With so many credit card welcome offers available, how do you know if you’re getting a good deal? One of the easiest ways to determine this is your “rate of return on spend” – in simpler terms, how much value do you get back for each dollar you’ve spent?

On top of that, it is tricky to determine which credit cards to keep in your wallet for the long term. With so many credit cards on the market, it can be tough to figure out whether you are using the best card for your spending habits. After all, you not only want to always be increasing your miles and points balances but also maximizing the value you receive.

Below we’ll give you all the tips to maximize your credit card spending to ensure you’re signing up for strong credit card offers and not leaving points on the table when it comes to earning welcome bonuses and maximizing your daily spending.

What is a Rate of Return?

Before we dive into the concept of maximizing your credit card spending, understanding the rate of return is critical when evaluating credit card welcome bonuses. The rate of return when talking about welcome bonuses is how many points you receive for how many dollars you spend to earn that bonus.

This is important to understand as many people will find that their actual expenses and purchase habits cap their ability to spend a set amount in a fixed period. With that in mind, we want to ensure we maximize our spending to get the most miles and points possible.

How to Calculate Rate of Return

Calculating the rate of return is a reasonably straightforward calculation but an important one. It’s exactly how you calculate any percentage, like how you used to do in school when your test results came back at 47 questions correct out of 60.

This time, though, instead of dividing the smaller number by the larger number, you’ll divide the value received from the welcome bonus by the dollars spent to earn that welcome bonus.

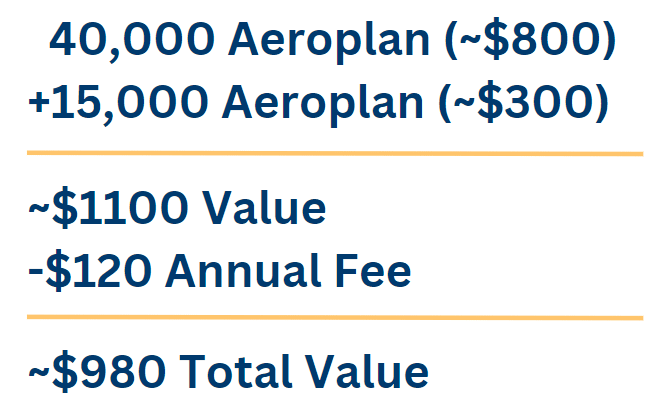

After doing this, you’ll be left with a decimal value; the closer to “1”, the better. Let’s use the example of an Aeroplan credit card that offers 55,000 Aeroplan points upon spending $4,500 in the first six months. The welcome bonus is awarded through a segmented offer structure, which I’ve outlined below:

- Earn 40,000 Aeroplan points after spending $3,000 in the first six months

- Earn 2,500 Aeroplan points per month when you spend $500 per month for six months (15,000 Aeroplan points available)

Our calculation to determine the total value of this welcome offer would be as outlined below, taking into account the value of the Aeroplan points and the expense of the annual fee:

You may question how I’ve developed these cash values for Aeroplan points. At Frugal Flyer, we’ve conducted many searches and concluded that, on average, an Aeroplan point is worth $0.02. But they can be worth much more with the right flight redemption.

Since we now have the total value expected to be earned from this welcome bonus, we will finish the rate of return calculation by dividing the total value by the total amount of dollars spent to earn that welcome bonus.

This rate of return calculation comes out to a 32% return on spend. Since the welcome bonus was strong with a small minimum spending requirement of only $3,000 over six months, new cardholders can receive excellent value from signing up compared to the amount of effort that is required.

In this example, we do need to remember that we are earning Aeroplan points and thus their main and best utility is to use them for flight award redemptions on Air Canada and Star Alliance carriers. The value calculation becomes much more straightforward when we are dealing with a fixed points currency, or cash equivalent currency, as we will touch on below.

Maximizing Spend on Credit Card Welcome Bonuses

While a 32% return on spend in the example above is excellent, if you’ve got a family of 4 to fly around the country (or world), 55,000 Aeroplan points will be used up quickly. Let’s evaluate a larger sign-up bonus on one of Canada’s best cards, the TD Aeroplan Visa Infinite Privilege card.

The TD® Aeroplan® Visa* Infinite Privilege* Card offers a variety of Air Canada benefits including priority boarding, free checked baggage, and Maple Leaf lounge access.

Check out our TD® Aeroplan® Visa* Infinite Privilege* Card review for more details.

85,000 Aeroplan

$24,000

$1,785+

$599

Yes

–

As of August 2023, the TD Aeroplan Visa Infinite Privilege card offers 115,000 Aeroplan Points as a welcome bonus. The essential components of the offer are as follows:

- Earn 20,000 Aeroplan points on the first purchase

- Earn 60,000 Aeroplan points after spending $7,500 in the first 180 days

- Earn 35,000 Aeroplan points awarded if total purchases are $12,000 or more in the first 12 months

We follow the same calculation as before to determine our total value.

After figuring out the total value received from the welcome bonus, we can divide it by the dollars spent to earn that welcome bonus.

With our 14% return on spend from this example, we are getting less than half the value per dollar spent compared to the Aeroplan card in the previous example.

While it’s a lower return, we do need to account for the fact that certain financial institutions may have terms and conditions that prevent you from getting the same bonus on a card twice or any other limitations. This is a great example where earning miles and points with a partner can take you that much further, essentially doubling your earning capacity since if you find an exceptional credit card welcome bonus offer, both you and your partner can sign up for it.

While return on spend is a useful calculation if you are trying to decide on a new credit card from many different options, it isn’t the ultimate decision maker. From time to time, you might find it necessary to take a less-than-ideal return on spend to supplement your miles and points earnings to get you closer to your next redemption.

Maximizing Spend on Everyday Credit Card Purchases

Once you’ve finished the minimum spending requirement and have earned your welcome bonus you’ve earned the biggest chunk of points that is readily available to you. That being said, there is value in keeping some cards around long-term since the value they present on daily spending can be very strong. The key to knowing which ones to keep is understanding the current value of points and how much of a return you’re receiving on certain categories.

This is where the concept of bonus categories comes into play. These are special categories on certain credit cards that reward additional points for any purchase made on the card that falls into a specific spending bucket, such as restaurants, groceries, or gasoline purchases.

For example, every Canadian should consider holding the American Express Cobalt card, which earns 5 Membership Rewards points per dollar on food and drink, making it a great daily driver credit card. This presents outsized value as you can transfer these points to various frequent flyer programs and hotel loyalty programs to extract even more from your points. This card earns only 1 MR point per dollar on every other purchase.

The American Express Cobalt card gives cardholders the opportunity to earn 5x Membership Rewards on eligible restaurant, food delivery, and grocery store purchases.

In 2025, we selected this card to receive the award Best Points Credit Card for Grocery Purchases.

Check out our American Express Cobalt card review for more details.

15,000 Membership Rewards

$9,000

$330+

$156

Yes

–

Compare that to the fixed value TD Rewards program, and consequently, the TD First Class Travel Visa Infinite card which earns 2x TD Rewards points on every purchase. While 2 TD Rewards points may sound better than 1 Membership Reward point, the valuation of each points currency is quite different. The value of a TD Reward point is $0.005 (½ of a penny), while an MR point is worth $0.02.

Another card that provides a nice daily return is the MBNA Rewards World Elite Mastercard, as it earns 5x on Household Utility, Memberships, and Food and Drink with an annual cap of $50,000 per category.

The MBNA Rewards World Elite Mastercard earns 5x MBNA Rewards points on restaurant, grocery, digital media, memberships, and household utility purchases.

Check out our MBNA Rewards World Elite Mastercard review for more details.

30,000 MBNA Rewards

$2,000

$400+

$120

Yes

–

MBNA Rewards points are only worth $0.01 in their current format and can be redeemed towards travel redemptions for best value.

While holding a few cards for specific use cases is important, you can keep one or both cards as daily driver credit cards to reduce the number of cards in your wallet. As grocery stores sell gift cards, you can always add some of those to your weekly grocery run to effectively receive the grocery category bonus on almost everything (in fact, buying gift cards is an easy way to meet minimum spending requirements).

If you want to better understand a specific loyalty program, check out our loyalty program guides and never get the short end of the stick when maximizing your miles and points rewards!

Fixed Points Currencies vs. Flexible Points Currencies

When evaluating the types of points you need to collect or determining your return on spend, you need to be aware of the two main categories of points currencies: fixed or flexible points. These points vary greatly when you consider the utility and value that can be extracted from each.

Value of Fixed Points Currencies – Things to Consider

When discussing a fixed value points currency, knowing you have no control over the value is vital. As long as the loyalty program keeps its reward structure the same, you cannot redeem for less or more than the stated value. This includes loyalty programs such as TD Rewards, Scene+ Rewards, and BMO Rewards.

Earning fixed points currencies results in a welcome bonus very easy to calculate. In addition, it makes redemptions extremely straightforward since there is a very low level of knowledge required when it comes to maximizing your points.

If you don’t have any travel plans but want to access the rewards cash value, you can often use the refundable hotel trick to cash your points into a statement credit. You won’t be able to use the refundable hotel trick with all currencies, but for most, it’s a great way to unlock the value of points as a statement credit. It may even be the best strategy because, at any time, a loyalty program can adjust its reward structure and value without notice.

Value of Variable Points Currencies – Things to Consider

Varible points currencies are where the fun begins for points maximizers like myself, as you can stretch a point’s value quite far if you know the tips and tricks of the loyalty program. Variable points currencies include programs such as Air Canada Aeroplan, British Airways Avios, American Express Membership Rewards, Alaska Miles, and more.

For example, Air Canada Aeroplan points are the go-to for many Canadians. As Aeroplan points are a variable or flexible points currency, you can choose to redeem 100,000 Aeroplan points for a Lufthansa First Class flight, but you can also redeem the same number of points for a blender. Is the best use of your Aeroplan points a blender or a first class flight? The choice is yours.

Variable points are undoubtly much harder to redeem, as to maximize their value for travel you must find award availability. While there are many best practices for booking award travel, one of the best ways to find award availability is to book 10-12 months in advance of when you want to travel, or book at the last minute.

It’s still possible to find flight awards in premium cabins in between these times, but it will require you to be very flexible in destination and date of travel. Just like the points currencies themselves, being flexible is imperative when booking award redemptions if you are looking to get the most value out of your redemption.

While it can be tempting to book a flight to Doha just to fly Qatar Airways Q-Suites, you want to make sure these redemptions fit your travel goals. It doesnt matter that you recieved 6 or 8 cents per point value if you are travelling to a place that you wouldn’t have gone otherwise.

Ultimately, if you are earning any variable or flexible points currencies, it is important to have a plan for how you want to use these points before acquiring putting in the effort to acquire them.

Conclusion

Maximizing your spending sounds easy at first, but in principal it requires a good amount of strategy. Understanding point values is the name of the game, and determining how to best utilize your natural spend becomes important once you get comfortable signing up for new credit cards.

Deciding which cards to keep in the long term is equally as important, because as we know about credit scores, you don’t necessarily want to sign up for cards every month (not to mention, there is a finite amount of credit cards on the market).

What’s your best-ever return on spend? Let me know in the comments!

Daniel Burkett

Latest posts by Daniel Burkett (see all)

- Review: American Airlines Flagship Business Class (A321) - Apr 16, 2025

- Review: Air Canada Business Class (A330) - Apr 9, 2025

- Aeroplan New Card Bonus Rules Explained - Mar 31, 2025

- Review: Hotel Muse Bangkok, Autograph Collection - Mar 12, 2025

- Partner Award Space: What You Need To Know - Feb 10, 2025