The Chase Sapphire Preferred, affectionately nicknamed the CSP, is a staple among Points and Miles collectors south of the border. Even people who don’t know what a transfer partner is, know this is a card you apply for if you want travel rewards. The CSP has an easy redeeming strategy for a basic points user but also sits at the top of the food chain for 5/24 counts and is an integral part of an advanced points strategy.

Below I’ll cover the ins and outs of this very rewarding card and why a savvy Canadian Points and Miles enthusiast should invest in an ITIN.

One note of caution before rushing to apply. Chase does like to see at least one year of US credit history before approving applicants for their products (however this can be subverted by applying in branch and/or having a Chase bank account).

Overview

Welcome Bonus

The Chase Sapphire Preferred card currently has a welcome bonus in which new cardholders can earn up to 75,000 Ultimate Rewards points:

- Earn 75,000 Ultimate Rewards upon spending $5,000 in the first 3 months

The Chase Sapphire Preferred card is an incredibly valuable US credit card that earns Ultimate Rewards points which can be transferred to numerous frequent flyer and hotel loyalty programs.

Check out our Chase Sapphire Preferred card review for more details.

75,000 Ultimate Rewards

$5,000

$1,275+

$95

No

–

Valuing the standard offer of 60,000 bonus points, at a minimum, you’ll have a welcome bonus worth $750 if redeemed at 1.25 cents per point through the Chase travel portal. If redeemed at a higher value through transfer partners, on average, the value is 2 cents per point, or $1,200.

Earning Rates

The earning rates are not fantastic on this card, but it’s OK for every day while you get your relationship with Chase and your US credit score up and running. There are four different bonus categories for spending which are:

- 5x on travel purchases booked through the Chase Travel Portal

- 3x on dining and specifically online grocery purchases (this excludes Target, Walmart, and warehouse stores)

- 3x on Apple Music, Apple TV, Disney+, ESPN+, Fubo TV, HBO Max, Hulu, Netflix, Pandora, Paramount+, Peacock, Showtime, SiriusXM, Sling, Spotify, YouTube Premium, YouTube TV and Vudu

- 2x on travel

- 1x on everything else

Chase offers an interesting incentive on the CSP: a 10% points anniversary bonus. For example, if you spend $10,000 on the card in the first year, you’ll receive 1,000 UR points for your trouble. Not a huge reward, but an effective $20 in value to shave off the annual fee is better than nothing!

Annual Fee

The Chase Sapphire Preferred has an annual fee of $95 USD. This is relatively easy to justify for the host of travel rewards and benefits the card offers, not to mention the CSP unlocks the ability to turn cashback from the Chase Freedom lineup of cards into much more valuable UR points.

Benefits

No Foreign Transaction Fees

We at Frugal Flyer avoid foreign transaction fees like the plague and getting your ITIN to apply for US credit cards is the best way to do that, as a large majority of US credit cards are without these fees. The CSP is an excellent second or third US-issued card to add to your lineup that you can use for purchases around the globe.

Related: Best No Foreign Transaction Fee Credit Cards for Canadians

Unlocking More Points

One of the most significant benefits the CSP affords cardholders is the ability to turn cashback into UR points. Chase also offers Freedom Flex and Freedom Unlimited cards that market themselves as cashback, but those cashback “points” can be transferred to your Sapphire product and then redeemed with partners.

The earning rates on the Freedom Flex are particularly interesting as it offers 5x rotating categories every quarter of the year, up to $1,500 spent. Being a $0 annual fee card (as is the Freedom Unlimited), it’s a great setup to earn 30,000 annual Ultimate Rewards points for only $6,000 USD spent.

Free DashPass

Part of being a card member is a complimentary membership in DoorDash’s premium service, DashPass, until 2025. This allows users to receive free delivery on orders of more than $12 from select restaurants. It’s important to note that this benefit is available only to US-based accounts when in the USA.If the perk of free DashPass interests you, but you’re based in Canada, RBC Avion Infinite cards also offer this perk! Albeit only for 12 months, but it’s better than no perk at all.

Chase Offers

Just like Amex Offers that most readers will be familiar with, Chase has their own offer system. We’ve found them somewhat useful, with about $30 redeemed in Cashback after holding the card for ten months.

Insurance (US Residents)

The Sapphire Preferred has excellent insurance, but just like other cards that are US issued, it’s tough to make a claim and not be a US resident. One thing we take for granted in Canada is Primary Car Rental Insurance on most premium cards. The Sapphire Preferred is one of the few that offers this coverage for US residents on a $95 card.

Below are the rest of the insurance coverages.

- Trip Cancellation / Interruption Insurance: If your trip is canceled or cut short by sickness, severe weather, and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.

- Trip Delay Reimbursement: If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

- Travel Accident Insurance: When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $500,000.

- Lost Luggage Insurance: If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

- Baggage Delay Insurance: Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days.

- Travel and Emergency Assistance: If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)

- Auto Rental Collision Damage Waiver: Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most rental cars in the U.S. and abroad.

$50 Hotel Credit

A newer perk that the Sapphire Preferred offers is $50 off a hotel booking once per cardmember year when booked through the Chase Travel Portal. While this credit looks great on the surface, I haven’t found much use for it. Unlike booking through Amex’s Fine Hotels and Resorts program, you won’t earn any hotel loyalty points or credit toward your status.

The only use case I can see this being beneficial is if you’re looking at an independent hotel that also happens to be on the Chase Travel portal, which is a niche situation.

If you can find a great use case for this, let me know in the comments!

Visa Signature

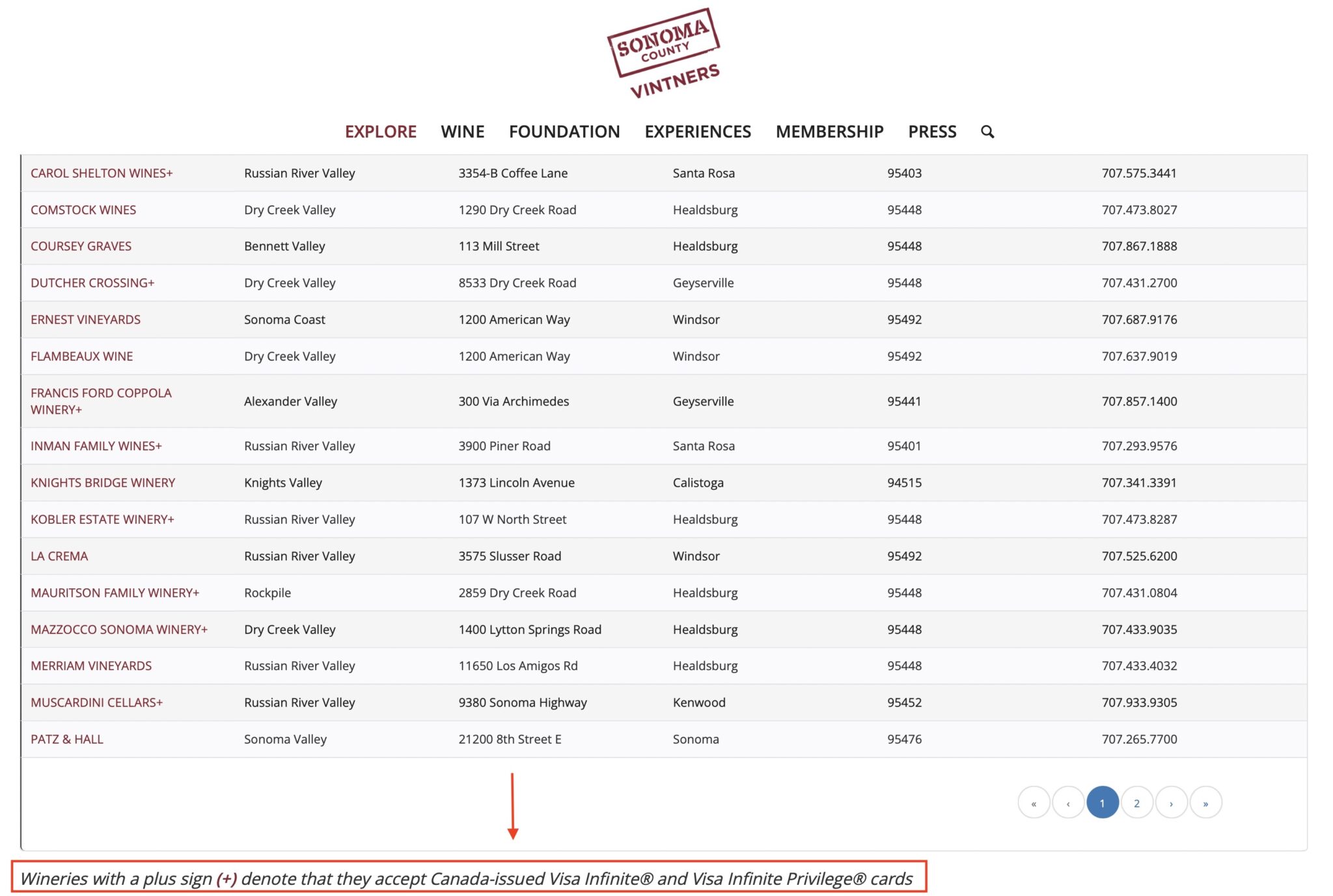

Being a Visa Signature branded product comes with many benefits, like what we see in Canada with the Infinite and Infinite Privilege branding. The benefits of this program include discounts on a Skillshare membership, discounted grocery delivery with Shipt, access to the Visa Signature Hotel Collection and Sonoma Wine County perks.

In my research, I discovered that Canadians can access the Sonoma Wine County perks with Infinite and Infinite Privilege cards at select wineries!

Lastly, being a cardholder also entitles access to the Visa Signature Concierge Service. There’s not much specific information about what the concierge can assist with, but I would assume the regular tasks of restaurant reservations, concert tickets and general trip planning.

Redeeming Chase Ultimate Rewards Points

I touched on redeeming Chase Ultimate Rewards points earlier in the article, and like any good flexible points currency, several avenues are available. The most lucrative option is transferring out to airline and hotel partners’ programs.

Chase has a unique place in the rewards ecosystem as it is one of the only transfer partners of Hyatt Hotels. World of Hyatt still uses an award chart (unlike Marriott and Hilton), so it creates consistent value without cherry-picking redemptions.

I have only redeemed our UR points with Hyatt, each time receiving over 2 cents per point in value without trying very hard. Other airline and hotel transfer partners for Chase include:

Airlines

- Aer Lingus

- Aeroplan

- British Airways

- Emirates

- Flying Blue KLM

- Jet Blue

- Singapore Airlines KrisFlyer

- Southwest

- United

- Virgin Atlantic

Hotels

- IHG

- Marriott

- Hyatt

Chase also offers the ability to redeem in their portal at 1.25 cents per point. While that is a decent value for the points and more generous than Amex’s 1 cent per point, booking through a portal can cause some issues.

When booking through a travel portal, you’re essentially using an online travel agency to book for you. This can get messy if there are flight delays, reservation mix-ups, etc., as the hotel or airline will always refer you back to the entity that made the reservation rather than fixing the problem themselves.

The advisable way to use rewards points is to utilize transfer partners and look for sweet spots within that partner’s award system.

Comparable Cards to the Chase Sapphire Preferred Card

Two main competitors to the Chase Sapphire Preferred are the Citi Premier and Capital One Venture Rewards cards.

| Chase Sapphire Preferred Visa Card | Capital One Venture Rewards Card | Citi Premier Mastercard | |

|---|---|---|---|

| Earn Rate | 5x on travel purchases booked through the Chase travel portal 3x on dining, online grocery, streaming 2x on travel | 5x on Hotels and Car rental booked through Capital One Travel 2x on everything else | 3x on grocery, gas, air and hotel travel purchases, dining |

| Welcome Bonusand Spend Requirement |

|

|

|

| Annual Fee | $95 | $95 | $95 |

| Net Points Value | $1,180 | $1,293 | $1,105 |

| Hotel Credit | $50 | $0 | $100 |

| Airport Lounge Access | None | 2 Visits | None |

| Foreign Transaction Fees | No | No | No |

Citi Premier Mastercard

The card most like the CSP is the Citi Premier card. The Citi Premier card offers better multipliers on spending categories, awarding 3x on Travel, Gas Station, Grocery, and Dining, all without any cap on points earned. However, it lacks insurance coverage and notably does not offer any travel protection. It does offer no foreign transaction fees.

Also, like the Sapphire products, you can convert your Citi Cash back from the DoubleCash and CustomCash into ThankYou Points, which can be transferred to travel partners. Citi has some unique transfer partners like Turkish Airlines and Wyndham Rewards.

The Citi Premier card also offers a hotel credit, double that of the CSP at $100, it’s only eligible on bookings of $500 or more made through the ThankYou portal. I would say this hotel credit is just as hard, if not harder, to use than the one offered by Chase, thanks to the $500 requirement. If I spend $500 on a hotel stay, I want some points and elite nights!

The Citi Strata Premier Card earns ThankYou points and is available to individuals in the United States.

This card earns 3 ThankYou Points per dollar spent on travel purchases and offers an annual $100 hotel credit for travel booked through Citi.

60,000 ThankYou Points

$4,000

$1,200+

$95

No

–

Capital One Venture Rewards Card

The Capital One Venture Rewards card currently offers the biggest sign-up bonus at 75,000 points and offers similar insurance benefits to the CSP. However, unlike the Citi Premier card, it doesn’t have an ecosystem that allows it to have extra earning rates with other cards.

The multipliers are good for uncategorized spending at 2x on everything. However, it has no meaningful multipliers other than 5x on hotels and car rentals through the Capital One travel portal.

To its credit, this is the only card on this list that includes complimentary access to airport lounges, granting two visits to a Capital One or Plaza Premium lounge per cardmember year.

Capital One also has access to unique transfer partners in FinnAir, Turkish Airlines and Wyndham rewards.

The Capital One Venture Rewards Card earns 5 Capital One Miles on all hotel and car rentals booked through Capital One Travel and offers a $50 USD credit when booking a stay through the Lifestyle Collection Hotels & Resorts program.

75,000 Capital One Miles

$4,000

$1,388+

$95

No

–

Conclusion

The Chase Sapphire Preferred is a staple in the US Points and Miles game for good reason. The ability to offset the annual fee with Chase Offers and Hotel Credit (if you can use it) make the card a reliable way to access one of the last great hotel programs, Hyatt.

While competitors exist, the Sapphire Preferred is the clear winner by having the best transfer partners, insurance, and eco-system for generating points.

Daniel Burkett

Latest posts by Daniel Burkett (see all)

- Review: Orlando World Center Marriott - Jul 2, 2025

- The Tech You Need for Travel Days - May 26, 2025

- Review: Los Angeles Airport Marriott - May 21, 2025

- How to Avoid Fees When Converting CAD to USD - May 19, 2025

- Review: American Airlines Flagship Business Class (A321) - Apr 16, 2025

Does the points multiplier work for use in Canada or just in the US?

Yes it works in Canada as well.