Whether you’re getting into your first American Express (US) card stateside, or are a Canadian who’s meticulously followed our US credit card guide to becoming a certified American credit card enjoyer, it can be a bit hard to navigate all of the American Express (US) rules that can impact new credit card applications and welcome bonus eligibility.

Today, let’s demystify some of their rules so that you can enjoy the best of everything that American Express (US) has to offer.

The Intricacies of Applying for American Express (US) Cards

Applying for American Express cards in the United States is a bit less straightforward than it often is in Canada.

In Canada, all we need to do to apply for a card is go through the online process and receive the yay or nay from Amex’s computer system.

While there have been recent reports of some hesitance on the part of the company to issue cards to customers with too many credit lines or too many past American Express products, generally it’s not hard to get a new card provided your credit score and credit report is good. Approval is usually followed by a welcome bonus once meeting the bonus requirements, provided you haven’t held that credit card product before.

In the United States, there are far more rules that you need to remember when applying for American Express (US) cards to ensure you remain eligible for approval and eligible for the welcome bonus.

Before we jump into the rules, it is important to note the difference between credit cards and charge cards, as different rules will apply to each category of cards. In the below list, we will identify if the rule applies only to credit cards or charge cards. If not mentioned, the rule applies to both types of cards.

Credit cards come with a set revolving credit limit provided by American Express, and only require a minimum payment to be paid upon the statement being cut (but you should be paying off your full balance every statement).

Charge cards, however, have no theoretical maximum limit, although if Amex gets antsy about your balance or purchase sizes they will let you know in very short order. Charge cards must also be paid in full by the due date on your statement, as minimum payments aren’t a thing on these products.

Charge cards also tend to round out Amex’s stable of premium offerings denominated in Membership Rewards points, with products such as the American Express Platinum card (US) and the American Express Business Gold card (US), the latter of which is now available in lovely white gold.

Regardless, it’s a bit more complicated to get Amex products in the United States, and running afoul of the following rules could result in your application being declined or not eligible for a welcome bonus. Just remember cardholders who mostly play nice with the rules often go well-rewarded.

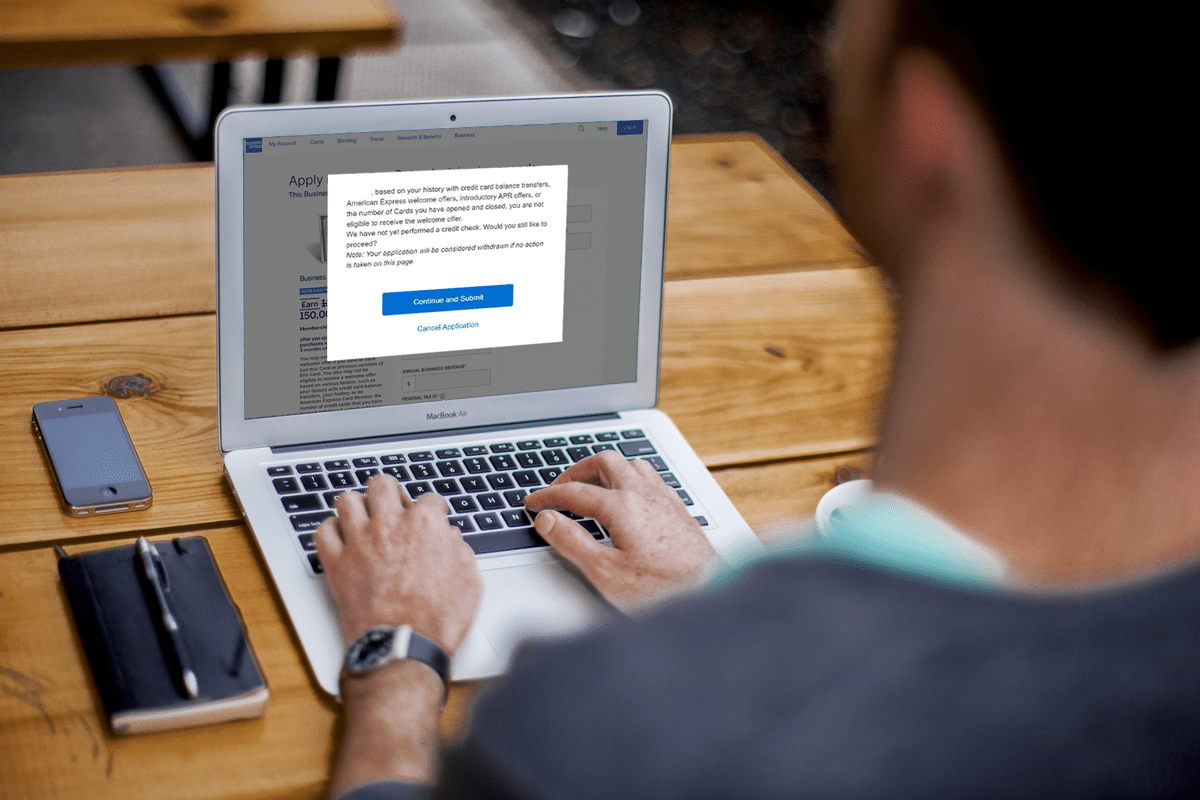

The American Express (US) Pop-Up Window

While not a hard and fast rule that can clearly be articulated in the list below, the American Express (US) pop-up window is worth mentioning. Ultimately, if you don’t use your existing American Express (US) credit cards enough for day-to-day transactions or they suspect you of trying to run through welcome bonuses, you may run into the dreaded American Express (US) pop-up window.

“Popup jail” as it is colloquially known consists of you not being able to receive a bonus on any number of American Express (US) cards that you’re trying to apply for. Worse yet, American Express (US) won’t tell you how to put yourself back into good standing.

One of the only sure ways to avoid this popup is to apply for a card whose welcome bonus specifically stipulates having no lifetime conditions, but this requires the legwork of doing your own research to find appropriate links that offer these conditions. These bonuses aren’t always as good as the public offers, either.

Rules to Remember For American Express (US) Cards

1/5 or 1 Credit Card in 5 Days

The 1/5 rule is American Express (US) policy that you can only be approved for one credit card every 5 days, unlike in Canada where same-day applications for multiple credit cards are accepted. This only specifically applies to credit cards and not to charge cards.

Since the 1/5 rule doesn’t affect charge cards, you can apply for one credit card and any number of charge cards on the same day without issue. If you want the welcome bonuses you’ll need to meet the minimum spend requirements, so don’t apply for more cards than your budget can handle.

American Express (US) is notoriously unsympathetic to people who miss minimum spending requirement (or payment) deadlines, so don’t expect any grace if you over-commit and can’t meet the minimum spending requirement in time.

2/90 or 2 Credit Cards in 90 Days

The 2/90 rule once again is only enforced against credit cards, and it is a hard rule whereby you can only get 2 new credit cards approved in any 90-day period.

On the other hand, you can be approved for as many charge cards as you wish within 90 days. However, applying for more than one charge card in a single 90-day period may trigger a manual review that requires you to call in to clear up any confusion.

Don’t forget that any non-business credit accounts will count against Chase’s 5/24 rule, should you be interested in products from Chase Bank down the line.

1/90 or 1 of the Same Card Per 90 Days

While this is the most likely the least impactful rule on the list for the majority of cardholders, American Express (US) will only approve a cardholder once in 90 days for the same card.

For example, if I apply for and am approved for an American Express Hilton Honors Surpass card (US), I cannot be approved for another Surpass card until 90 days have passed. While this won’t be applicable for many individuals, if you are looking into no lifetime language links, it can inadvertently come into play.

The 5 Credit Card Limit

One of the toughest issues for your American Express (US) strategy is the 5 credit card hard limit.

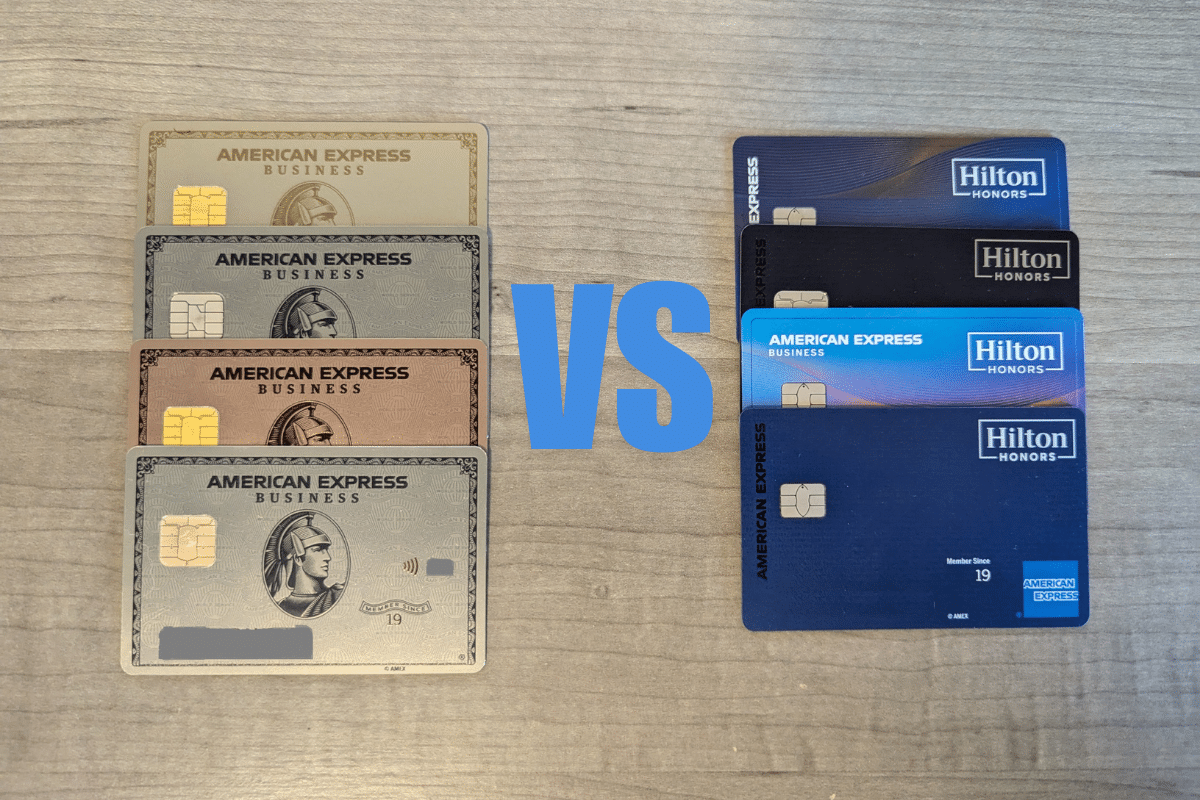

This limit is imposed only on credit cards, which is unfortunate as many of American Express’ best offerings, such as their Hilton family of co-branded cards, Delta SkyMiles cards, and Marriott Bonvoy products are all counted as credit cards.

In fact, the only charge cards that Amex issues in the United States are denominated in their in-house currency of Membership Rewards. Here in Canada, we still have the basic American Express Aeroplan card as the last of a dying breed of third-party points currency charge cards.

What this means is that if you want a credit card that can earn points such as Delta Sky Miles, or Hilton Honors points, both of which are very hard to come by in Canada, you’ll need to “sacrifice” one of your credit card slots.

Two particularly notorious examples are the co-branded Marriott and Hilton credit cards, as they each offer a valuable benefit: the Marriott Bonvoy free night certificate and the Hilton Honors free night certificate. Many cardholders often keep around more than one of these cards for their incredible free night award benefits, reducing the amount of credit card slots significantly.

While in Canada the limit is 4 credit cards, there are data points of some cardholders applying for several credit cards on the same day and being approved without issue. As always, your mileage may vary, but due to the 1/5 rule, such a strategy is impossible in the US.

The 10 Charge Card Limit

While this threshold may be hard to cross for the average person, American Express (US) does set a 10 charge card limit.

Most cardholders will most likely not run into this limit as it is very generous. In fact, it may only be an issue for those people with very high spending capacity who may have received targeted offers for multiple business charge cards.

Family Language Restrictions

The United States may be the best credit card market on Earth, but it is one where the issuers are very wise to the proclivities of their customer bases.

American Express (US) family language restrictions can exclude you from receiving multiple bonuses for credit cards that belong to a certain family, but won’t impact you from being approved or taking advantage of the benefits that the card offers.

For example, if you’ve been approved for the American Express Marriott Bonvoy Brilliant card (US), you will encounter the following language when trying to apply for the American Express Marriott Bonvoy Bevy card (US):

You may not be eligible to receive a welcome offer if you have or have had this Card, the Marriott Bonvoy Brilliant® American Express® Card, or previous versions of these Cards.

Essentially, since you already hold a card in that family, you are no longer eligible for a welcome bonus on a card that is considered a lesser version in that family. Brush up on family language restrictions, as applying for new cards in the correct order can make this rule simply not applicable.

Once in a Lifetime Welcome Bonus (For Real)

In Canada, banks often say they will only issue one bonus per lifetime but whether this is enforced or not is issuer-dependent. In the US, though, financial institutions mean it when they say “one bonus per lifetime” as it is often hard-coded into their offers.

American Express is one such issuer, and they have been known to crack down in recent years on cardholders who have received too many welcome bonuses in the past. To avoid this sort of headache continuing in the United States, the company has maintained a strong once-in-a-lifetime bonus structure, though there are reports that sometimes “lifetime” is closer to “seven years” (which is still a long time).

While there are some ways to potentially get around this, such as by reading an offer’s lifetime language super closely, it’s often best to remember one bonus per lifetime is a serious promise from most issuers, especially American Express.

Conclusion

We hope that you’ve found today’s roundup of American Express (US)’s rules to be informative.

While the rules are not as open as those available from Amex on the Canadian side, that doesn’t mean there isn’t room to maximize your travel using US American Express cards. Its portfolio of products remains one of the most competitive on the market, and it’s worth playing by its rules so you never miss a great offer.

Until next time, may your flights and hotels be free.

Kirin Tsang

Latest posts by Kirin Tsang (see all)

- eSIM Services Compared: Save Money on Cellular Data When Traveling - Jun 25, 2025

- The Real Out-of-Pocket Costs of Award Travel - Jun 9, 2025

- Review: W São Paulo - Jun 7, 2025

- What You Need to Know About Merchant Category Codes (MCC) - May 30, 2025

- Canadian Tire Bill Pay: Pay Your Bills & Earn Rewards - May 23, 2025