Being approved for your first Chase business credit card represents an all-important final step of a year’s long journey. From understanding how to get US credit cards as a Canadian to opening your first US American Express card with Nova Credit, to getting your Individual Taxpayer Identification Number (ITIN), and building your US credit history, make no mistake, it’s a long process.

Chase can be particularly fastidious when it comes to approving new business cards, especially for first-timers. So, if you’re used to the American Express ‘no questions asked’ approach to approving business cards, you’ll find the two companies differ quite significantly here.

While it will most likely require quite a bit more time and energy to get approved for your first Chase business card, the rewards for your efforts are often spectacular. Chase issues several no annual fee business cards that can offer up to 90,000 points on a welcome bonus, which is basically unheard of in comparison to what is available in Canada on a no annual fee card.

I’ll take you through my recent application for my first Chase business card, all the way from initial denial to eventual approval. Hopefully, this will give you a better understanding of what to expect throughout the process. In addition, I’ll offer some tips and best practices to have in place prior to hitting that ‘submit’ button on your application.

Credit History and Credit Score

If you’re at a point where you think it might be time to apply for your first Chase business card, you should already have several years of US credit history on your file. On top of that, I’d recommend having held a personal Chase card for at least six months, ideally either the Chase Sapphire Preferred card or Chase Sapphire Reserve. I’ll explain why you’ll want one of these cards later on.

Anecdotally, I’ve seen data points suggesting that these timelines can be reduced by holding a considerable deposit in a Chase banking account.

As a point of comparison, I have five years of credit history with American Express in the US. Moreover, I had held a personal Chase card for about ten months and had just been instantly approved for a second personal Chase card.

This instant approval gave me a sense that my chances for a successful business card application would be somewhat decent. That, coupled with some solid welcome bonus offers that were set to end soon, I figured it was as good a time as any.

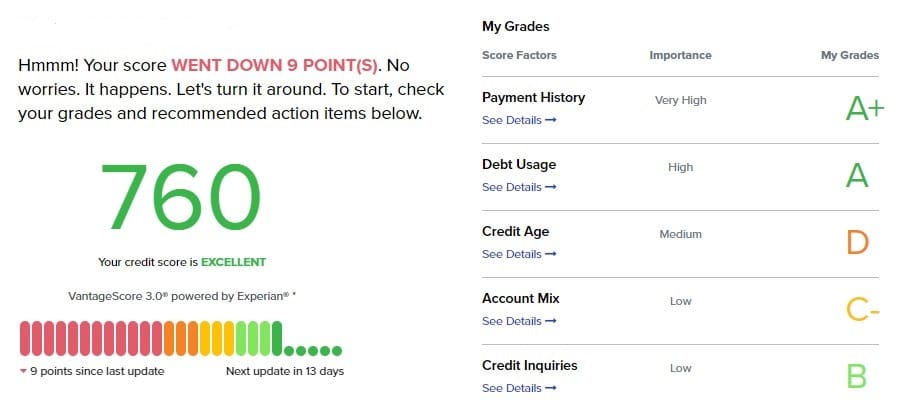

Lastly, I wouldn’t worry too much about your credit score. If you’ve been holding a handful of Chase and Amex cards for a few years, you will have a reasonably well-established credit history by this point. As long as there are no missed payments or derogatory marks on your file you should have a credit score in the 700’s, which is more than sufficient for most lenders.

Chase’s 5/24 and 2/30 Rules

Chances are if you’ve opened at least one personal Chase credit card, then you’ve probably heard of the Chase 5/24 rule. This rule will play a sizable role in your US credit card strategy, as it can have an impact on your ability to get approved for certain credit cards.

So, what exactly is the Chase 5/24 rule? In short, it means that if you have opened five or more credit card accounts (from any bank) in the past 24 months, then you will not be approved for certain Chase credit cards. Nearly all of Chase’s top rewards credit cards are subject to the 5/24 rule.

So, how do you coordinate your US credit card strategy around the nuances of Chase’s 5/24 rule? Here are a few tips to keep in mind:

- Prioritize Chase cards early on – If you’re interested in Chase credit cards, it’s best to apply for them early on in your credit card journey. This way, you can maximize your chances of getting approved before you hit the 5/24 limit.

- Be strategic – If you’re nearing the 5/24 limit, it’s important to be strategic about your credit card applications. Consider holding off on applying for cards from other banks until you’ve secured the Chase cards you’re interested in.

- Apply for business credit cards from American Express or Citi – Business credit cards in the US are not listed on your personal credit report. As a result, they do not add to your 5/24 count.

- Keep track of your credit card approvals – Finally, it’s important to keep track of your credit card applications so you know where you stand in relation to the 5/24 rule. Consider using a spreadsheet or another tracking tool to help you stay organized.

Chase business cards have a unique aspect regarding the 5/24 policy. Most business cards from Chase are subject to approval under the 5/24 rule, which requires applicants to have less than five accounts opened within the last 24 months. However, as with business cards from other issuers, Chase business cards do not count towards this limit.

For example, if you are currently 4/24 and are approved for a new Chase business card you will still be at 4/24.

Similar to the 5/24 rule, Chase also has a 2/30 policy. This means you will only be approved for at most two new credit card accounts per 30-day period.

Establishing a long-term strategy is really critical here. You don’t want to end up locked out of Chase for an extended period of time. Always keeping at least one slot open on your 5/24 is a good idea in order to capitalize on any of Chase’s often outstanding limited-time welcome bonuses.

Earning Ultimate Rewards with Chase Business Cards

It goes without saying that earning flexible point currencies should always be the preferred form of travel rewards to be accumulating. In addition to being a hedge against devaluations, their versatility opens up award opportunities with many loyalty programs rather than being tied to a single one.

Along with American Express Membership Rewards, Chase Ultimate Rewards are considered the ‘gold standard’ of flexible points currencies.

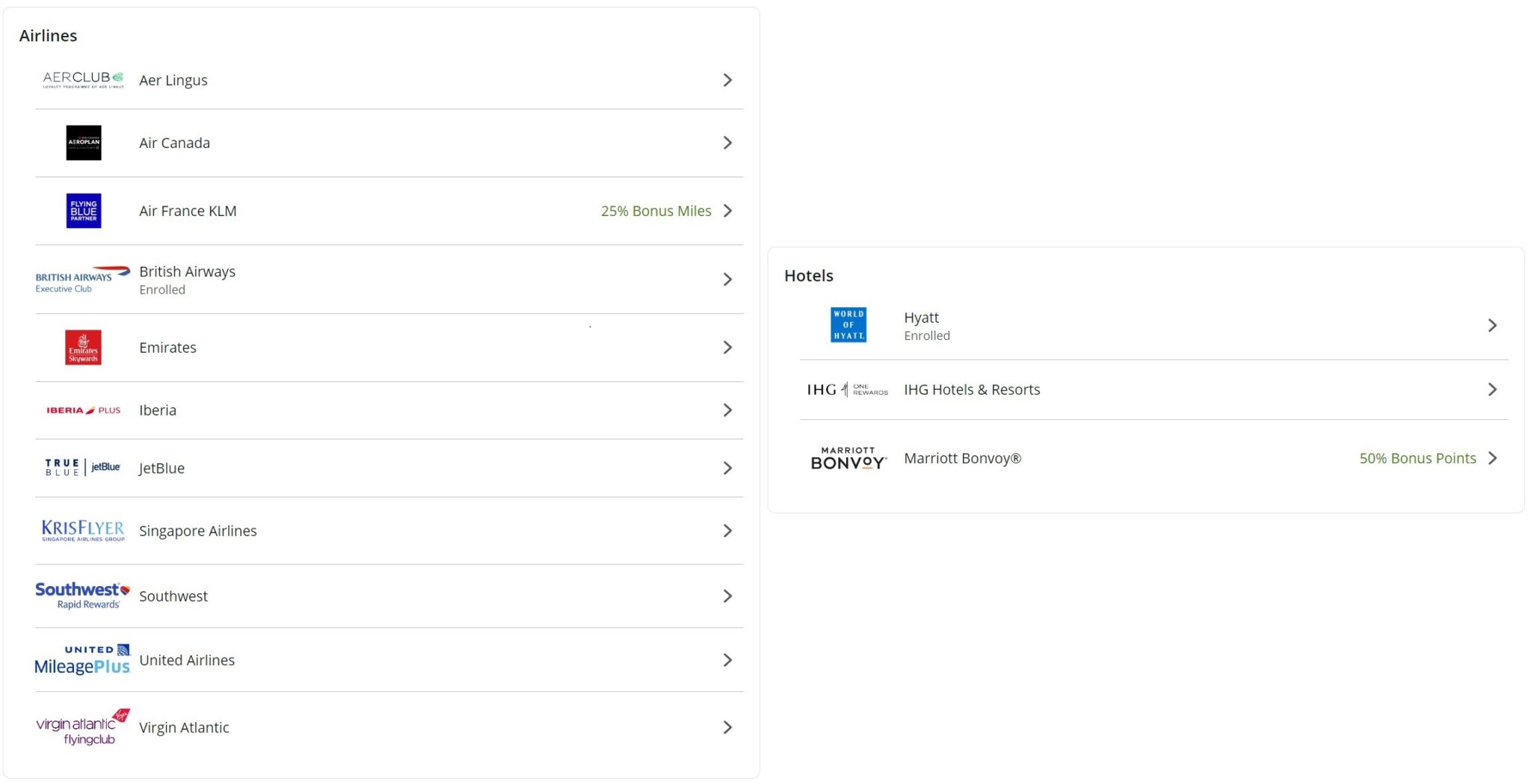

While it is possible to redeem Ultimate Rewards for cash back, gift cards, and bookings made through the Chase Travel portal, their true value lies in the ability to transfer them out to a partner program.

Of course, there are several airline programs that will interest us, but Chase’s standout transfer partner is unquestionably going to be World of Hyatt. As the exclusive partner of World of Hyatt, Ultimate Rewards and the co-branded Chase World of Hyatt Visa card are the only ways to accumulate a considerable amount of World of Hyatt points.

This is especially important for Canadians due to the distinct lack of co-branded hotel credit cards available in Canada. It is particularly important in diversifying yourself against solely relying on Marriott for your hotel stays. As one of the last hotel loyalty programs that still publishes a standard award chart, it is not hard to extract 3+ cents per point on World of Hyatt redemptions.

Transferring your points to some of Chase’s airline partners, such as Emirates, Singapore Airlines, and Virgin Atlantic, can undoubtedly provide exceptional value. Nonetheless, most of Ultimate Rewards airline transfer partners are also accessible through US Membership Rewards and Citi’s Thank You points. However, as the only way to redeem your points for stays at some of Hyatt’s iconic properties throughout the world, coupled with their partnership with Small Luxury Hotels of the World, it’s hard to resist the appeal World of Hyatt presents.

What Card Should You Get First?

Chase offers four business cards that earn Ultimate Rewards. Two of these cards have no annual fee, which I think makes them both ideal choices for your first cards.

The Chase Ink Cash and Chase Ink Unlimited are the two cards most people will gravitate to initially. Offering huge welcome bonuses and excellent return on spend for no annual fee. These two cards have a significant drawback for Canadians though, as both impose a 3% foreign transaction fee.

| Chase Ink Business Cash card | Chase Ink Business Unlimited card | Chase Ink Business Premier card | Chase Ink Business Preferred card | |

|---|---|---|---|---|

| Earn Rate | 5% cash back at office supply stores and on internet, cable and phone services Earn 2% cash back at gas stations and restaurants | 3X on shipping, advertising, cable, internet, phone, and travel | 2.5% cash back on every purchase of $5,000 or more Unlimited 2% cash back on all other purchases | 3X on shipping, advertising, cable, internet, phone and travel |

| Welcome Bonus |

|

|

|

|

| Annual Fee | $0 | $0 | $195 | $95 |

| Foreign Transaction Fees | 3% | 3% | No | No |

If you aren’t in a position to meet the spend on those cards entirely in USD, you’ll probably want to consider either the Chase Ink Preferred or Chase Ink Premier. Opting for this path requires you to pay an annual fee; however, it provides you with the benefit of having no foreign transaction fees if a substantial portion of your expenses will be incurred in Canada. However, similar to their no-annual-fee counterparts, these cards come with their own set of disadvantages.

The Chase Ink Preferred and Chase Ink Premier each have a rather onerous US$10,000 and US$15,000 minimum spending requirement, respectively.

You’ll have to weigh your individual spending patterns and ability to meet MSR to determine which one suits you best.

Just to clarify, Chase markets some of their Ink cards as cash back cards, however, the cash back is rewarded in the form of Ultimate Rewards. Chase sets the value of each Ultimate Reward point at 1 cent. Therefore, you can view a $750 cash back welcome bonus as equal to 75,000 UR.

All Ultimate Reward points are not equivalent though, as the points earned with the Chase Ink Cash, Ink Unlimited, and Ink Premier cards cannot be transferred to partner programs.

To unlock the ability to transfer these points you also need to be holding one of the following cards:

One of the main reasons the Chase Sapphire Preferred card is so often suggested as the first personal Chase card to get is for this reason, the ability to combine your points so they can be transferred out.

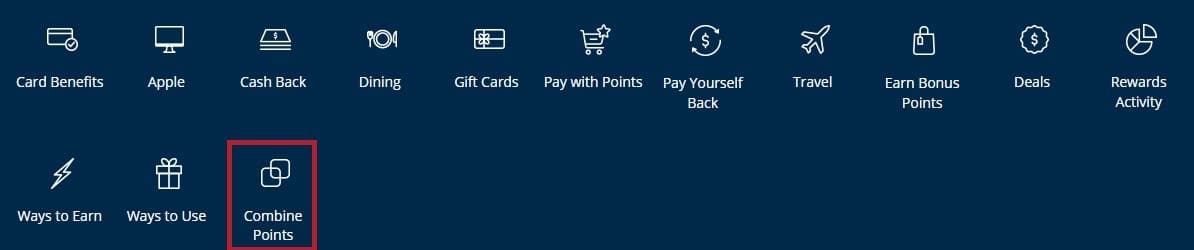

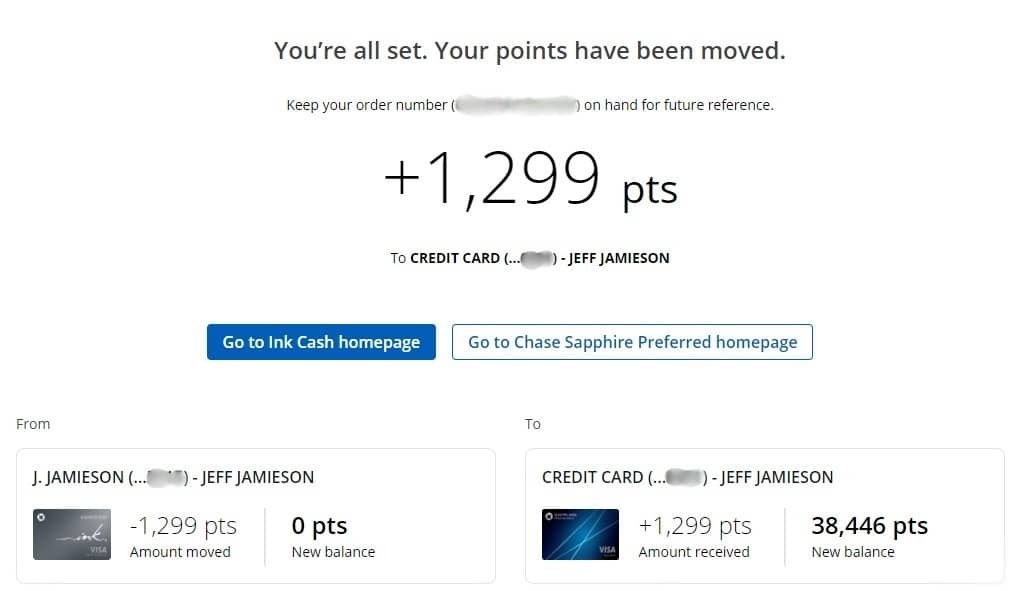

Combining your points on the Chase website is simple and the points transfer instantly. Click on ‘Combine Points’ from the Ultimate Rewards dashboard and select the cards you want to transfer between and you’ll be all set.

Combining your points on the Chase website is simple and the points transfer instantly. Click on ‘Combine Points’ from the Ultimate Rewards dashboard and select the cards you want to transfer between and you’ll be all set.

Odds and Ends Before Applying

- US phone number – When calling Chase customer support their preferred way of verifying your identity is by sending a one-time passcode (OTP) to your mobile phone. I’ve seen data points suggesting that some Canadian carriers will receive text messages from Chase and some will not. Consequently, you’ll want to ensure you have a phone number that can reliably receive Chase’s OTP’s. Consider getting a US phone number if you don’t have one yet, such as Google Fi, to avoid any headaches.

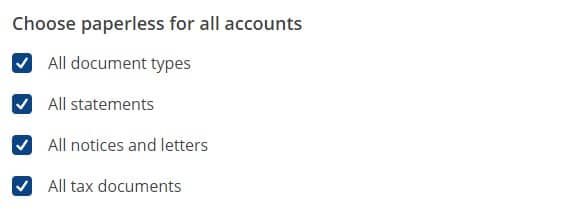

- Paperless settings on your Chase account – Throughout the application process for my business card, Chase sent many notices and letters to me regarding my application. Ensure you have paperless delivery selected for all documents on your account, otherwise, Chase will send notices regarding your application via letter mail to your US address.

- Have your business documents in order – While I wasn’t asked for any proof of my business, there’s always a chance you will be. Having some demonstrable evidence that you do actually have business dealings in the US is important to have prior to applying. Unlike Amex agents who have never asked me a single question about the nature of my business when applying for business cards, it’s possible for Chase phone agents to be quite diligent when it comes to verifying your business, so don’t just expect them to take you at your word.

- Have a lot of patience – From start to finish my application process took well over a month. I have no idea if this is typical, but it’s something to keep in mind when planning out your minimum spending. Also, set aside a decent amount of time before you call in, two of my three phone calls to Chase lasted close to an hour each.

- Have a plan for the minimum spending requirement – I know I’ve touched on this already and it might seem silly to be pointing out something so obvious, but it bears repeating. A common theme among US business cards is that they all have very large minimum spending requirements. If you decide to get one of the no annual fee Ink business cards, don’t forget to factor in the foreign transaction fees. Hitting the entirety of an MSR in USD will probably be challenging for some people, therefore try to time your application around some upcoming USD spending.

- Chase 5/24 – Last but not least, if you’re over 5/24 do not bother applying. You will be automatically rejected.

Filling Out the Application

For individuals who already possess business credit cards, the application form on the Chase website will look familiar.

As part of the application process for a Chase business credit card, you will need to answer some additional questions beyond the usual personal inquiries about your income, ITIN, and similar information.

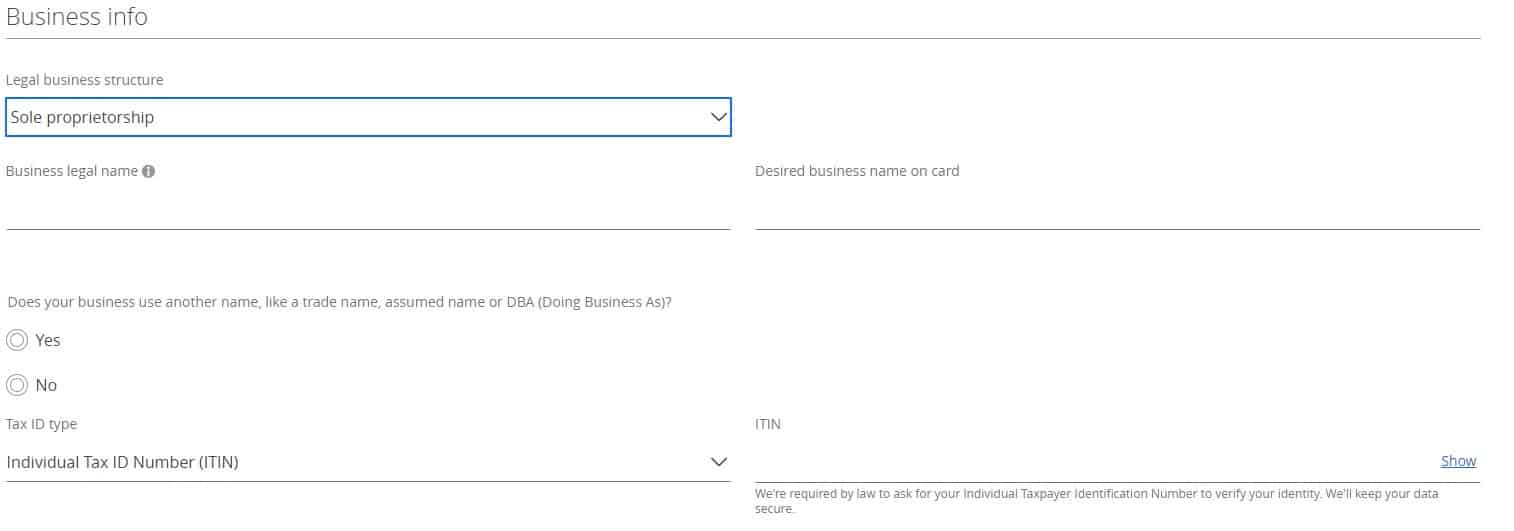

As a sole proprietor you are eligible for Chase business cards. You can use your full name as the legal name of your business, and your business mailing address and phone number can be the same as your personal information.

Selecting sole proprietorship from the Legal Business Structure drop-down will allow you to enter your ITIN as the Tax ID.

Lastly, saying there is only one employee, having a small amount of revenue and a few years of established business are all perfectly acceptable

Once you’ve gone through all the steps and submitted your application, you most likely won’t receive instant approval. Give it one or two days and a notice should show up in your account, which will most likely ask you to call in.

Initial Denial

The day after I received the aforementioned letter, I made my first phone call to Chase. After confirming my identity, the agent placed me on hold while reviewing my application. Upon returning he said he was going to ask me some questions about my credit history.

We then individually went through each and every US credit card I had opened. He confirmed with me the month and year the card was opened, in addition to the credit limit and issuer of each card. At this point, I had quite a few US credit cards, so the agent was curious as to why I was trying to open another new account. After answering his questions, I was placed on hold again.

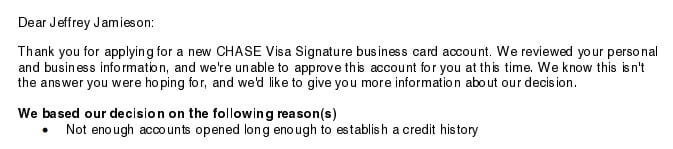

Returning to the line a few minutes later the agent informed me my application was being denied due to an insufficient credit history.

While not totally surprised I was being denied, I was somewhat taken aback by the reason. I tried to push back a bit and pointed out that my almost five years of credit history was spotless. He agreed with me but then asserted that I was being denied based on the mix (or lack thereof in my case) of credit on my report.

Going on to explain, the phone agent said Chase typically likes to see some more established forms of debt in a person’s credit history, such as a mortgage or auto loan before extending business related credit.

In a last ditch attempt, I asked if his decision was final. He said yes and there was nothing more he could do at the time.

The following morning, I received official notice in writing of my denial.

Reconsideration

Knowing I still had a shot at reversing the denial, a few days later I called the Chase reconsideration line.

Even though the official reason for my denial was insufficient credit history, the reconsideration agent I spoke with didn’t bring up my credit history at all. Instead choosing to focus entirely on the details of my business.

I don’t remember every question that I was asked, though some of what I recall were the following:

- What is the nature of your business?

- For how long has your business been established?

- What is the past, current, and expected revenue for your business?

- Is your business home based or retail storefront?

- Do you pay taxes on business revenue?

- Are you up to date on your taxes?

- What are your estimated monthly expenses?

- Why do you need this card?

The questions I was asked seem to be some of the most common questions people get when calling for reconsideration, so make sure you have an answer ready for all of them. Remember what you entered on your initial application to avoid giving contradictory answers.

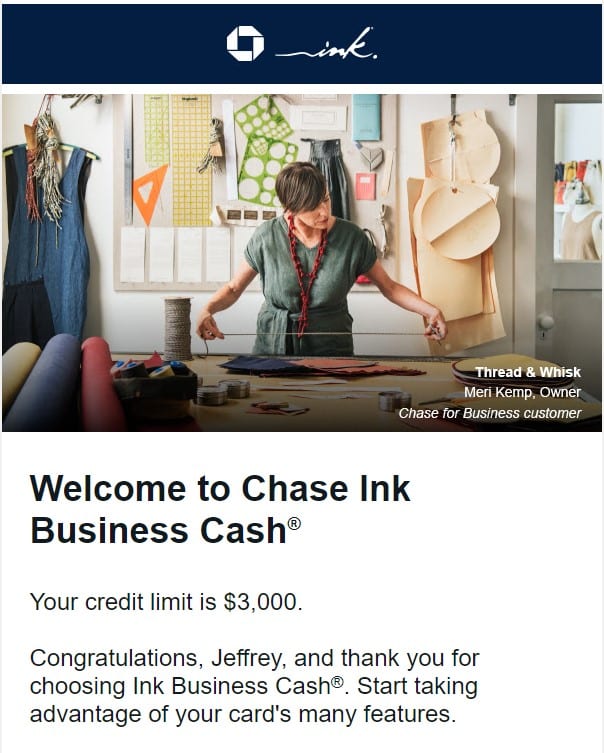

I was placed on hold again while the agent reviewed our conversation. Then returning to the line the agent told me that my application would be resubmitted with a recommendation for approval, albeit at the lowest possible credit limit of $3000. I was told it could take up to 30 days for a final decision to be rendered.

I can’t really point to any one thing in particular that I might have said to have the decision reversed. I gave as thorough an answer as possible to every question while focusing on how this new card would benefit me and my business.

Then, after a 27 day wait, I finally received the email I had been waiting for.

Some Takeaways from My Experience

- If the legitimacy of your ‘business’ is somewhat flimsy, you’re probably going to struggle during these phone calls. The agents wanted very specific answers to their questions, with financial figures to back up what I was saying. They speak with business owners every day, so I’m almost certain reconsideration agents have a good sense that something might be off if you sound hesitant or unsure.

- If you have a lot of open US credit cards, be prepared to explain why you have so many and why you want to open more new accounts.

- The types of accounts on your credit report are taken into consideration by Chase. While there’s very little as Canadians we can do about this, it can be the reason you do end up being denied.

- When explaining why you need this new card, it’s best to have a well thought out answer prepared in advance. Know the features and benefits of the card you’re applying for and detail how they will help your business. Simply mentioning the awesome welcome bonus isn’t the answer I think they’re looking for here.

- You’re going to need whoever you are speaking with to advocate for you if you are to be successful here. Some personality and friendliness can go a long way in situations like this.

Conclusion

Regardless of how prepared you are, it’s still entirely possible you’ll end up being denied in the end. Although it’s a small sample size, all the people I have spoken with that have gone through a Chase business card application, just as many have been denied as have been approved. It quite likely will just come down to the reconsideration agent you happen to get the day you call.

The entire process can seem quite intimidating. I admit to feeling that way before I first called, let me ease your mind in this regard. I found the phone agents to be very friendly and seemingly quite willing to help my application get pushed through for approval. All things considered, I was pleasantly surprised by the outcome.

With upwards of 300,000 points available from the Chase Ink family of cards it’s obviously something that should have our attention. It certainly will require jumping through many more hoops that we’re accustomed to, but pushing the boundaries and taking some risks in this game often reap the greatest rewards.

Jeff Jamieson

Latest posts by Jeff Jamieson (see all)

- Air Canada Bid Upgrades: How Do They Work? - Jun 6, 2025

- Combined Air-Rail Tickets: A Guide for Canadians - Jun 2, 2025

- Review: Ritz-Carlton Hong Kong - May 28, 2025

- Review: Emirates First Class (A380) - Apr 30, 2025

- Guide to the Marriott Bonvoy Annual Choice Benefit - Apr 28, 2025

I got approved for a chase business card after 2 weeks of my application entering a ‘identity verification failed’ loop. Requested me to go to the branch but I submitted all the docs they requested for and called recon line again. It depends on which agent you get connected to and how knowledgable they are.

Is applying in branch going to be easier? I had trouble in the past applying online for the CSP online and was denied in the end. Few months later i applied in branch, instant approved. But thats my personal card side. I wonder if it’s easier also in branch for business cards?

I haven’t applied in branch for a biz card but I would guess- yes. At the same time, business cards seem to be seeing greater success rates online as of late. I would expect to be asked to answer a few more questions about the business in branch than you might receive when applying online too.