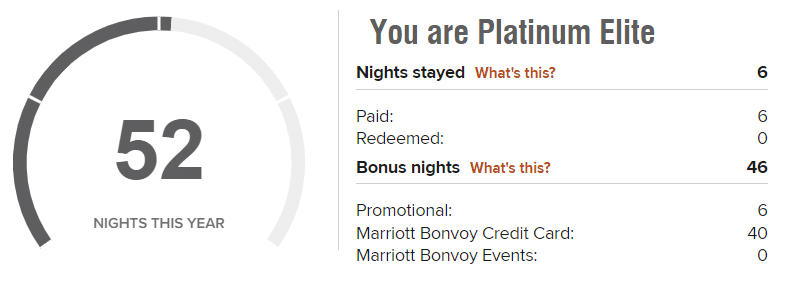

Annual 15 Elite Night Qualifying Night Credits

Those who hold the Marriott Bonvoy American Express card will earn 15 elite qualifying night credits each calendar year to work towards elite status. These elite qualifying night credits will be granted upon being approved for the American Express Marriott Bonvoy credit card, and at the start of every new year for as long as the card is held.

These elite qualifying night credits will show up on your Marriott Bonvoy account as “Marriott Bonvoy Credit Card” bonus nights.

While the Marriott Bonvoy program has many levels of status, the one worth shooting for is Platinum Elite status. You can expect complimentary breakfast for yourself and a guest, room upgrades, Nightly Upgrade Awards, and more at participating Marriott Bonvoy properties.

Needless to say, working towards and earning platinum is well worth it if you have any plans to stay at Marriott properties in the near future. Consider getting yourself on the fast track to Marriott Bonvoy Platinum Elite status today.

Insurance Coverage

The American Express Marriott Bonvoy Personal credit card provides cardholders with eight types of insurance coverages:

- Flight delay and baggage delay insurance

- Hotel burglary insurance

- Lost or stolen baggage coverage

- Travel accident insurance

- Rental car theft and damage coverage

- Buyer assurance protection

- Purchase protection

Refer to the American Express Marriott Bonvoy Personal insurance certificate for additional details, including terms and conditions for eligibility.

Note that while the card does provide some travel-related insurance coverage, many of them are not applicable if you do not charge the full fare cost of the booking to the card. This means that the insurance will not apply to flight award bookings for example, since you cannot charge the full fare to the credit card.

Redeeming Marriott Bonvoy Points

The best use for Marriott Bonvoy points is to redeem them for hotel stays. Since Marriott has such a worldwide portfolio, it absolutely isn’t a challenge to find hotels to redeem points at on your next vacation. Additionally, the absolute best use is to redeem a hotel stay for five nights at a time on points, since you will only pay for four nights and receive the fifth night free.

Alternatively, you can also transfer Marriott Bonvoy points to various frequent flyer programs and airline partners if you are looking to top up your balances. Points can be transferred at a rate of 60,000 Marriott Bonvoy points to 25,000 points of the frequent flyer program of your choice.

Click to learn more about the Marriott Bonvoy loyalty program and how you can best redeem your points. Members can also combine their Marriott Bonvoy points with another person to get that much closer to their next redemption.

Comparable Credit Cards

Unfortunately, there isn’t much of a market when it comes to credit cards that earn hotel loyalty program points in Canada. However, if you are looking for other cards to supplement your Marriott Bonvoy American Express card, there are a few options that you may consider.

American Express Marriott Bonvoy Business Card

The American Express Marriott Bonvoy Business credit card is the business version of the normal Bonvoy card.

The American Express Marriott Bonvoy Business card offers benefits that include an annual Marriott Bonvoy free night certificate and 15 elite qualifying nights towards Marriott Bonvoy elite status.

130,000 Marriott Bonvoy

$30,000

$1,170+

$150

Yes

Aug 18, 2025

While it has a higher annual fee of $150 CAD, it also offers a great welcome bonus in addition to an annual free night award worth 35,000 Marriott Bonvoy points and 15 elite qualifying nights to work towards Marriott elite status.

If you are looking to rack up the annual free night award certificates for your travels to Marriott hotels, you are eligible to hold both the normal version and business version of the Marriott Bonvoy cards at the same time.

American Express Cobalt Card

While the American Express Cobalt credit card isn’t tied to a hotel loyalty program, there is still immense value in considering this card as an alternative.

The American Express Cobalt card gives cardholders the opportunity to earn 5x Membership Rewards on eligible restaurant, food delivery, and grocery store purchases.

In 2025, we selected this card to receive the award Best Points Credit Card for Grocery Purchases.

Check out our American Express Cobalt card review for more details.

15,000 Membership Rewards

$9,000

$300+

$155.88

Yes

–

This card has a monthly fee of $12.99 CAD ($155.88 per year) and offers stronger earning rates on categories such as food and drink purchases, including restaurants and grocery stores.

While you do earn Membership Rewards points for all purchases, these can be transferred at a rate of 5 Membership Rewards points to 6 Marriott Bonvoy points. This means that 10,000 Membership Rewards points can be transferred to 12,000 Marriott Bonvoy points if you are looking to top up your hotel point balance for your next redemption.

Conclusion

The American Express Marriott Bonvoy card is the quintessential hotel credit card for every Canadian to have in their wallet. With a strong welcome bonus, coupled with a low annual fee, an annual free night certificate, and 15 elite qualifying night credits to work towards status, this card is absolutely one you will want to keep in your wallet for years to come.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment.

Josh Bandura

Latest posts by Josh Bandura (see all)

- New BMO Credit Card Offers (July 2025) - Jul 7, 2025

- Earn Cash Back Rebates on BMO Credit Cards - Jul 3, 2025

- New Scotiabank Credit Card Offers (July 2025) - Jul 2, 2025

- Best Credit Cards in Canada (July 2025) - Jul 1, 2025

- Definitive Guide: CIBC Aventura Airline Rewards Chart - Jun 30, 2025