PayPower is no secret to the dedicated miles and points enthusiast. The reloadable prepaid debit Mastercard was a potent manufactured spending outlet several years ago.

In the past it could be scaled by signing up for multiple PayPower cards, however, Peoples Trust, the company that issues most prepaid cards in Canada, has since cracked down on this with enhanced identity resolution and compliance.

Still, the PayPower Mastercard, and other reloadable cards such as the Titanium+ prepaid Mastercard, do retain a role in the wallets of credit card rewards and miles and points enthusiasts. This is twofold: 1) manufactured spending is still viable with the PayPower Prepaid MasterCard for a nominal profit per reload, and 2) it can relieve some of the financial pressure of meeting minimum spends if you are working on many cards at once.

I find the latter to be of particular importance as someone who signs up for many many cards a year, but also is extremely frugal and doesn’t have the organic spend to support such a practice.

In this post, we’ll walk you through exactly how to best use the PayPower Prepaid MasterCard for both of these objectives, manufactured spending and meeting credit card minimum spending requirements, with the maximum convenience possible.

What is the PayPower Prepaid Mastercard?

PayPower cards are prepaid Mastercards (and Visa cards) that come in reloadable and non-reloadable flavours. As with most prepaid cards in Canada, they are issued by Peoples Trust Company. Generally, the best card to get is the black reloadable MasterCard, which can be loaded and reloaded with amounts from $20-500.

PayPower Prepaid MasterCards have an assortment of fees, including an activation or new card fee. Once you’ve purchased the card for the first time, you can register the card and upgrade it to become a reloadable prepaid MasterCard.

Once upgraded, the money you load to the card can be withdrawn at ATMs or used to make bill payments. We’ll show you how to get creative with the latter to withdraw the money back to your bank account.

Where to Buy the PayPower Prepaid Mastercard?

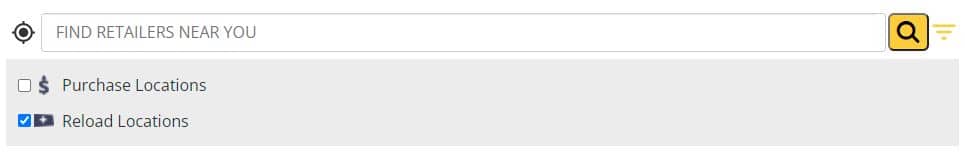

PayPower Prepaid MasterCards can be purchased or reloaded at several different brick-and-mortar locations, such as Circle K, 7-Eleven, Esso, Canadian Tire, Safeway, Save-On-Foods, etc. You can browse the full list of retailers on PayPower’s website.

What makes PayPower lucrative is the fact that you can get a category spend bonus (such as ‘Grocery’ spend) when you purchase or reload your PayPower prepaid card. This more than offsets the fees associated with the card and with withdrawing the cash. With the right credit card, you will make a decent profit.

How to Reload the PayPower Mastercard with a Credit Card

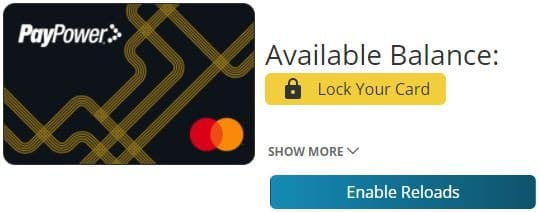

After you’ve purchased and activated your first PayPower black card, go to https://paypower.ca and create an account. Once logged into your PayPower account, enter the card number to register the card, and upgrade it to the “Reloadable Power” tier by clicking “Enable Reloads”.

At this step, you will have to go through KYC (Know Your Customer) verification, and be asked a series of security questions regarding your credit history and financial health, to confirm your identity. The second stage of this will involve linking your bank account. Make sure to pass KYC carefully as PayPower customer support is notoriously unhelpful for those who get stuck at this step and can’t upgrade their card.

Related: How to Manufacture Spend with Buying Groups

Once you’ve got your card upgraded to reloadable, you can take it to any of the retailers designated as ‘Reload Locations’ on the PayPower website.

At the retailer, you will provide your PayPower Prepaid MasterCard to the employee and ask to do a reload. If they seem confused, instruct them to treat it as a gift card. Once the card is scanned the system will prompt for the reload amount. The maximum you can load at one time is $500. Of course, if you have a nice cashier, you can ask them to load it again for you, but you’ll pay the reload fee ($6.95) each time.

You may also have more luck utilizing the customer service checkout at grocery stores as they may have more familiarity with these kinds of transactions.

How to Withdraw Money from the PayPower Prepaid Mastercard

Once your PayPower Prepaid MasterCard is loaded with money, there are essentially two options available to transfer funds: withdraw them in cash at an ATM or utilize bill payment to send funds to a credit card or other account.

ATM withdrawal is not a very effective method as the max per transaction is $250, and you will pay not only the $1.95 withdrawal fee, but any fees charged by the ATM as well. Drawing down a large PayPower balance via ATM has also resulted in a ban for one of the Frugal Flyer authors. :/

Bill payment is the superior method from a cost perspective, and also from a convenience perspective: after all, who wants to be making trips to an ATM all the time as there is a per day withdrawal limit.

How to Use Bill Payment to Empty your PayPower Mastercard

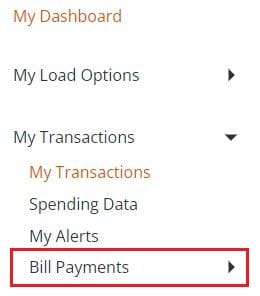

In the PayPower dashboard, you can initiate Bill Payments through the ‘My Transactions’ tab.

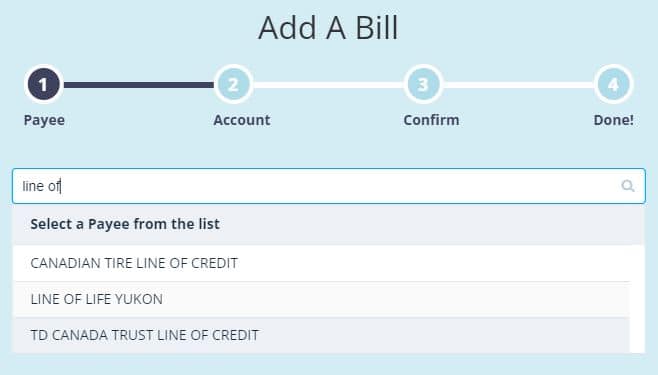

From there, you can select ‘Bills’, then ‘Add a Bill’, and search for various payees. Most credit card issuers in Canada are available.

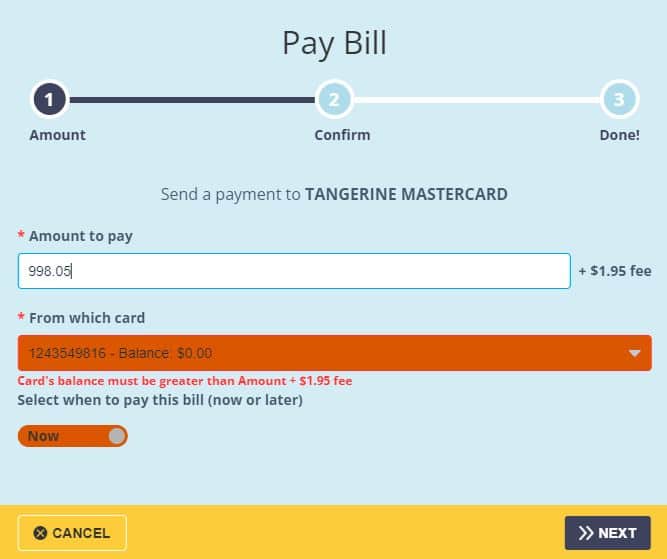

I like to send my bill payments to my Tangerine credit card, and then when the balance builds up, I request a manual transfer of the debited amount to my Tangerine No-Fee Daily Chequing Account. I personally just find Tangerine to be a bank that doesn’t care or question what you do with your accounts. However, the same process should work with most banks and credit card combinations.

One last note – Paypower includes the $1.95 fee in the $1000 daily limit, so the actual maximum amount you can bill pay works out to $998.05.

Fees and Limits Associated with the PayPower Prepaid Mastercard

Fees

The PayPower Prepaid Mastercard does have an assortment of fees. For the initial purchase of the card, you will pay an activation fee of $9.95.

For each reload, you will pay a reload fee of $6.95.

You will also pay a monthly fee of $4.95, which will be deducted from your card balance.

Finally, sending a bill payment or withdrawing from an ATM will incur a fee of $1.95.

Limits

In terms of limits, the PayPower Reloadable card can only be loaded with $500 per transaction, to a maximum of $2,500 daily and the maximum balance that can be held on the card is also $2,500.

The other limit to be concerned with is bill payment. The maximum is $1,000 daily, $2,500 weekly, and $5,000 monthly.

Using PayPower Prepaid Mastercard for Manufactured Spending

Using the PayPower Prepaid card to generate points is a valid and profitable manufactured spending strategy, but only when paired with the right credit card at the right retailer.

The best practice is to use a credit card that earns an increased category spend at grocery stores, such as the MBNA Rewards World Elite Mastercard or the Scotiabank Gold American Express Card.

Related: Best Credit Cards for Grocery Purchases in Canada

The MBNA Rewards World Elite earns 5 MBNA Rewards points per $1 spent on stand-alone grocery stores in Canada. You can earn at this rate to a maximum of $50,000 in net purchases per year, which would amount to 250,000 points if maximized.

The MBNA Rewards World Elite Mastercard earns 5x MBNA Rewards points on restaurant, grocery, digital media, memberships, and household utility purchases.

Check out our MBNA Rewards World Elite Mastercard review for more details.

30,000 MBNA Rewards

$2,000

$425+

$120

Yes

–

The Scotiabank Gold American Express Card earns 5 Scene+ points per $1 spent at grocery stores. It also earns 3 Scene+ points per $1 spent at gas stations. You can earn at the 5X rate on a maximum of $50,000 in net purchases per year, which would amount to 250,000 Scene+ points if maxed.

The Scotiabank Gold American Express card earns up to 6x Scene+ points at Empire grocery stores and charges no foreign exchange fees on purchases made in foreign currencies.

In 2025, we awarded this card as the Best Fixed Value Points Credit Card.

Check out our Scotiabank Gold American Express card review for more details.

50,000 Scene+

$7,500

$650+

$120 (FYF)

No

Oct 31, 2025

Now, taking into account the monthly bill payment limit of $5,000 we can do some math to see the return on each $500 load, and on maxing and depleting the PayPower Prepaid MasterCard monthly:

| Return on Loading PayPower with 5x Earning Credit Card | |

|---|---|

| Return per transaction | $500 = 2,500 points = $25 CAD (at value of $0.01 CAD per point) – $6.95 = $18 CAD |

| Return per month | $250 CAD ($25 * 10) – $69.50 CAD ($6.95 * 10) – $9.75 CAD (1.95 * 5) – $4.95 CAD (monthly fee) = $165.80 CAD/month |

This produces a modest return, which becomes a little better if scaled with a Player 2. Also consider that the value of the points can be higher if redeemed for travel, depending on the program. In this comparison, we simplified it by using the value if liquidated to cash at the highest possible rate.

Using the PayPower Prepaid Mastercard for Meeting Credit Card Minimum Spend Requirements

Aside from maxing out your PayPower Prepaid Mastercard on any credit cards that have a high category spending bonus on groceries, you can reload PayPower cards to meet minimum spending requirements for any cards you may be working on, even US credit cards. This method is the same approach as buying gift cards to meet minimum spending requirements.

This also opens up some options for reload locations. For example, if the card you’re working on happens to earn a category bonus at gas stations, then it may make more sense to do your reloads at ESSO.

Without any category bonus, you will ultimately net a small loss due to fees when reloading PayPower to meet minimum spends. The math works out as follows:

- Cost per $1,000 loaded = $6.95*2 + $1.95 = $15.85

- $15.85/$1,000 *100 = 1.59%

So approximately a 1.59% cost of manufactured spending, which isn’t bad if we assume any credit card will earn at least 1% in points value. A small loss is still worth it as it allows you to work towards minimum spend requirements.

Summary Table: PayPower Mastercard and Other Reloadable Prepaid Cards in Canada

| PayPower Prepaid Mastercard | MoneyMart Titanium+ Card | MyVanilla Prepaid MasterCard | |

|---|---|---|---|

| DETAILS | |||

| Type | Mastercard | Mastercard | Mastercard |

| Reloadable | Yes | Yes | Yes |

| Load Method | Reload in-store | Vanilla Reload | Vanilla Reload |

| Withdrawal Method | Canadian ATM or Bill Payment | Canadian ATM or MoneyMart cash | Canadian ATM |

| FEES | |||

| New Card Fee | $9.95 +tax | $9.99 +tax | $9.95 |

| Monthly Fee | $4.95 | $6.50 | $4.95 |

| Fee to Load | $6.95 | $3.95 +tax | $3.95 +tax |

| Fee to Withdraw | $1.95† | $1.95† | $1.95† |

| LIMITS | |||

| Max Load | $500 per transaction, $2,500 daily | $500 daily via Vanilla Reload | $500 per transaction, $2,500 daily, $5,000 monthly |

| Max Withdrawal | $1,000 daily, $2,500 weekly, $5,000 monthly (bill pay) | $3,000 daily | $500 per transaction, $2,000 per day, $2,500 per month |

| Max Card Balance | $2,500 | $15,000 | $9,999 |

Conclusion

PayPower cards are less abusable and consequently less lucrative these days. However, it’s still a valuable tool for the dedicated miles and points enthusiast, primarily as a means to meet minimum spending requirements when you otherwise might not be able to.

If you decide to scale PayPower to earn the most points possible, remember that there are risks. Many horror stories have occurred where money was stuck in limbo with PayPower, and financial institutions may flag and investigate suspicious transactions.

Best practices dictate the following: 1) don’t overdo it with ATM transactions, bill payment is best, and 2) don’t create a circular loop where you bill pay to the same card you loaded with. It’s best to instead bill pay to a credit card (or line of credit) at a separate bank and then have your bank transfer that negative balance to your checking account.

Frequently Asked Questions

PayPower is issued by the Peoples Trust Company under license from Mastercard International. People’s Trust is the issuer of a large majority of prepaid products in Canada, including the reloadable Titanium+ Mastercard, PayPower Prepaid Mastercard, and Vanilla prepaid cards.

Funds loaded onto the PayPower Prepaid Mastercard are not insured by the Canada Deposit Insurance Corporation (CDIC).

If you violate the terms of PayPower there is always a risk that you will be banned. If this happens you will get your PayPower balance back as a check, but your money may be stuck in limbo for up to a few months.

It is best to use a spreadsheet. Calculated fields can help with knowing how much you have on your card and where you’re at with daily, weekly, or monthly limits. We have a template tracker in Google Sheets for tracking PayPower and Titanium+ reloads.

Yes, PayPower can be used for online purchases if that is how you wish to use it. A PIN is not required, although you may set one up by calling PayPower customer service at 1-888-677-3299.

Yes, you can use PayPower to buy Costco Cash cards at Costco.ca. Read more about methods to use prepaid cards for Costco purchases.

Matt Astro

Latest posts by Matt Astro (see all)

- American Express (US) & No Lifetime Language (NLL) Offers - Feb 5, 2024

- Top Travel Hacks from the Obnoxious Autobiography of Justin Ross Lee - Jan 5, 2023

- Air Miles Onyx Personal Shopper: A Tutorial - Nov 24, 2022

- Post Mortem: Revolut’s Revolving Doors of Remittance - Jun 23, 2022

- Review: Vought Rewards Black Card - May 8, 2022

Been reloading 4 transactions of $500 at local Metro every month.

Today only first transaction went through and second transaction got declined. Staff told me the new system they had would only allow one transaction every 24 hours.

Any idea?

Same experience at local Food Basics. Looks like PayPower system has evolved.

I have a PayPower master card and trying to the address to get my money back because the cards declines and there is $100.00 left on it.

Hi Reed, I am new to this and started using my Amex to reload digital Paypower card.

I can’t reload it in Freshco (Ontario, 6% Scene rewards), but can load it in Foodbasics (5% rewards).

Is it because of digital card or it was never possible to reload at Freshco grocery store.

Hi Nail,

I do see Freshco listed as a reload retailer. Did they try to do it and it didn’t work, or was it a store policy not to reload?

Yes, they tried but it doesn’t work. PayPower CSR is helpless… I was curious if this was due to new “digital” reloadable card (option to reload thru barcode), or this was always the case – working thru Foodbasics stores but not thru Freshco. Although PayPower website included Freshco reloading option.

PS: also noted that I can’t see option to pay into Simplii LOC, perhaps PayPower removed it by now.

Thank you.

Hi, I used to make bank withdrawal with my card once in a while. So with digital card it won’t be possible. In the information page about the changes they mention:

’’PayPower will be adding the Send Money Interac e-Transfer service soon! Keep checking back for updates.’’

Would this mean it could be possible to transfer money in my bank account through Interac?

Hi Reed & Frugal team, sorry to bug you, after I loaded a total aggregate amount of $10,000.00 onto the card (over a three month period), I can no longer load anymore onto the card at POS at Sobeys using my CC. Attempts at trying to load anymore result in a transaction fail. I had been bill paying consistently throughout the three month period so my total balance at any one time with never more than $5,000.00.

-Has this been your experience also?

-Seeing as the digital reloadable master card is one per life time for client, how do I get another one? Do I have to keep adding them for P2,P3,P4..etc?

Hello,

1. I would typically not leave much money on the paypower card, load and then unload, as opposed to loading up a balance and then unloading over months.

2. Yes you can add another player and give you main card a break and perhaps try again in the future.

I’m having trouble with the KYC, it keeps failing. I’m not sure how to fix it. I tried sending PayPower an email that I found online but not sure if it goes anywhere. And their phone service seems to be useless if you don’t already have a card.

Did you get this resolved? I also keep failing the verification

Hi Reed,

I’ve had the card for a while and have always reloaded at the grocery store using my physical card. Now that they are moving to digital only, do you have any info on whether or not we will still be able to reload at grocery stores? Or will it be a digital reload only?

Hi, I know that at my grocery store (Métro) the manager told me another customer uses a digital Paypower to reload. I suppose that if you can add it to your digital wallet this should work. Maybe check with your grocery store.

Hello Reed,

Have you been using there app?

I tried to download it today, but the reviews about the app are really bad.

How safe would it be to have money in that app?

Please share your personal expirience with us.

Hey Mario,

I use the app. I haven’t had any problems. But I also don’t leave money in the app for more than a few hours. I wouldn’t recommend leaving money in the app for extended amounts of time.

Hello Reed,

I started using this pay power app first week of January. I tried the bill pay option with a $10 and when I saw that it does work in timely manner, i decided to complete almost all my bills using the app.

What I consider being a disadvantage is that when you load at the supermarket where I can take the advantage of my credit card and earn the most rewards; There is a max of $500 plus the load fee.

Do you consider that a risk of the credit card trying to said that I am manufacturing spending? I feel that perhaps that will not be case, as I also buy other kinds of gift card like amazon or coffee shops.

What is your opinion towards using the credit card just at the supermarket where is where you make the must out of your rewards?

Hi Mario. Depends on the card issuer. I wouldn’t go crazy with Amex, but I use it with a quite a few other issuers with no issue and I only ever load at Safeway and unload the card same day. Sometimes for two loads of $500. Cheers.

Sorry to bring up an old article but it seems like many don’t have the physical card anymore in-store. It’s my understanding that paypower ie the only one that allows for reloading rather than vanilla prepaid. What’s another avenue for an Amex holder?

PayPower now has digital reloadable cards you can enable in the app. The overall process is exactly the same except you present your digital barcode instead of the physical card.

Hi Reed,

Did you ever run into issues with the CC for always loading exactly $500.00 (as a round number) from the grocery store or convenience store or did you always add a loaf of bread etc to make the amount $500.00 + a few dollars extra? Thanks.

I often add an item. The number wont be round anyways as its 506.95 with the fee, but if I am going to be loading multiple tx on the same card I prefer they not all be the same amount.

I tried to create the bill payment, but this option is not available on my dashboard. Any thoughts?

Hi all, are there any new stats on whether Sobeys or Circle K are now able to reload the new digital cards? TIA

Need an update on grocery store reload of the digital cards.

Paypower are scam.

I tried to follow as described.

They no longer allow reloading of any physically purchased cards even though the packaging and website say they are capable.

They are changing their rules and system. Hours with customer service to find out the truth of why i was unable to access reloading feature. Stay clear of paypower

Hi Glen,

Yes – they only offer the digital reloadable cards now, as shown on their website homepage.

Would agree they should retire the physical cards sold in stores with “reloadable” branding, however I wouldn’t go so far as to say its a scam as many are still using grandfathered physical and the new digital cards successfully.

Regards.

I have the reloadable card. I can load it at grocery and gas stations. So everything is a win in this regard. Biggest issue for me is that I cannot use the card at a store. I can load it in a store but can’t use it in the same store… Not much of a prepaid card. Any work arounds that are feesable?

You mean you can’t use the digital card? Have you tried adding it to Apple Pay or Google Pay and using it that way?

You’ll need the add the card to a mobile wallet and use it from there.

Alternatively, you can shop online with it.