The world of points and miles can be a complicated place. When you choose to maximize rather than simplify, your miles and points strategy will become more complex and nuanced. With added complexity, there is of course a higher risk of human error occurring, which is why it is important to derisk with awareness and knowledge.

The reality is that everyone makes mistakes in their points and miles journey. In this article, I’ve listed some of the most common mistakes that you can hopefully avoid after reading this article. They are listed, in my opinion, from most egregious to least impactful.

With that in mind, let’s jump into my list of the top 10 miles & points mistakes to avoid.

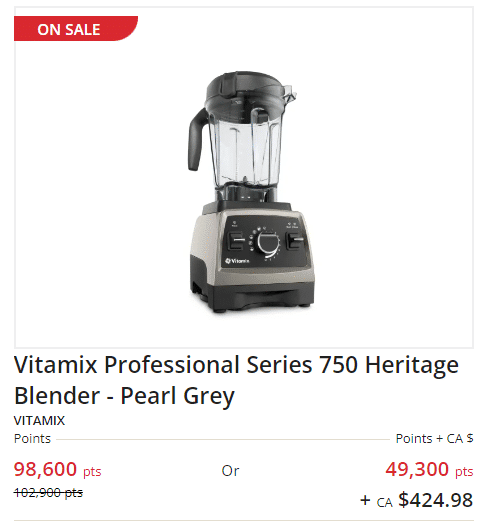

1. Redeeming Flexible Points for Merchandise

I’ve said it once in my ultimate guide to maximizing your spending, and I will continue to preach it. You can choose to redeem 100,000 Aeroplan points for a blender or a once-in-a-lifetime experience of flying Lufthansa First Class.

If you’re new here, we’re talking about the voodoo magic of flexible miles and points currencies. While they are amazingly powerful, their potential will likely go untapped unless you know where their power lies.

While it may be perfectly fine to redeem some miles and points currencies for regular household items, such as taking advantage of the Air Miles Onyx Personal Shopper service, you want to ensure you aim to keep your flexible points for their intended use, which is always travel-related redemptions.

On the flip side, fixed points currencies are the points you can redeem for everyday things. For example, I redeemed 700 Scene+ Rewards points to see the new Spiderman movie. They would be worth $7.00 towards a Disneyland ticket or 50% off my $14.00 movie ticket; no matter the redemption, the value of 700 Scene+ Rewards points remains $7.

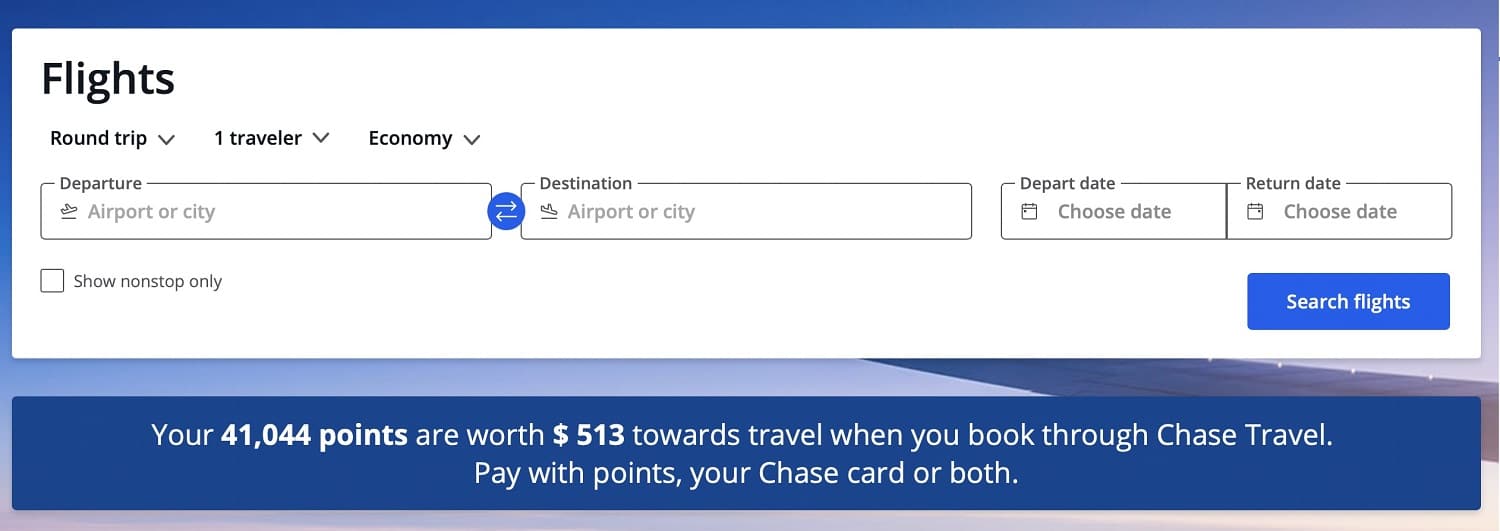

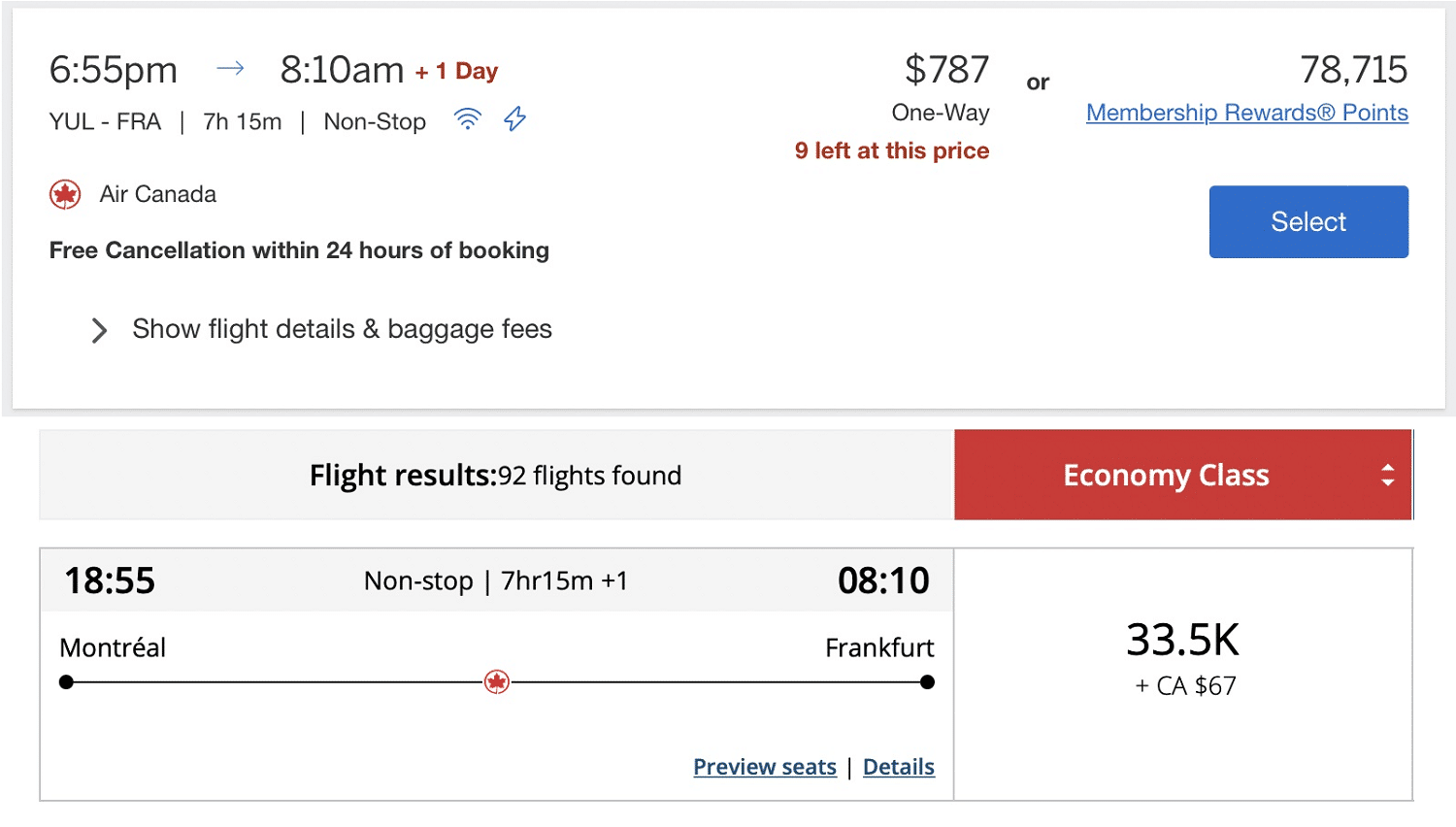

2. Redeeming Flexible Points on Travel Portals

Sticking with the theme of poor redemptions, redeeming your points through a financial institution travel portal is almost always a bad deal. The caveat of almost is essential, as there are 2 or 3 niche cases where it does make sense, but it’s few and far between.

Two of the most common misuses of flexible points are redeeming American Express Membership Rewards through the American Express Travel Portal and redeeming Chase Ultimate Rewards through the Chase Travel Portal.

These portals allow you to redeem your flexible points at a fixed value of 1.00 or 1.25 cents per point respectively towards travel redemptions. Generally speaking, you can usually transfer your points to partner frequent flyer or hotel loyalty programs and use fewer points for the same flight or hotel.

This is an easy trap to get caught in, as banks will wow you with how much redeemable value you have when you click “use points.”

For example, let’s compare the price of booking the same flight with Amex Travel versus booking with Aeroplan points.

It doesn’t always work out to be less expensive, so definitely do your homework by comparing redemption options before booking anything. But as a general rule, frequent flyer programs are more rewarding than a bank and will give you the opportunity to further maximize the value of your miles and points.

3. Misspelling Names in Loyalty Accounts

This is a more common issue than you might think and can cause significant issues. When transferring points from your financial institution to a loyalty account, your name on the loyalty account must be an exact match with the information your financial institution has.

Without that exact match, your points may be caught in limbo or held hostage by the loyalty program because they believe you are abusing the program. Loyalty programs fight back against grey market points sellers every day, and you don’t want to get in their bad books.

This name mix-up can even cause you to miss your flight if the name on your ticket doesn’t match your passport. Perhaps the biggest stickler for this is when you attempt to transfer British Airways Avios to Qatar Privilege Club to redeem for a flight on the renowned Qatar Airways airline.

However, no matter the program, always ensure you enter your personal information and details the same way every time. Consistency is key and will help you avoid any problems down the line.

4. Closing the Wrong Credit Card Accounts

When you start this hobby, you may be struck with the bug that got me, Points Revenge. While it’s an exciting time, you want to ensure each card application or cancellation is calculated.

I am guilty of this, as I closed a valuable TD credit card when I started maximizing my points and miles. In my mind, it was a cashback card I didn’t need anymore, which served me no purpose. This was before I learned about TD product switching and how my oldest cards can significantly impact my credit score.

I lost out on some bonus points, and my credit score was impacted as my years of great payment history on that card were gone. At the end of the day, this won’t ruin your points journey, but it will cause regrets, which are never fun.

5. Paying Taxes & Fees with the Wrong Card

This is an easy mistake, especially if you’re constantly working on meeting minimum spending requirements. While it may not seem like a big deal, knowing the terms and conditions of your credit card travel insurance coverage is critical. If you pay your Aeroplan flight redemption taxes and fees with a card like the TD Aeroplan Visa Infinite Privilege card, you will have all the insurance protections as if you paid cash.

However, if you pay those taxes and fees with an American Express Platinum card, you will not have any insurance coverage as the American Express Platinum card does not offer coverage on award bookings. Ultimately, when making flight award bookings, you want to use a credit card that will provide insurance coverage as long as you charge the taxes and fees to the card, such as the National Bank World Elite Mastercard.

Unfortunately, I am guilty of this mistake as well. I booked my mother a flight to visit me on Vancouver Island using points, and I paid the taxes and fees. She was delayed overnight in Calgary because of the weather, and even though she has her own American Express Aeroplan Reserve card, insurance did not cover the cost of her hotel. She could have claimed that overnight hotel stay if she had paid the taxes and fees using her own credit card.

6. Missing a Credit Card Welcome Bonus

While this mistake is frustrating and might seem like a HUGE deal when it happens, it usually doesn’t spell complete disaster. For most issuers, you can get away with this through product switching the card you missed the spending requirement on and reapplying 6-12 months later. You may have a different bonus offer than you originally signed up for, but at least you still get a bonus.

The issuer where this is a bigger deal is American Express, both in Canada and the United States. American Express will not award you a signup bonus unless it’s your first time being a primary card holder.

This means if you upgrade your American Express Hilton Honors card (US) to an American Express Hilton Honors Surpass card (US), you’re no longer eligible to receive a bonus if you apply for another Surpass. Josh wrote an excellent article about maximizing American Express Hilton Honors cards upgrading and downgrading if you are a current cardholder and want to maximize your Hilton Honors earnings.

The long and the short of it is you always want to have a plan for meeting your minimum spend. Personally, I like buying groups as there are usually no fees to use the service.

7. Missing Out on Award Availability

I always say there are two kinds of award travelers. Those who have missed out on an award and those who will miss out on an award. It is an inevitable and frustrating moment that’s a part of our game. Whether a points transfer takes too long or you’re waiting for a welcome bonus to post on the next credit card account statement, eventually, you’ll experience the dismay of watching availability disappear.

Luckily, I have some tips to help you avoid this! If possible, you want to keep 100,000 points available in transferrable currencies most of the time. For example, this could include points currencies such as American Express Membership Rewards and RBC Avion Rewards. Aeroplan points would also count, but sometimes the best deals are with OneWorld carriers regardless of their higher taxes and fees on OneWorld redemptions.

Unfortunately, this mistake happened to me recently when booking Hotel 50 Bowery in New York. I needed a room with two double beds as my wife planned to travel with two of her friends. The desired room type was available, but I needed to wait 24 hours for points to be posted from my Chase Sapphire Preferred credit card statement.

Twenty-four hours later, once the points were in my World of Hyatt account, the award availability was gone. Had I only remembered that Points Advance is a feature available to World of Hyatt Globalist members, I would have been able to book the room type I wanted.

8. Misplacing Documents for Credit Card Insurance Reimbursement

Until you make your first insurance claim with a credit card insurance perk, you probably don’t know you need all original documents. This includes boarding passes, baggage claim tickets, and any receipts from items you purchased.

Most people only make this mistake once, but hopefully, you can avoid it! If you have electronic-only boarding passes, take screenshots before boarding. I keep an album on my phone for each trip, which I delete after everything goes smoothly.

9. Not Aging Loyalty Accounts

This might sound like a strange title, but its premise is simple. You want to create an account for any decent loyalty programs ASAP after starting your miles and points journey. Many loyalty programs, such as World of Hyatt, will only allow you to buy points 60 days after creation. By taking 90 minutes of your time (if that) when you start this hobby to sign up for some of the key frequent flyer and hotel loyalty programs, you’ll be able to have a much smoother experience when the need arises.

Personally, I have a Google Sheets document that lists both my and my player two’s loyalty numbers so I can access them without needing to pull out my laptop and open up an Excel file. This also plays into the need for organization in the hobby of miles and points, which is a key skill to have.

I would recommend making accounts for the following loyalty programs:

- Air Canada Aeroplan

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Avianca LifeMiles

- KLM Flying Blue

- American Airlines AAdvantage

- Turkish Miles and Smiles

- Aer Lingus Aer Club

- Iberia Plus

- Qatar Airways Privilege Club

- Hilton Honors

- Marriott Bonvoy

- World of Hyatt

- IHG Rewards Club

- Choice Privileges

- Sandman RSVP Rewards

10. Sweating the Small Stuff

Points and miles, just like travel, can have snafus. Whether the Aeroplan eStore doesn’t post your points correctly, or an Uber Comfort ride to the airport only gives you 1x rather than 2x, you’re bound to run into some IT snags. When analyzing your transactions and points balances, you want to ensure the time you spend chasing points is worth it.

If you lose out on 600 Aeroplan points because the shopping portal didn’t track your purchase, it’s important to remember that those points are only worth $12. You probably won’t miss them, and they won’t stop you from booking your trip.

While there is nothing wrong with submitting a missing transaction request for those points, it might not be worth the time spent. Instead, use that time and energy to create a perfect referral or application strategy, which is more fun and rewarding. For example, did you know you can earn 15,000 points per referral by referring family and friends to an American Express Cobalt card? If this sounds more fun than emailing the eStore support team, head to my Ultimate Guide to Referral Links to learn more.

Conclusion

Mistakes are a part of everyday life, and you’re bound to make some of the ones I’ve listed here during your miles and points journey. However, the best thing you can do is learn from someone else’s mistakes so as to not have to experience them yourself.

Have any mistakes you’ve made during your time in the world of miles and points? I hope this comment section is filled with other travelers’ “best” mistakes so we can all learn from them and they shall never be repeated.

Daniel Burkett

Latest posts by Daniel Burkett (see all)

- Everything You Need To Know About Transfer Bonuses - Jul 22, 2024

- How I Used Miles & Points to See Taylor Swift in Europe - Jun 28, 2024

- Review: Marriott Downtown at CF Toronto Eaton Centre - Jun 12, 2024

- The Complete Air Canada Aeroplan Status Guide - Jun 10, 2024

- Understanding the Aeroplan Award Chart - Jun 3, 2024