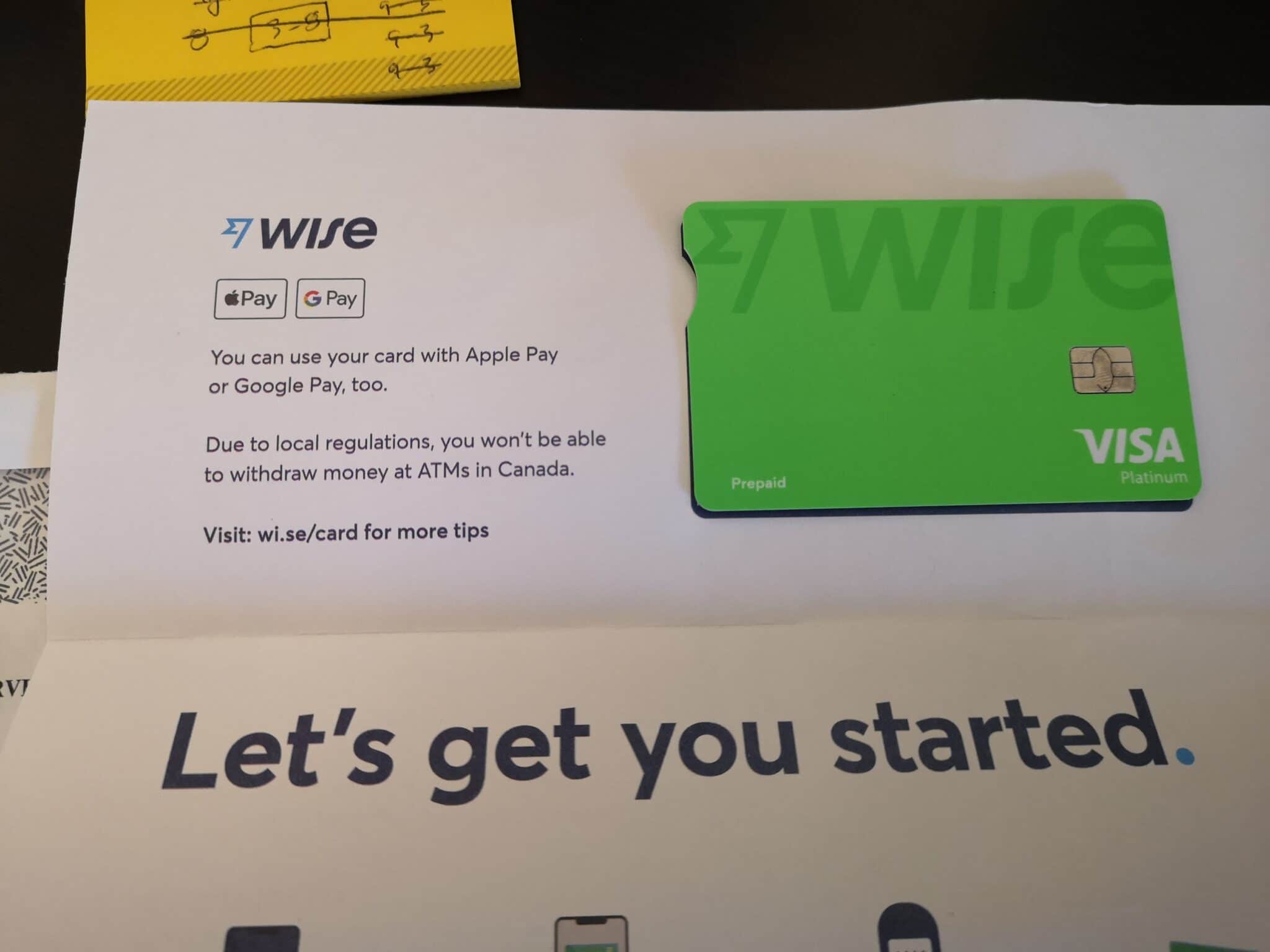

In this article, we will review a brand new (to Canada) prepaid card from a UK company that’s been around for a while: Wise (formerly TransferWise). We’ve previously discussed the use of Wise for cheap international money transfers and currency conversion. Consequently, the Wise card benefits from Wise’s stellar remittance features.

Let’s take a look at the Wise Visa Platinum Prepaid card to see if it is worth adding to your wallet.

What is Wise (formerly TransferWise)?

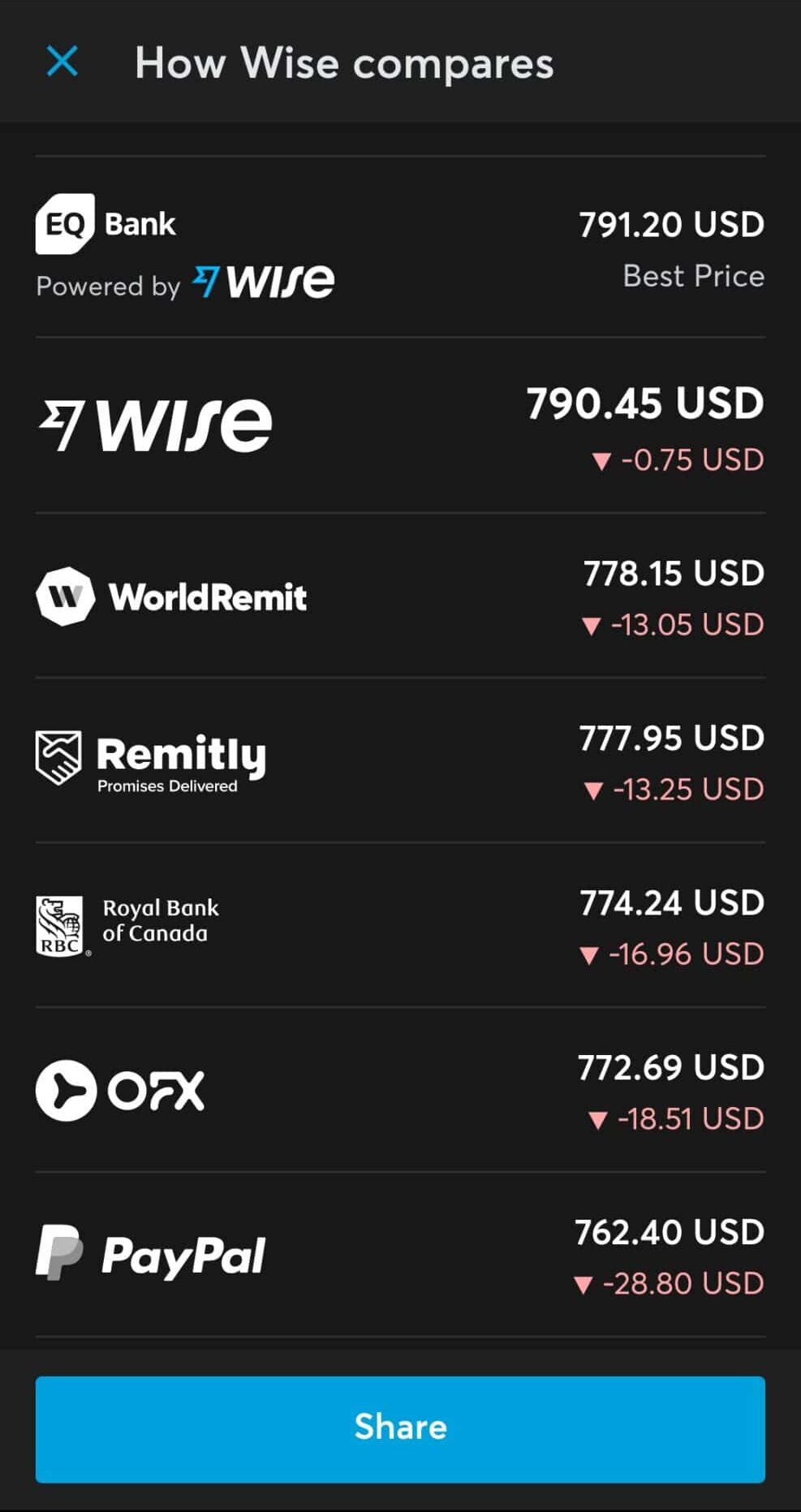

Wise is a multi-currency account, and an international money conversion and transfer service. Wise is actually one of the services we recommend for getting US dollars. It is convenient, fast, and cheap. It does what it claims to do in a refreshingly transparent way.

Wise allows you to hold and convert over 50 international currencies within the Wise app and send money to over 80 different countries. In this regard, it fulfills a similar role to Revolut (R.I.P), a discontinued international transfer app from the UK. And like Revolut, Wise now offers a virtual and physical spending card for the Canadian market…

What is the Wise Card?

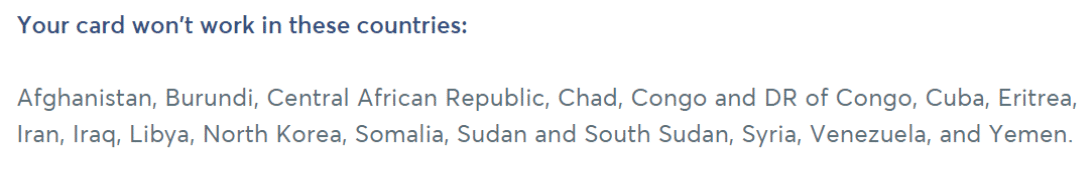

The ‘Wise Card’ is a prepaid debit-like Visa Platinum card. This card was introduced to the Canadian market on November 30, 2021, and can be used almost anywhere that Visa is accepted, worldwide (aside from a small list of excluded countries). The Wise card is considered to be one of the best reloadable prepaid cards in Canada, as it has excellent utility when traveling.

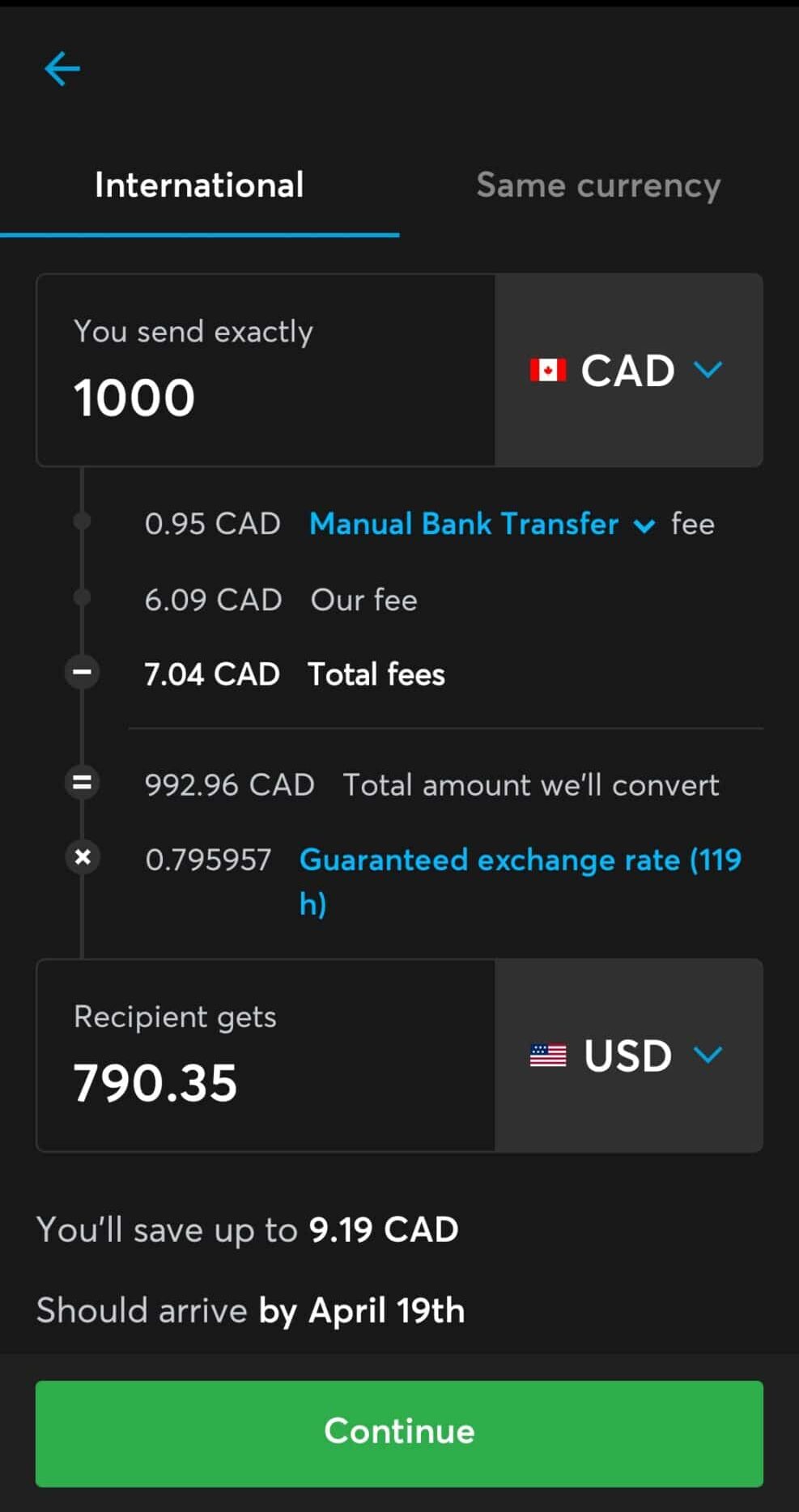

You can use the Wise card to spend directly from your Wise multi-currency account. You can spend directly and automatically from any of your loaded currencies, or you can just load CAD and foreign transactions will automatically be converted using Wise’s conversion service. For this conversion, Wise does charge a small fee, but much lower than the typical 2.5-3% FX charged by many credit cards.

You can also withdraw currency from ATMs when abroad, with no additional fees from Wise for the first two transactions of up to $350 CAD total, per calendar month. You would of course be subject to any service charge from the ATM (usually ~$2-3).

What is the Wise Card Good For?

The Wise multi-currency account along with the Wise card is potentially very useful for frequent travelers, nomads, and anyone who needs to send money internationally in a foreign (non-Canadian) currency. If you relocate a lot or move around a lot, you can receive local currency from employers without having to set up multiple bank accounts or convert at bad rates.

However, the Wise card’s main use case for most of our readership is likely cheap foreign cash via ATM withdrawal. And it’s frankly the only gap it truly fills in the Canadian market. For most international transactions, you’re going to want to use a Canadian or US credit card with no FX fees so that you can earn points on your purchases, something that Wise lacks as a prepaid card. However, should you ever need cash in the local currency, Wise is great because you get up to $350 CAD-equivalent in free ATM withdrawals per month.

An aside: consider using our Canadian credit card comparison tool or US credit card comparison tool to find cards that offer no foreign exchange fees. The US market is far superior in this domain, which is why you’ll want to get an ITIN and apply for your first US American Express card to start building your US credit history.

Features of the Wise Card

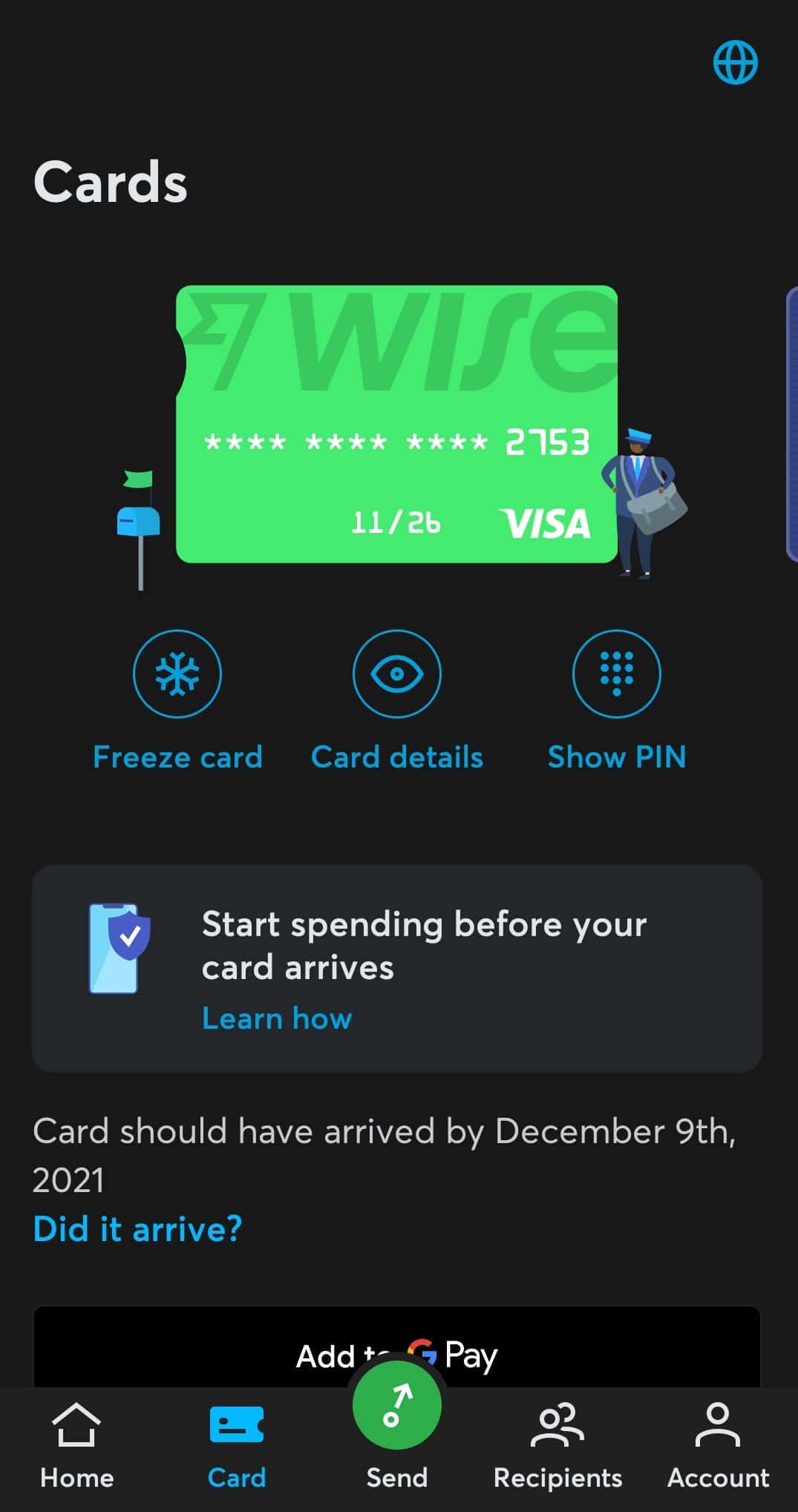

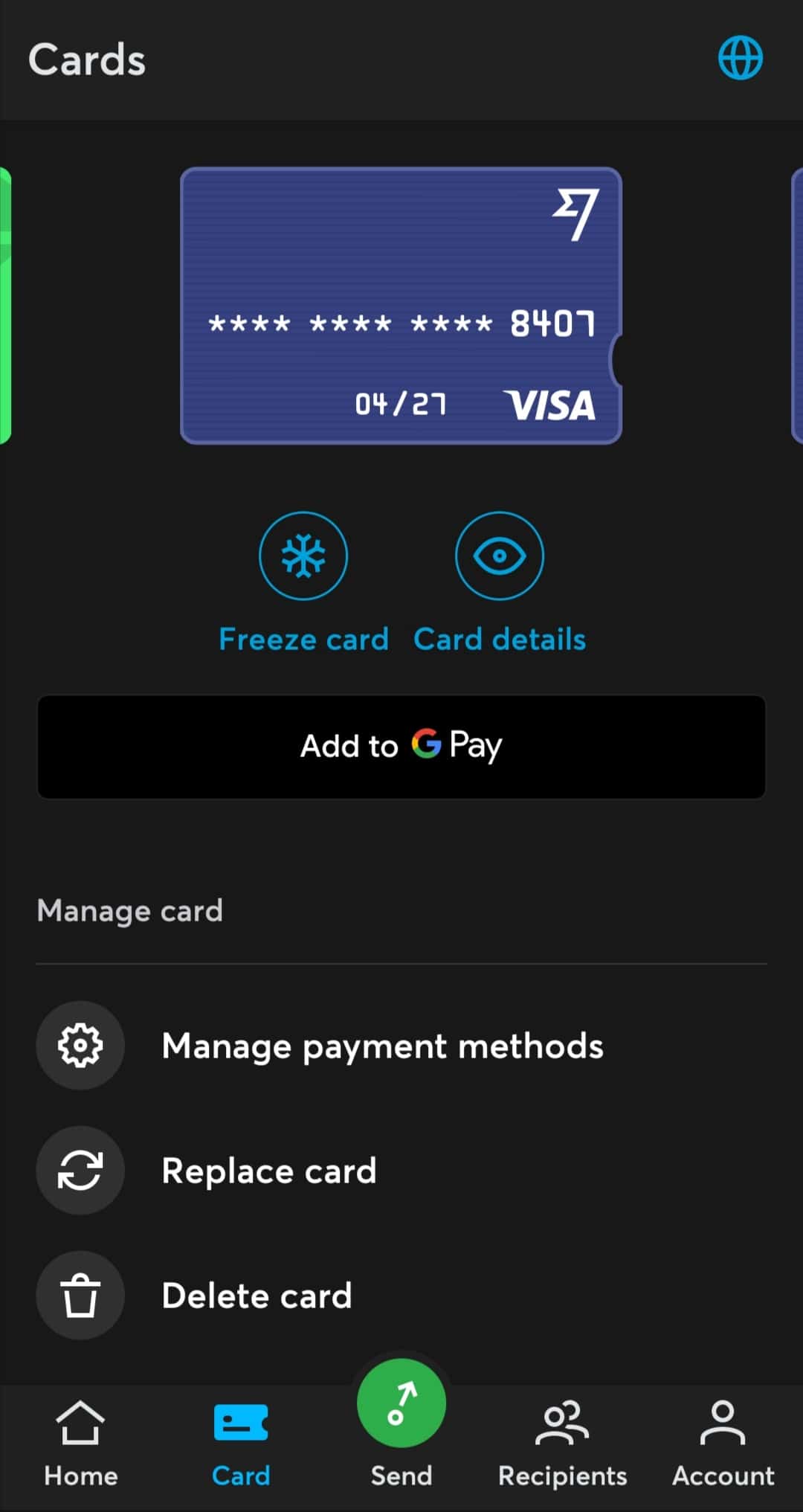

Virtual Wise Card

Even before you receive your physical Wise card, you can access your physical card’s details (such as your card number, PIN, and expiry date) in the Wise app. This means you can start using the Wise card before it arrives, add it to your virtual wallets, Google Pay, and so on.

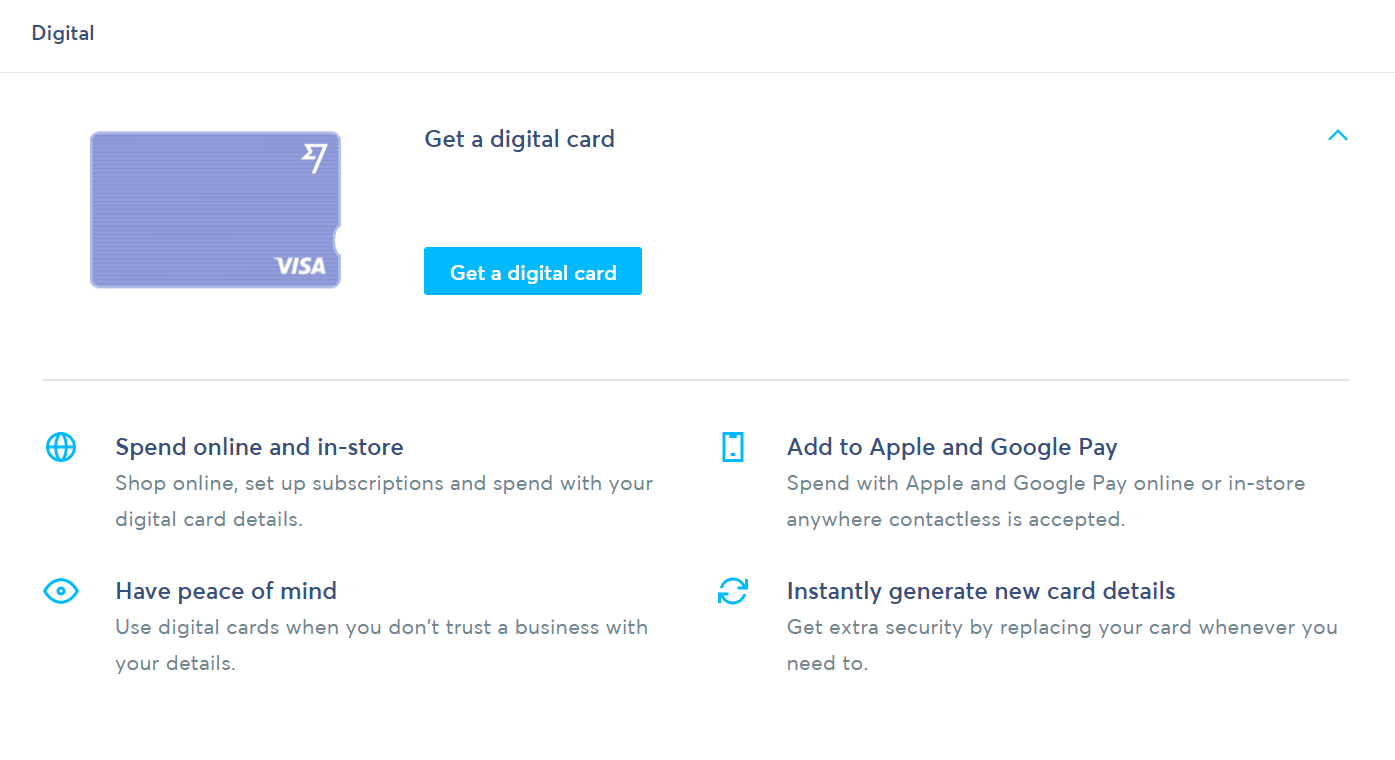

Disposable Virtual Wise Cards

This feature is actually a little harder to find as you must create and access disposable digital cards from the Wise web application.

Once you create them (and you can create multiple to use simultaneously), they will appear in your mobile app. You can then use the card, delete it, or replace it with brand new card details at your discretion.

This is something that’s been available through other fintech apps before but is always appreciated for those of us in the miles and points game, for numerous reasons 😉

ATM Withdrawals

With the Wise card, you are able to enjoy 2 free ATM withdrawals overseas, up to $350 CAD equivalent each calendar month.

After that, you’ll be charged CAD $1.50 per withdrawal and a 1.75% commission.

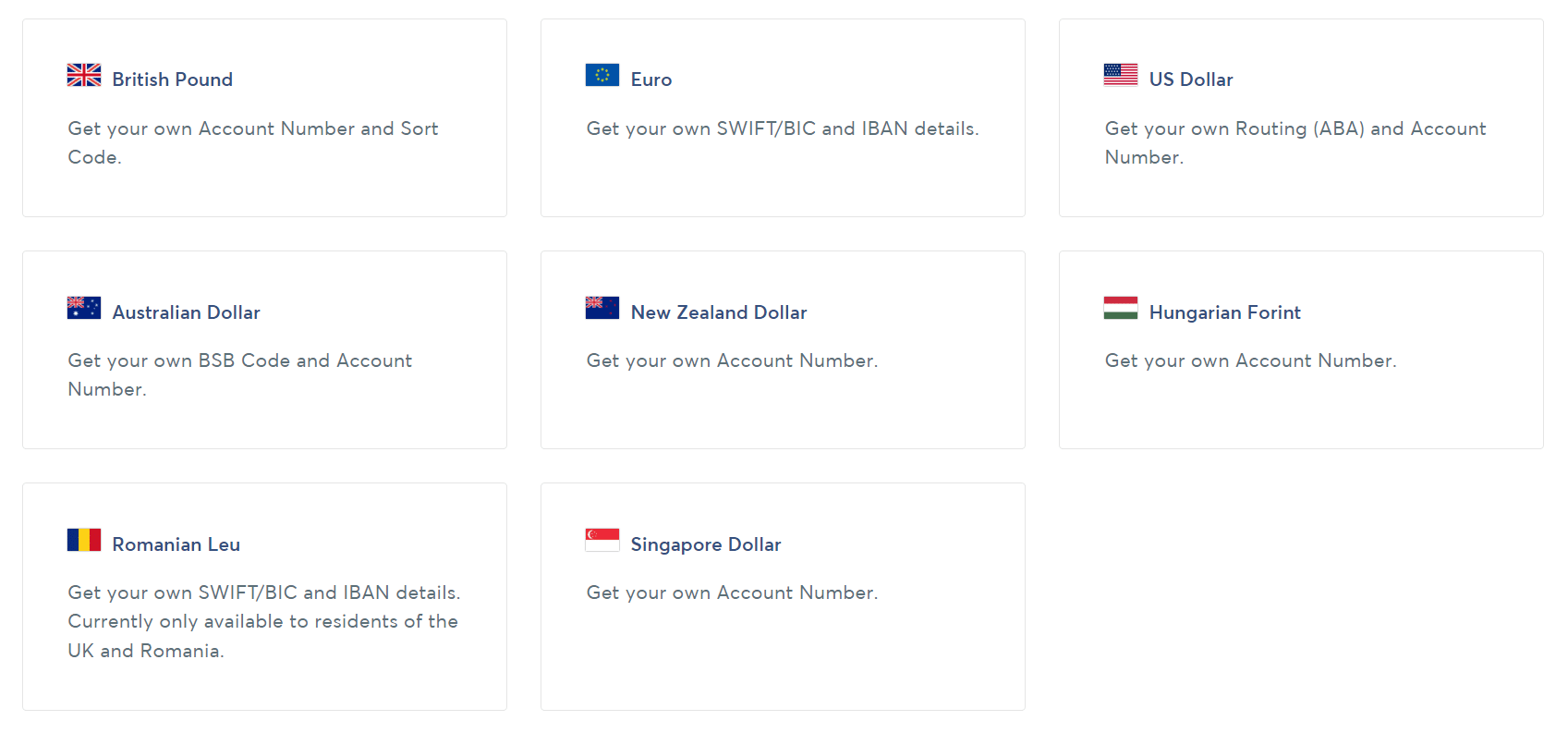

Foreign Currency Deposits

You can get account details set up to receive direct deposits in foreign currency from the US, Canada, UK, Eurozone, Australia, New Zealand, and others.

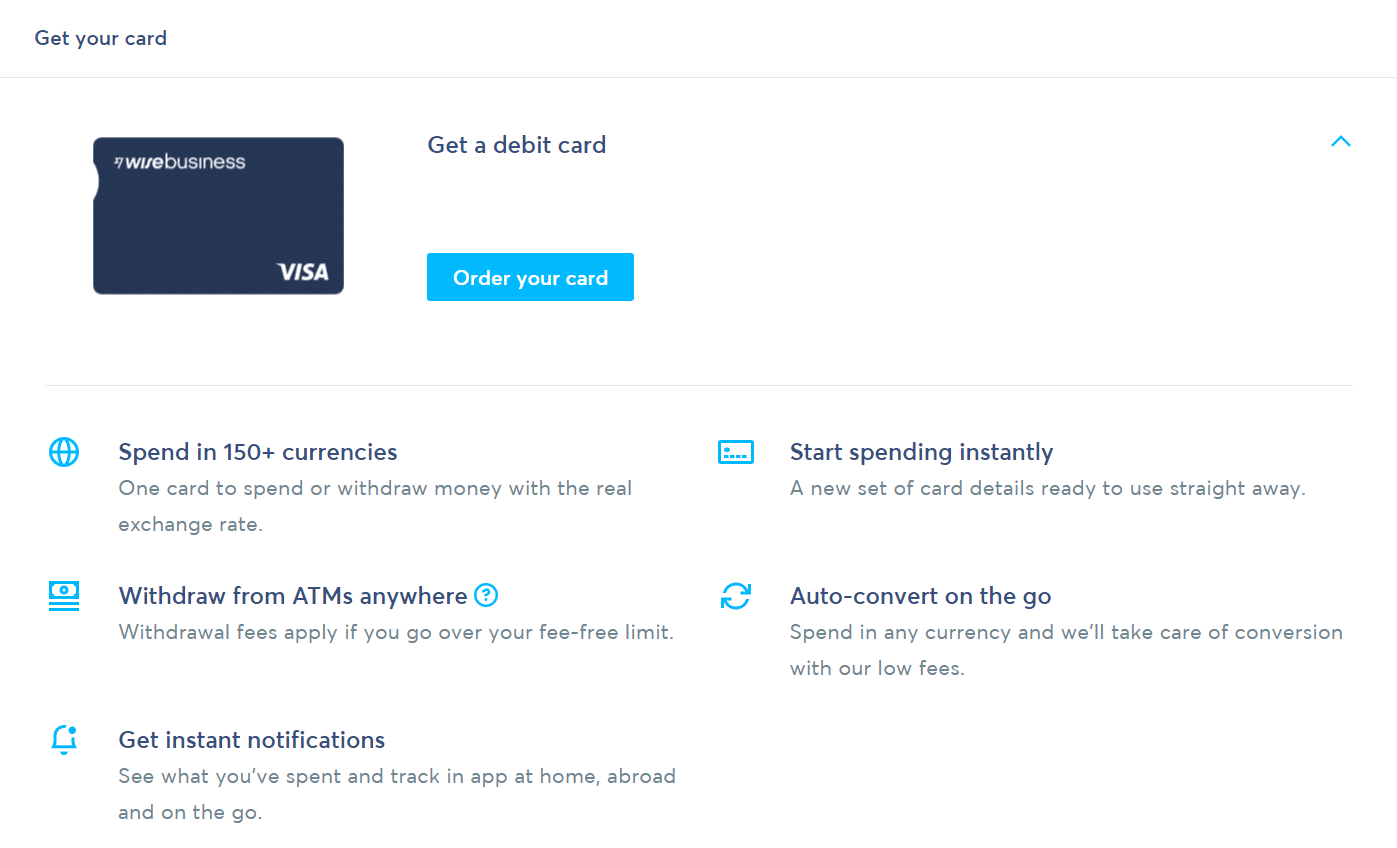

Wise Business Account

If you have a small business, you can have both a personal and business Wise account and a business Wise card. The card functions largely the same as the personal card, however, the business account has some additional features like bill payments, Quickbooks integration, bulk payments tool, and more. Something to keep in mind.

Wise Card Fees and Limits

As mentioned, you can take out money for free from an ATM twice a month — as long as the total amount is under the equivalent of 350 CAD. But after that, Wise will charge the equivalent of 1.50 CAD per transaction as a fixed fee. If you take out over 350 CAD in one month, you’ll also be charged 1.75% on top.

The other obvious fee is for converting currency. This is variable and dependent on the currencies being converted. You can view the Wise fee calculator here.

There are one-time fees for ordering your physical Wise card ($10 CAD), as well as ordering a replacement card ($5 CAD).

Wise also has limits in total transaction amounts for different transaction types as well:

| Limits Per Transaction Type | Single Payment | Daily | Monthly |

|---|---|---|---|

| Chip & PIN | Default: 4,400 Max: 17,000 | Default: 5,500 Max: 17,500 | Default: 17,500 Max: 55,000 |

| ATM withdrawal | Default: 1,750 Max: 1,750 | Default: 2,650 Max: 2,650 | Default: 5,500 Max: 7,000 |

| Contactless | Default: 900 Max: 900 | Default: 900 Max: 1750 | Default: 7,000 Max: 7,000 |

| Magnetic stripe | Default: 550 Max: 2,100 | Default: 700 Max: 2,100 | Default: 2,100 Max:10,500 |

| Online purchase | Default: 1,750 Max: 17,500 | Default: 1,750 Max: 17,500 | Default: 3,500 Max: 55,000 |

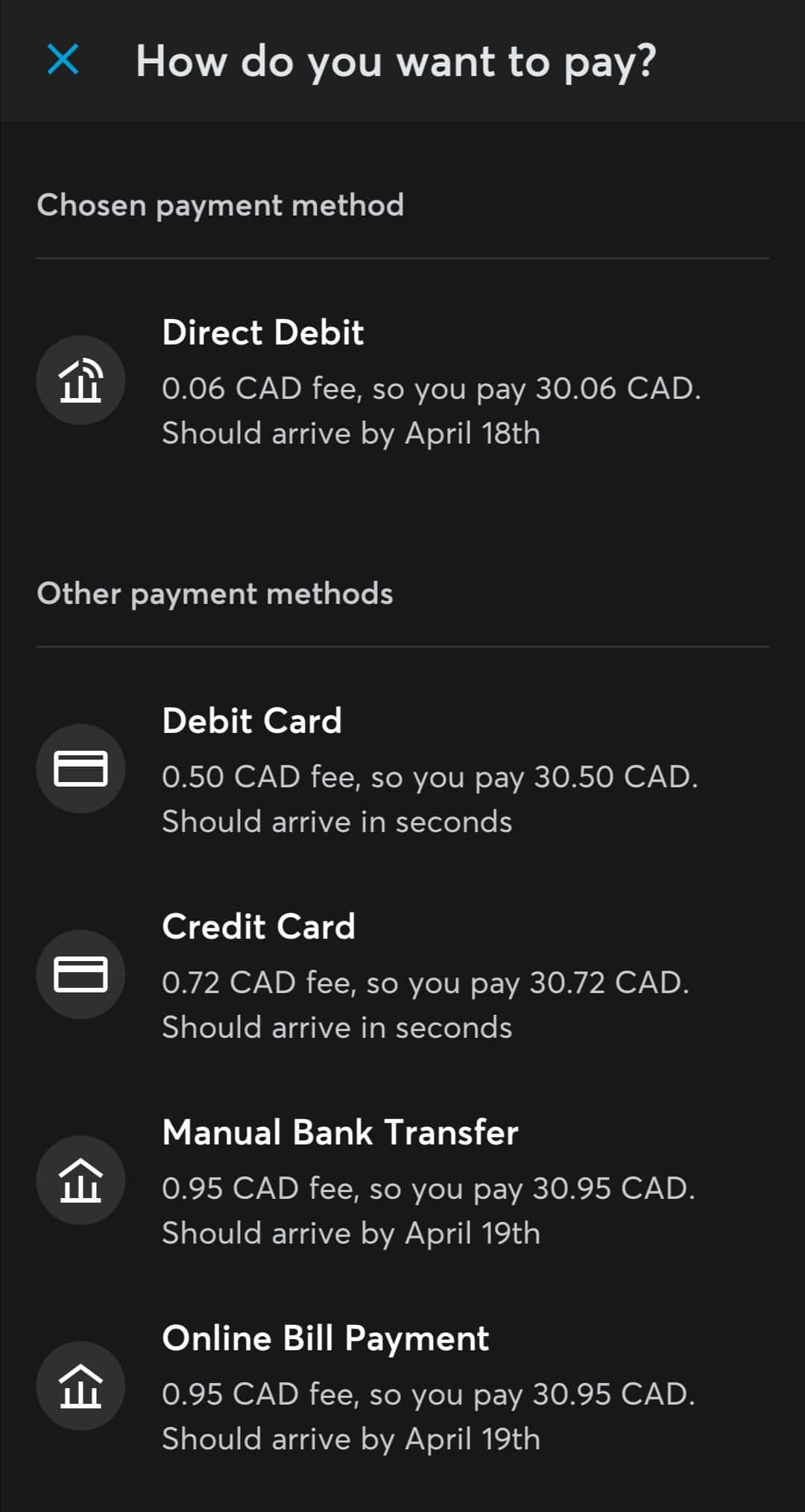

And of course, loading the account with currency can incur fees depending on the funding method. Direct debit is the cheapest. More on that later.

How Do I Get the Wise Card?

To get the Wise card, you will first need to have a Wise account. Then in the mobile or web app, you will see a tab labeled ‘Card’. You will need to enter some personal information and your address.

Before you can use the card, you’ll need to set up a CAD currency account. The first time you fund it, you’ll need to deposit a minimum of $30, and you’ll have to pay a small loading fee. After this, you’ll be asked for further verification (selfie + front and back of driver’s license). Finally, you’ll be given full account details, with which you can use EFT to make future transfers without paying any loading fees.

A bit of a convoluted process, I know… but only for the first load and then you can link Wise as an external account on somewhere like Tangerine, EQ Bank, PC Financial, PayPal, etc and set up EFT from there for future transfers. In fact, when linking the account you’ll probably get the 6 cents back in micro-deposits anyways.

On a side note: apparently, it is quite a task to link Wise to Simplii Financial according to RedFlagDeals – YMMV.

Wise Card Alternatives

There really isn’t much of an alternative to the Wise card anymore as far as foreign currency is concerned. Wise has great rates for conversion and no 2.5% currency conversion fee. Compare that to other prepaid like Stack (now charges 2.5%), the Koho Mastercard (charges 1.5%), or AC Conversion (high spreads between currencies), and it’s no contest.

Perhaps the only true competitor right now to the Wise card is the new Wealthsimple Cash card, which also offers free ATM withdrawals and no forex fees. While Wise has more currency features with its multi-currency accounts, Wealthsimple may edge out slightly given it has no fees for foreign purchases and uses the Visa exchange rate. It also offers much higher limits for ATM withdrawal (up to $500 per transaction, $1000 per day).

Ultimately, it comes down to what specific features you require. I take the approach that it can’t hurt to have both cards, particularly with how fast things can change in the fintech space, as we saw with Stack.

Conclusion

The Wise card is an interesting new prepaid product in Canada, and seems to fill the gap that was abruptly left by Revolut. There is no other product available right now that allows you to load, access, and convert between as many foreign currencies. The competitive conversion rates and fee-free ATM allowance also make Wise a viable solution for foreign cash needs when traveling, although it doesn’t replace a good no-FX credit card nor beat out Wealthsimple Cash’s offering. Nonetheless, I believe it’s worthwhile to have the card in your arsenal.

Use our referral link to sign up for Wise and get fees waived on your first 500 GBP worth of transfers!

Frequently Asked Questions

Once you receive your Wise card, simply pay in-store using your PIN to activate it. Find your PIN by selecting ‘Show PIN’ in the Wise app.

Almost all countries support the Wise card. Here is a list of the countries you can send money to with Wise. For the Canadian-issued Wise card, the excluded countries are quite a small list:

Sadly, no, the Wise card does not earn any rewards. It is inferior to Wealthsimple Cash in this regard, which offers a flat 1% cashback on all purchases.

The Wise Card is issued in Canada by Wise Payments Canada Inc (not Peoples Trust or DCBank).

Edit: Wise may still be partnered with Peoples Trust as the account details issued for my Canadian currency account belong to Peoples Trust Company.

The Wise Card is issued in Canada by Wise Payments Canada Inc (not Peoples Trust or DCBank).

Edit: Wise may still be partnered with Peoples Trust as the account details issued for my Canadian currency account belong to Peoples Trust Company.

Once you’ve set up Wise as an external account on another bank like Tangerine, then you can do a free EFT pull from the Wise CAD account to Tangerine and then do a free cash withdrawal from a Scotia ATM, as an example.

Reed Sutton

Latest posts by Reed Sutton (see all)

- Earn Cash Back Rebates on National Bank Credit Cards - Jun 29, 2025

- Review: Starlux Airlines Premium Economy (A350-900) - Jun 23, 2025

- Review: Hotel Proverbs Taipei, a Member of Design Hotels - Jun 18, 2025

- Review: ZIPAIR “Full Flat” Business Class (787-8) - Jun 4, 2025

- Booked: Morocco & Portugal 2025 - May 18, 2025

Hi Reed, thanks for an informative and great blog! I opened up a Wise account and loaded my first CAD30 to my Wise account successfully. I confirmed with a Wise agent that each time you load Wise charges a small fee even with Direct Debit from your bank account. Your blog mentioned linking Wise as an external account on somewhere like Tangerine which is what I attempted to do. The problem is when I called Wise to get the needed info: transit, institution and account number in order to link it on Tangerine, the Wise agent said they cannot provide me with the transit, institution and account number because Wise has several banking partners and it may change periodically. Does this make any sense to you?

Hi Mary,

When you click through Direct Debit on Wise it prompts you to login to your external account and link it right from Wise. For example I currently have my Tangerine and EQ bank accounts linked. It costs $0.05 per load.

Thanks for your reply, Reed. I linked my Tangerine account from Wise as per your instructions, then when I tried to Add CAD350 to my Wise account using Direct Debit option, it says Pay 350.84 from the bank account so it costs $0.84 for this $350 load. I changed the load amount to $50 and the cost became $0.12 for the $50 load. Looks like the load fee is variable to the load amount.

Glad it worked for you. Good to know, still pretty cheap overall!

I just opened up a Wise account and ordered a physical card to be mailed to my Canadian address. Provided my driver’s license and everything is verified. Now it asks How would you like to pay? Direct Debit: 0 CAD in total fees, so you pay 30 CAD. Does this mean for a physical Wise card it will cost me CAD30? I’m confused coz from all the blogs that I’ve read, they all say that it’s free. Please confirm, thanks for the clarification!

$30 is the minimum deposit amount.

Hi, I have a question about Can the wise visa debit card use the benefits provided by visa?

Which benefits? As far as I know Visa Platinum doesn’t come with many benefits. Also Wise isn’t listed here: https://www.visa.ca/en_CA/pay-with-visa/cards/credit-cards/classic-gold-platinum.html#3…so I’d be included to say probably not.

Can I use visa infinite at pos machine?

Yes, I would assume so.

Hello Reed. First, I’d like to thank you for a very thorough review of the Wise card service – a review written from a user’s point of view rather than someone regurgitating what everyone else has previously written. Well done! I’ve been reading too many reviews and banging my head on the wall trying to identify Canadian issuers of virtual cards. True virtual cards. Cards where I can mask my account’s true identifiers and protect my financial information, not unlike email aliases. So far, it’s slim pickins. I live in a small city in BC. So, much of my purchasing is on line. I’m carefull, very carefull, yet my cards are regularily compromised even though my purchasing is done from mainstream busineses. It would be of great value to me and perhaps many others, if you could suggest a short-list of card issuers that offer true ‘virtual cards’ in Canada. Perhaps you would consider writing a complete article on this topic. I find it stunning that most card issuers have not adopted this security measure as a centerpiece of protecting worldwide commerce. I guess they’d rather keep those call-centers churning away. OK, I’ll get off my soapbox now. Cheers and thanks for your consideration. Richard

How do I activate my wise Visa card

Hi Tina,

The card is activated as soon as you use it to pay for something using your PIN.

PIN can be found in the app.

One huge minus of the card (at least in my case) is the forced 2 stage log in verification. I just created an account and found I cannot log into my account on a laptop/desktop unless I have access to my smartphone. It sends a push notification there asking for my approval for the desktop logon. But what happens if I don’t have access to

my phone ? I would be locked out of my account. And if the phone was stolen, I wouldn’t be able to put a timely freeze on the card. There’s no apparent online way of disabling 2 step log in.

I’ve asked Wise support if I can disable it, otherwise I’ll unfortunately have to bin the card.

Hi Pete. I myself always use 2 step verification anyways, but I agree it is unfortunate that they don’t at least provide the option.

Not sure it would help but you are allowed to receive SMS instead for verification, and can additionally have a backup number so either number can receive the SMS. See here: https://wise.com/help/articles/2951949/-step-login-isnt-working

Now this is an exceptionally timely article. I’ve got the Wise card in order before heading to Qatar in a few weeks. Thanks for laying it out Reed.

Happy to help 🙂